Field & Main Bank

Field & Main Bank

Reporting period: Mar 31st, 2025

Filling Date: Apr 23rd, 2025

Field & Main Bank is a community-focused financial institution based in Henderson, Kentucky. Established through the merger of two long-standing local banks in 2015, Field & Main Bank combines a rich history with a modern approach to banking.

The bank offers a variety of financial services, including personal and business banking, loans, mortgages, and wealth management. Known for its emphasis on personalized service and strong community ties, Field & Main Bank aims to provide tailored financial solutions that meet the unique needs of its customers. With a commitment to local economic growth and customer satisfaction, Field & Main Bank has positioned itself as a trusted and reliable banking partner in its region.

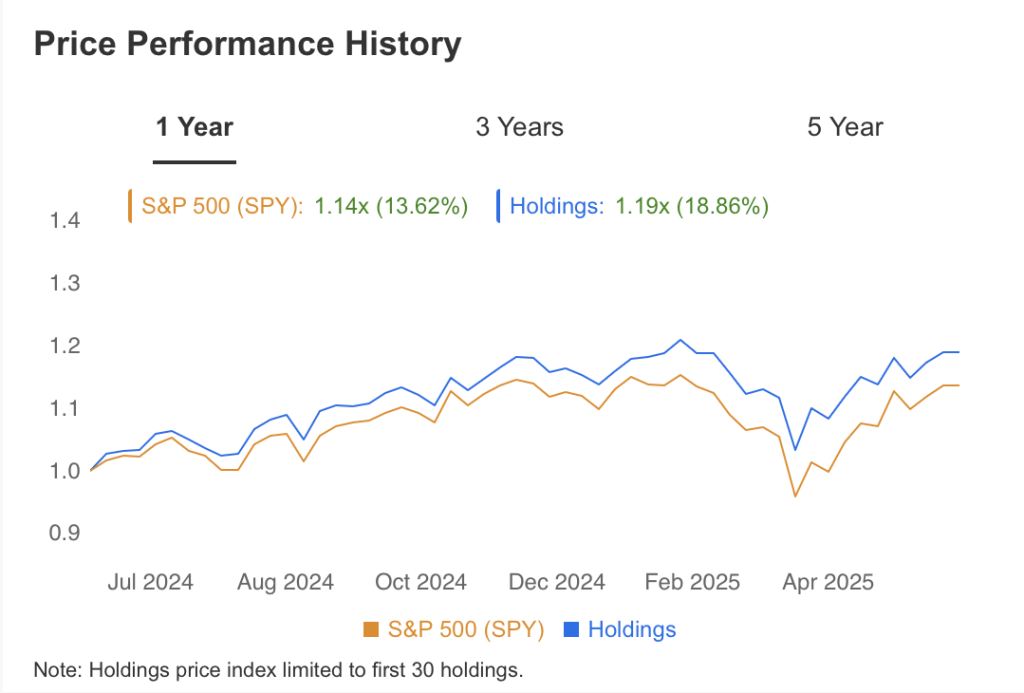

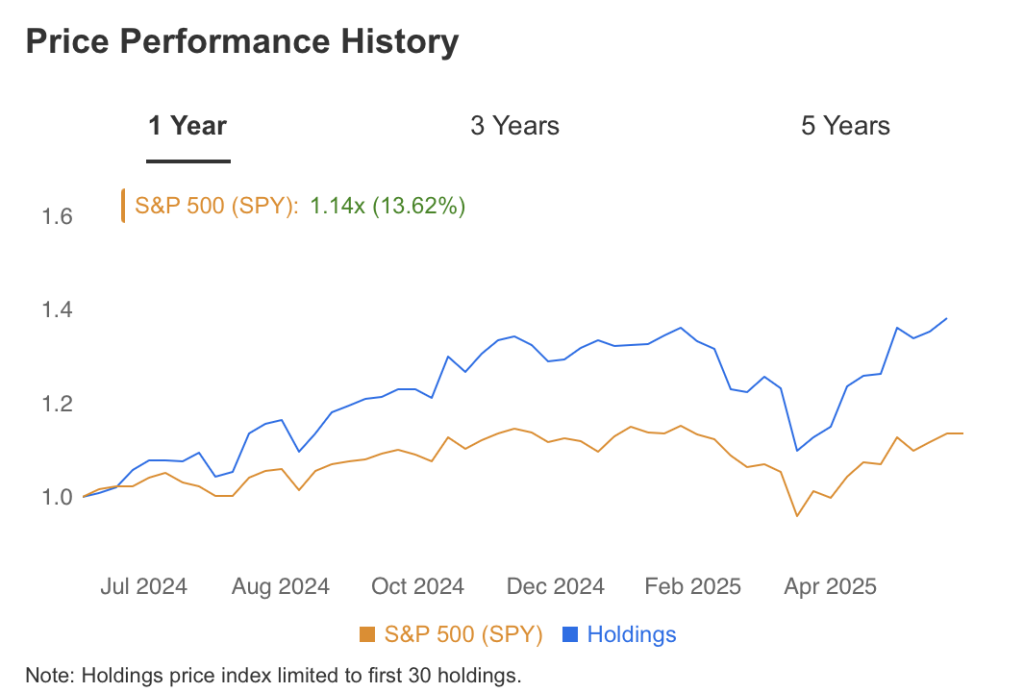

Three Year Return & Holdings Summary

View Holdings

Field & Main Bank

Holdings Summary

View Market

Field & Main Bank

Market View

View Projections

Field & Main Bank

Projections

View Health

Field & Main Bank

Health

S&T Bank

S&T Bank

Reporting period: Mar 31st, 2025

Filling Date: May 15th, 2025

S&T Bank is a regional financial institution headquartered in Indiana, Pennsylvania, offering a wide range of banking services to individuals, businesses, and organizations.

Founded in 1902, S&T Bank provides services such as personal and business banking, mortgages, loans, and wealth management. The bank is known for its strong community focus and commitment to personalized customer service. S&T Bank operates through a network of branches across Pennsylvania and surrounding states, aiming to deliver tailored financial solutions and support local economic development. Its long history and dedication to customer care have established it as a respected player in the regional banking sector.

