David Tepper

David Tepper

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

David Tepper is the founder and president of Appaloosa Management, a highly successful hedge fund known for its opportunistic and distressed debt investing strategies.

Since establishing the firm in 1993, Tepper has built a reputation as one of the most astute and successful investors in the world, with a particular talent for identifying undervalued assets and profiting from economic downturns. His bold and decisive investment moves, especially during financial crises, have earned Appaloosa exceptional returns and cemented Tepper’s status as a leading figure in the hedge fund industry. His ability to navigate volatile markets and achieve significant returns has made him one of the most respected and influential investors in the financial community.

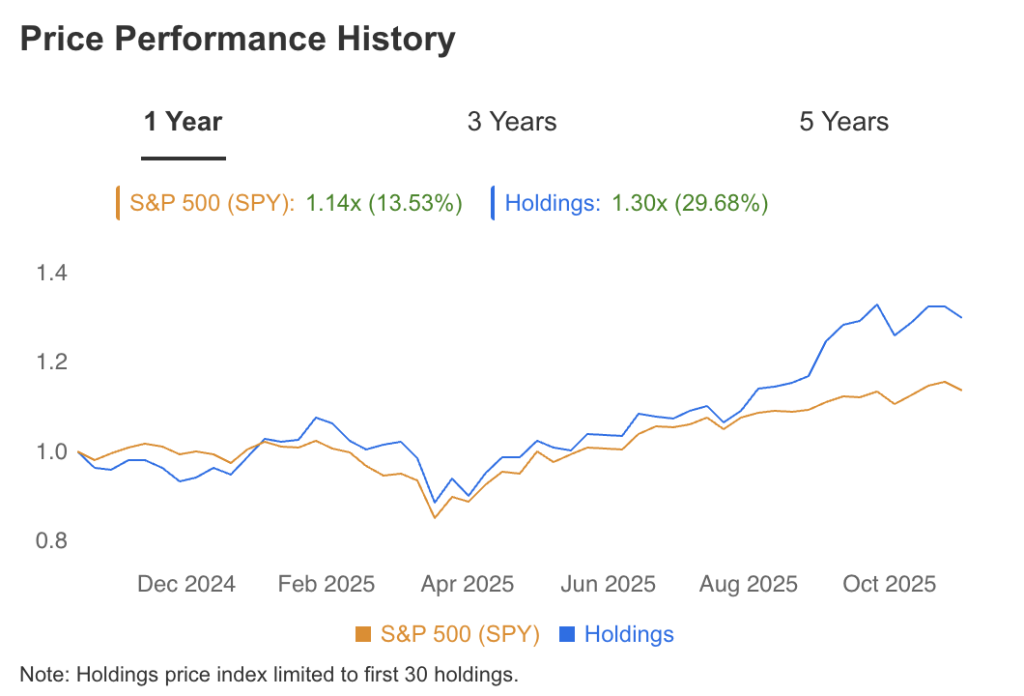

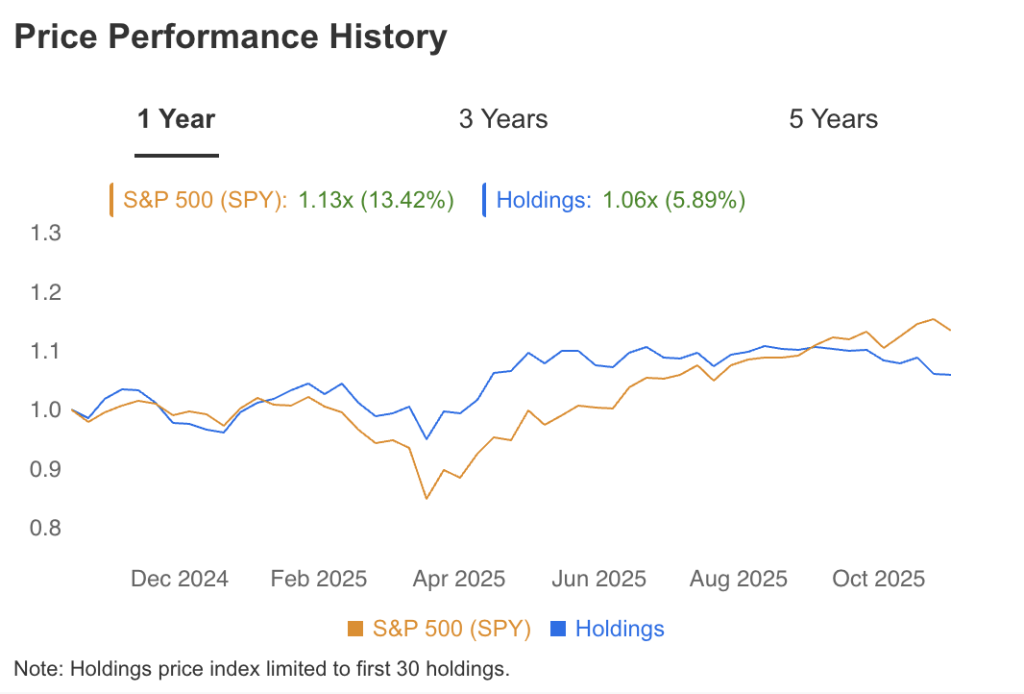

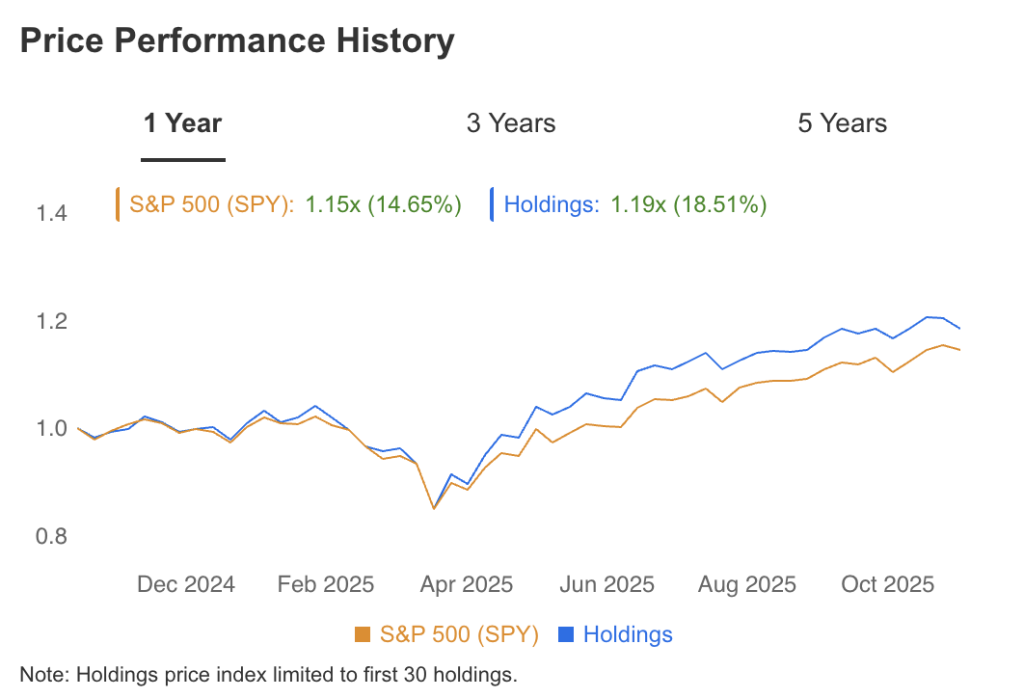

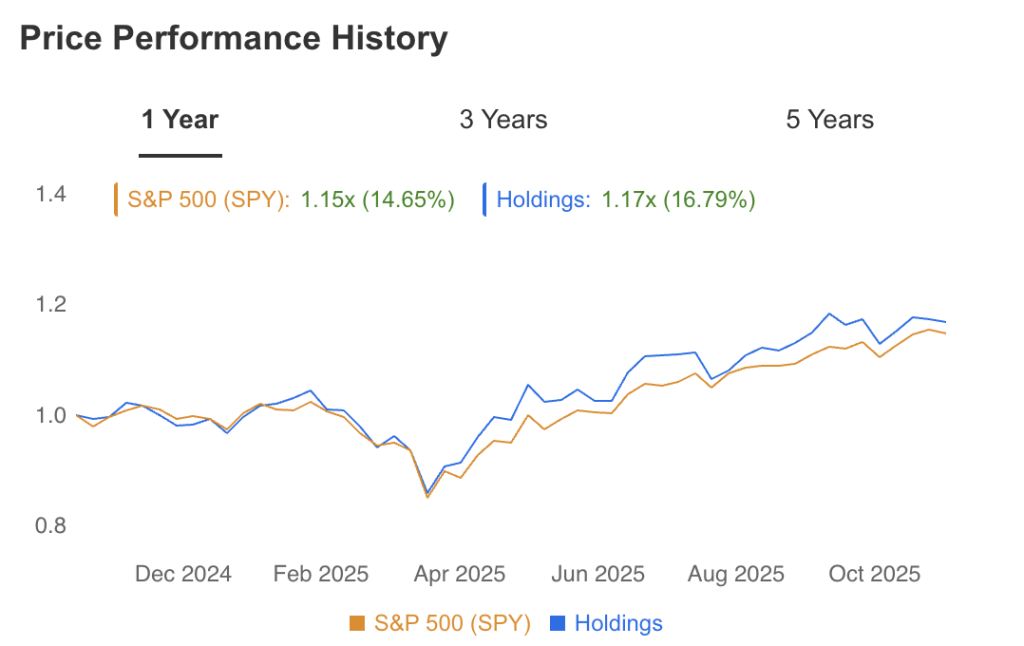

Three Year Return & Holdings Summary

View Holdings

David Tepper