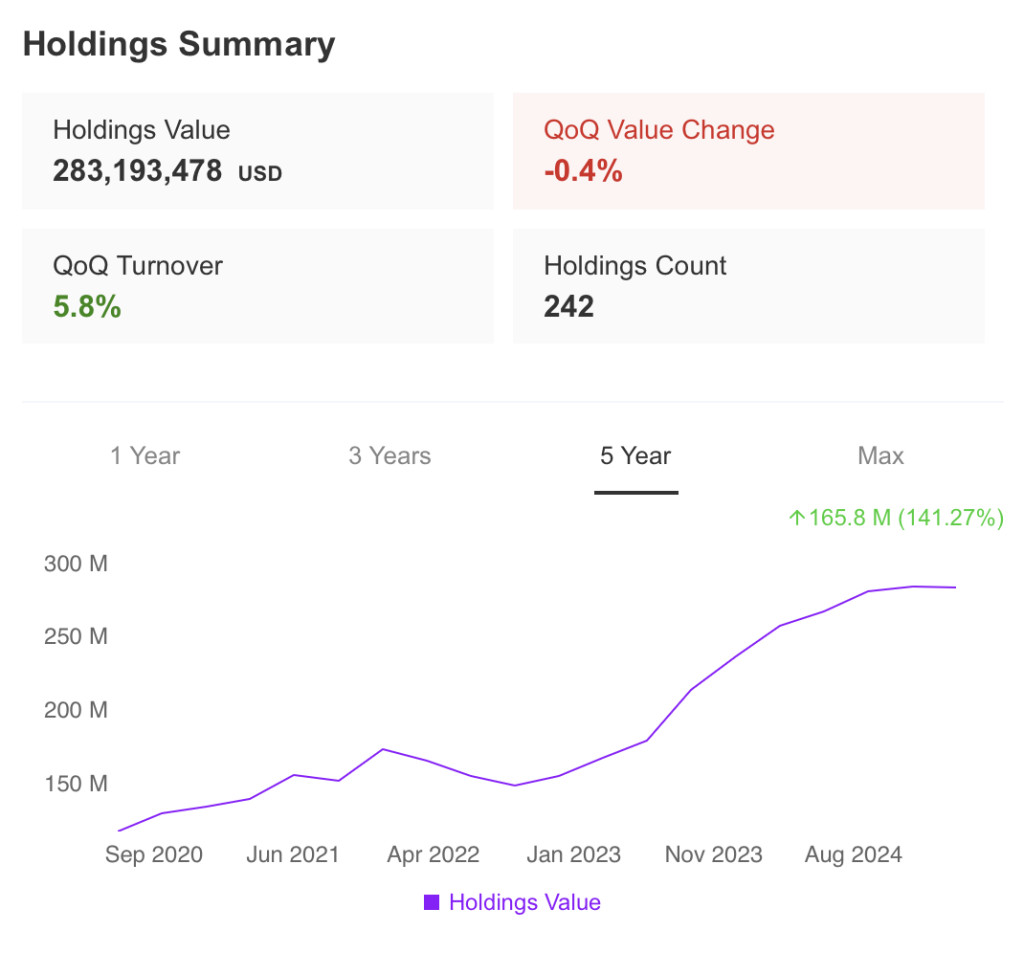

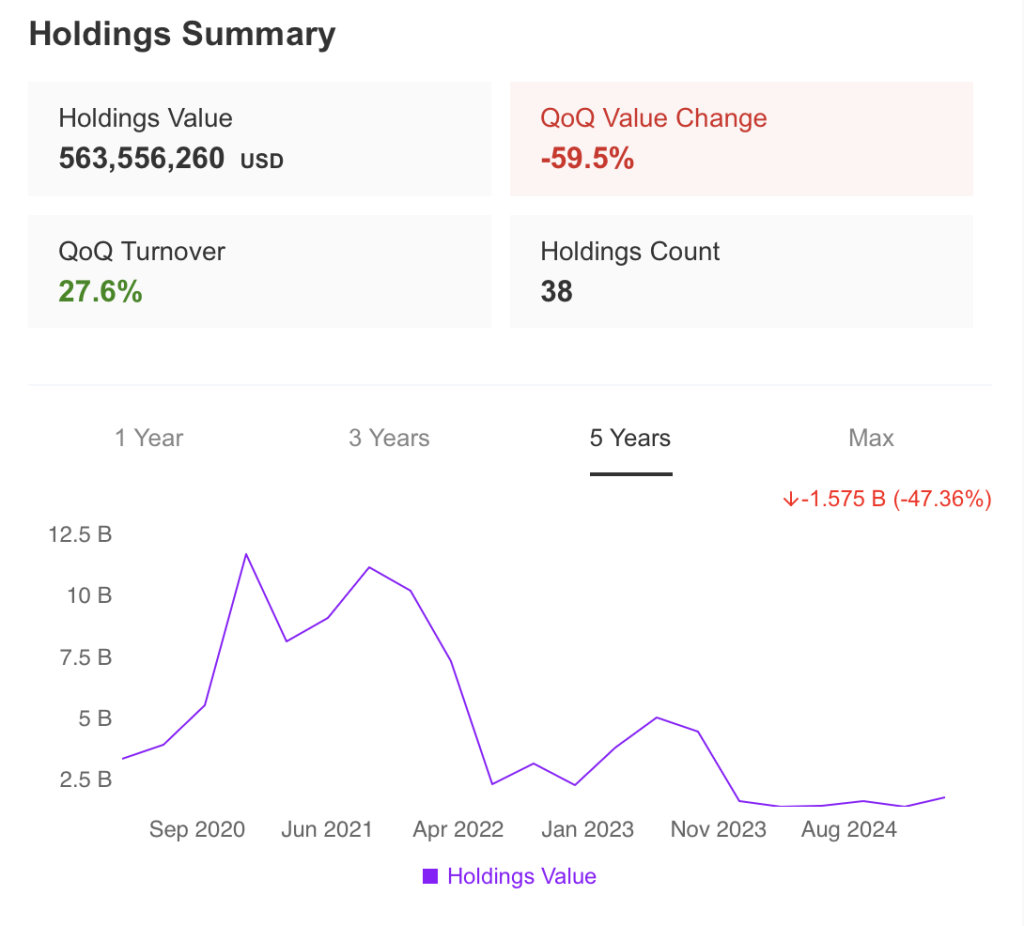

Three Year Return & Holdings Summary

View Holdings

S&T Bank

Holdings Summary

View Market

S&T Bank

Market View

View Projections

S&T Bank

Projections

View Health

S&T Bank

Health

Jeffrey C. Smith

Jeffrey C. Smith

Reporting period: Mar 31st, 2025

Filling Date: May 15th, 2025

Jeffrey C. Smith is the co-founder and managing member of Starboard Value, a hedge fund known for its activist investing strategies and focus on improving corporate governance and operational efficiency.

Under his leadership, Starboard has gained a reputation for its hands-on approach to driving change in the companies it invests in, often pushing for boardroom shakeups, cost-cutting measures, and strategic redirections. Smith has successfully led activist campaigns in major companies such as Darden Restaurants, Yahoo, and Marvell Technology, generating significant returns for shareholders. His strategic insight and ability to effect meaningful change have made him one of the most influential and respected activist investors in the financial community.

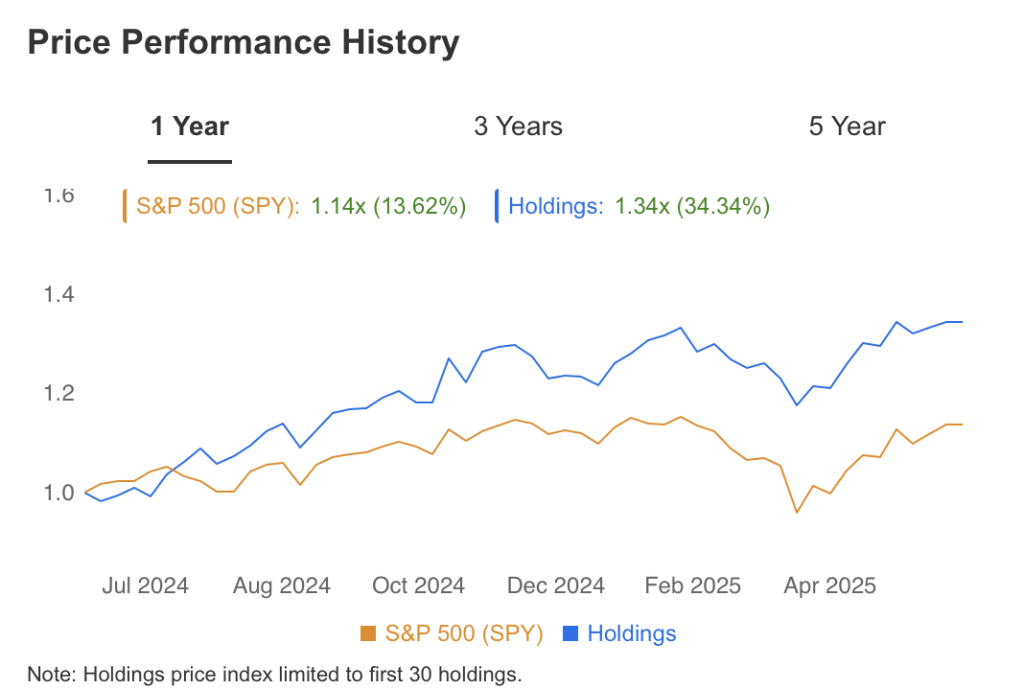

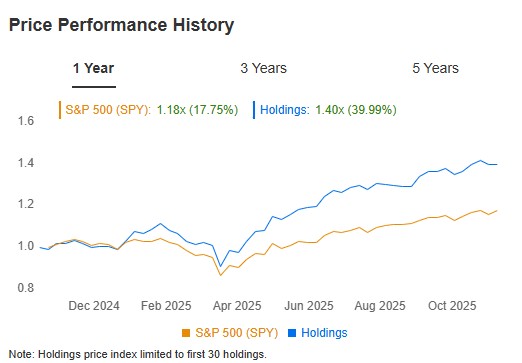

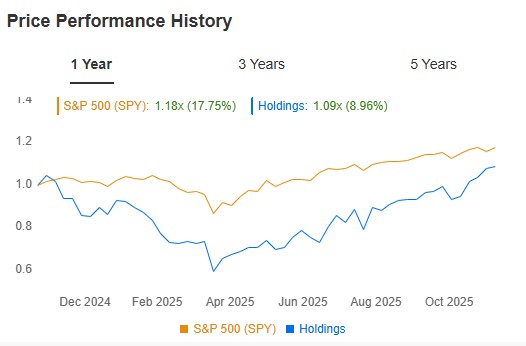

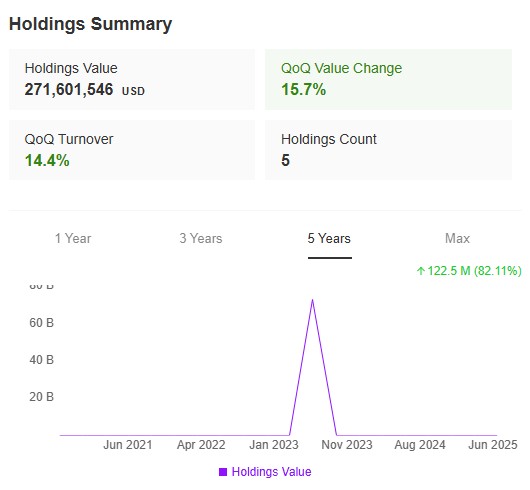

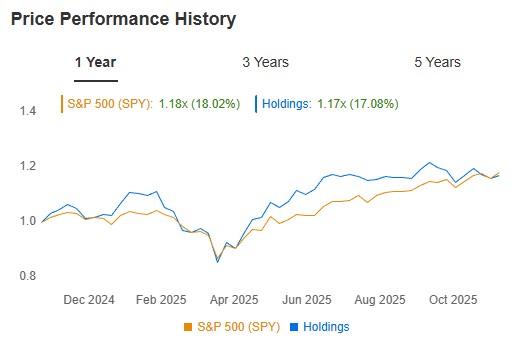

Three Year Return & Holdings Summary

View Holdings

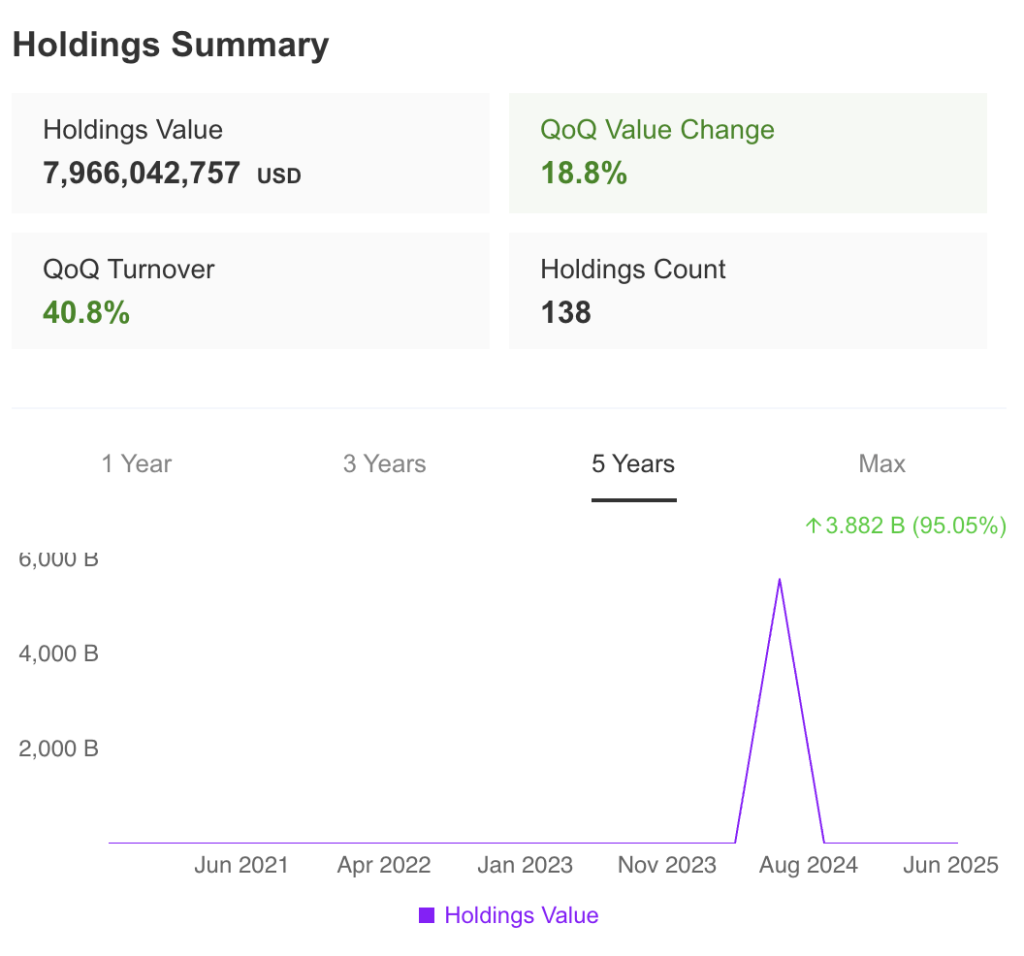

Jeffrey C. Smith

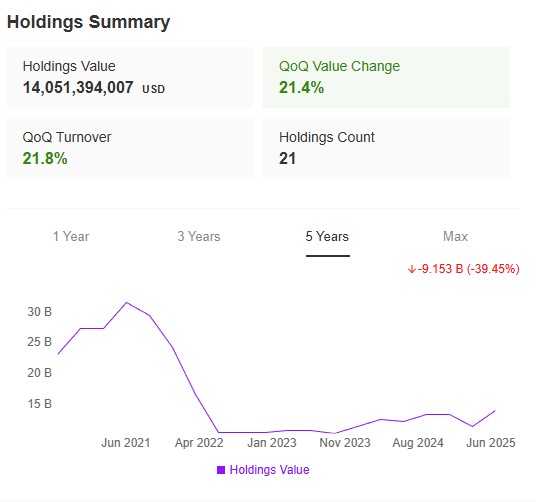

Holdings Summary

View Market

Jeffrey C. Smith

Market View

View Projections

Jeffrey C. Smith

Projections

View Health

Jeffrey C. Smith

Health

Luxor Capital Group

Luxor Capital Group

Reporting period: Mar 31st, 2025

Filling Date: May 15th, 2025

Luxor Capital Group is a prominent hedge fund known for its multi-strategy investment approach, focusing on both public and private markets. Founded in 2002 by Christian Leone, the firm manages billions of dollars in assets, employing a combination of long/short equity, credit, and event-driven strategies to generate strong risk-adjusted returns.

Luxor Capital is recognized for its deep research and flexible investment style, which allows it to adapt to changing market conditions and identify opportunities across various sectors and geographies. Under Leone’s leadership, the firm has established a reputation for its disciplined approach and strong performance, making it a significant player in the global hedge fund industry.

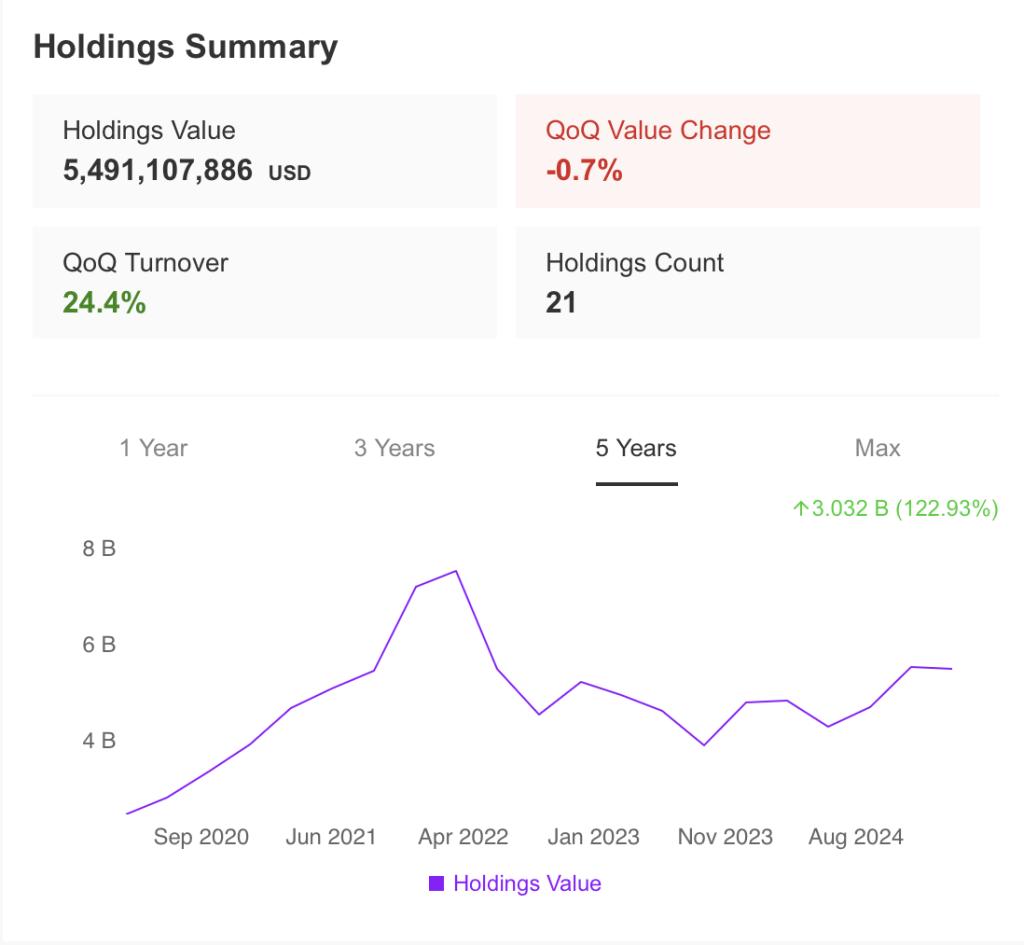

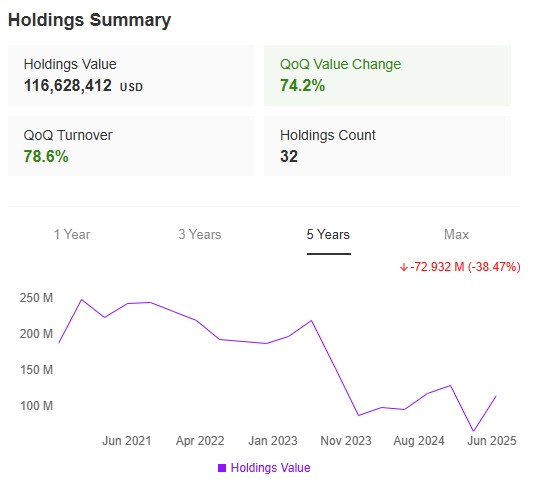

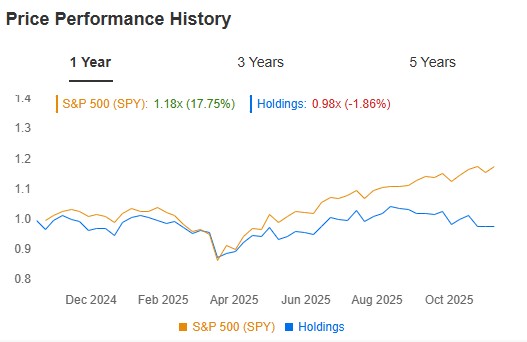

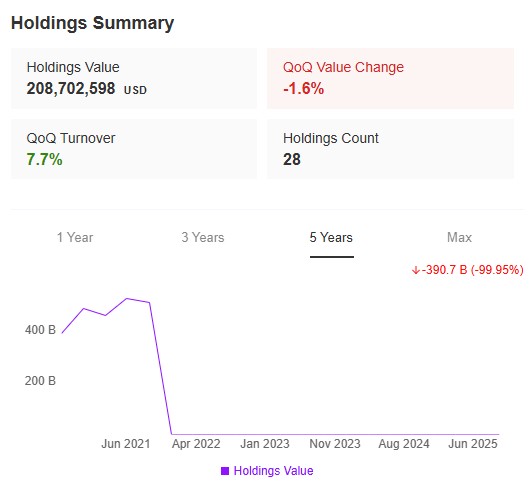

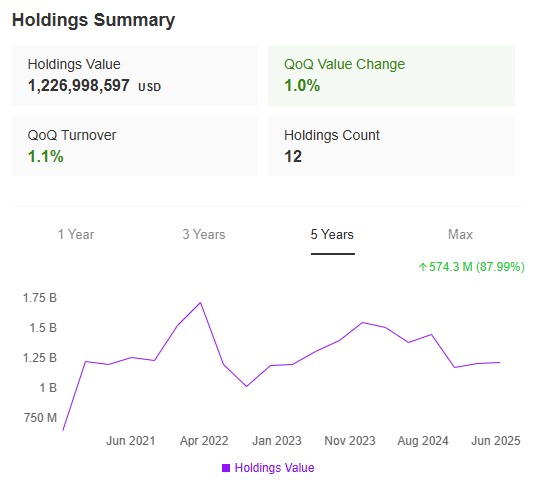

Three Year Return & Holdings Summary

View Holdings

Luxor Capital Group

Holdings Summary

View Market

Luxor Capital Group

Market View

View Projections

Luxor Capital Group

Projections

View Health

Luxor Capital Group

Health

Marvin & Palmer

Marvin & Palmer

Reporting period: Jun 30th, 2025

Filling Date: Aug 12th, 2025

Marvin & Palmer Associates is a global investment management firm known for its focus on emerging markets and international equities. Founded in 1986 by Reginald “Reggie” Palmer and George Marvin, the firm gained prominence for its expertise in identifying growth opportunities in rapidly developing economies.

Marvin & Palmer’s investment strategies center on rigorous research and a disciplined approach to portfolio management, aiming to capitalize on the dynamic potential of global markets. Over the years, the firm has built a reputation for delivering strong returns by investing in high-growth sectors and companies in emerging regions. Their deep understanding of global economic trends and ability to navigate complex international markets have established Marvin & Palmer as a respected name in the investment management industry.

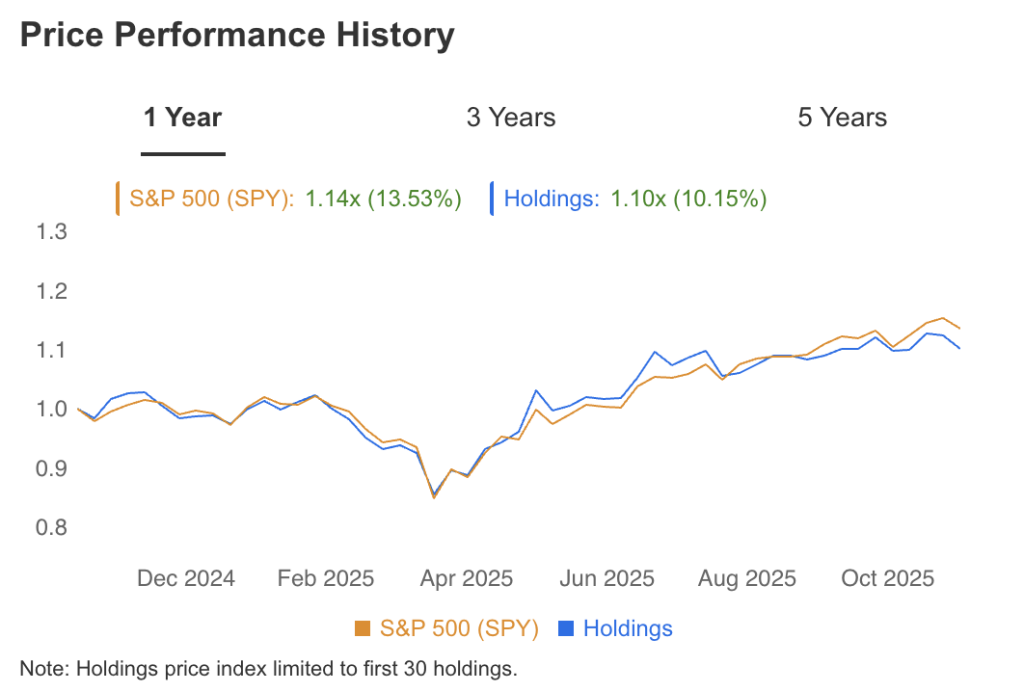

Three Year Return & Holdings Summary

View Holdings

Marvin & Palmer

Holdings Summary

View Market

Marvin & Palmer

Market View

View Projections

Marvin & Palmer

Projections

View Health

Marvin & Palmer

Health

Mohnish Pabrai

Mohnish Pabrai

Reporting period: Jun 30th, 2025

Filling Date: Aug 13th, 2025

Mohnish Pabrai is the founder and managing partner of Pabrai Investment Funds, a value-oriented investment firm that he established in 1999. Inspired by the principles of legendary investors like Warren Buffett and Charlie Munger, Pabrai is known for his disciplined approach to investing, focusing on buying high-quality businesses at significant discounts to their intrinsic value.

His investment philosophy emphasizes patience, thorough research, and a long-term perspective, often concentrating on a small number of deeply undervalued companies. Pabrai’s ability to generate strong returns through this focused approach has earned him recognition as a leading value investor. In addition to his work in finance, Pabrai is also a philanthropist, co-founding the Dakshana Foundation, which provides educational opportunities to underprivileged students in India.

Three Year Return & Holdings Summary

View Holdings

Mohnish Pabrai

Holdings Summary

View Market

Mohnish Pabrai

Market View

View Projections

Mohnish Pabrai

Projections

View Health

Mohnish Pabrai

Health

Hahn Capital

Hahn Capital

Reporting period: Sep 30th, 2025

Filling Date: Oct 20th, 2025

Hahn Capital Management is a distinguished investment management firm specializing in equity investing with a focus on small and mid-cap companies. Founded in 1995 by Warren Hahn, the firm is known for its research-driven, bottom-up investment approach.

Hahn Capital’s strategy involves identifying high-quality businesses with strong growth potential and attractive valuations, often emphasizing a long-term investment horizon. The firm has built a reputation for its disciplined analysis and selective investment process, aiming to deliver strong risk-adjusted returns to its clients. Hahn Capital’s expertise in navigating various market conditions and its focus on fundamentally sound companies have established it as a respected player in the equity investment space.

Three Year Return & Holdings Summary

View Holdings

Hahn Capital

Holdings Summary

View Market

Hahn Capital

Market View

View Projections

Hahn Capital

Projections

View Health

Hahn Capital

Health

Stephen Mandel

Stephen Mandel

Reporting period: Jun 30, 2025

Filling Date: Aug 14, 2025

Stephen Mandel is the founder of Lone Pine Capital, a highly successful hedge fund known for its long/short equity strategies and deep fundamental research.

Since founding the firm in 1997, Mandel has built a reputation as one of the leading figures in the investment world, particularly for his ability to identify high-growth companies with strong competitive advantages. Under his leadership, Lone Pine Capital has managed billions of dollars in assets, achieving impressive returns by investing in a concentrated portfolio of global equities. Mandel’s analytical rigor and focus on high-quality businesses have established him as a prominent and influential investor, particularly in the technology and consumer sectors. Though he stepped back from day-to-day management in 2019, Mandel’s legacy and approach continue to influence the investment strategies at Lone Pine.

Three Year Return & Holdings Summary

View Holdings

Stephen Mandel

Holdings Summary

View Market

Stephen Mandel

Market View

View Projections

Stephen Mandel

Projections

View Health

Stephen Mandel

Health

Bruce Berkowitz

Bruce Berkowitz

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

Bruce Berkowitz is the founder and managing member of Fairholme Capital Management, an investment firm renowned for its focused, value-oriented investment approach.

Established in 1997, Fairholme gained recognition for its concentrated portfolio strategy, where Berkowitz invests heavily in a select few companies that he believes are significantly undervalued. Known for his deep research and contrarian mindset, Berkowitz has achieved impressive returns by investing in sectors and companies often overlooked by others. His notable investments include significant stakes in financial companies during the aftermath of the 2008 financial crisis, which paid off handsomely. Berkowitz’s disciplined approach and long-term perspective have earned him a reputation as one of the most respected value investors in the industry.

Three Year Return & Holdings Summary

View Holdings

Bruce Berkowitz

Holdings Summary

View Market

Bruce Berkowitz

Market View

View Projections

Bruce Berkowitz

Projections

View Health

Bruce Berkowitz

Health

George Soros

George Soros

Reporting period: Jun 30, 2025

Filling Date: Aug 14, 2025

George Soros is the founder of Soros Fund Management and one of the most renowned investors and philanthropists in the world. Known for his pioneering role in the development of hedge funds, Soros gained fame for his bold currency trades, most notably his shorting of the British pound in 1992, which earned him over a billion dollars and the nickname “The Man Who Broke the Bank of England.”

Under his leadership, Soros Fund Management became one of the most successful hedge funds globally, with a focus on global macroeconomic strategies. Beyond investing, Soros is also a major philanthropist, using his wealth to support various social causes through the Open Society Foundations. His combination of financial acumen and philanthropic efforts has made him a towering figure in both the financial and global humanitarian communities.

Three Year Return & Holdings Summary

View Holdings

George Soros

Holdings Summary

View Market

George Soros

Market View

View Projections

George Soros

Projections

View Health

George Soros

Health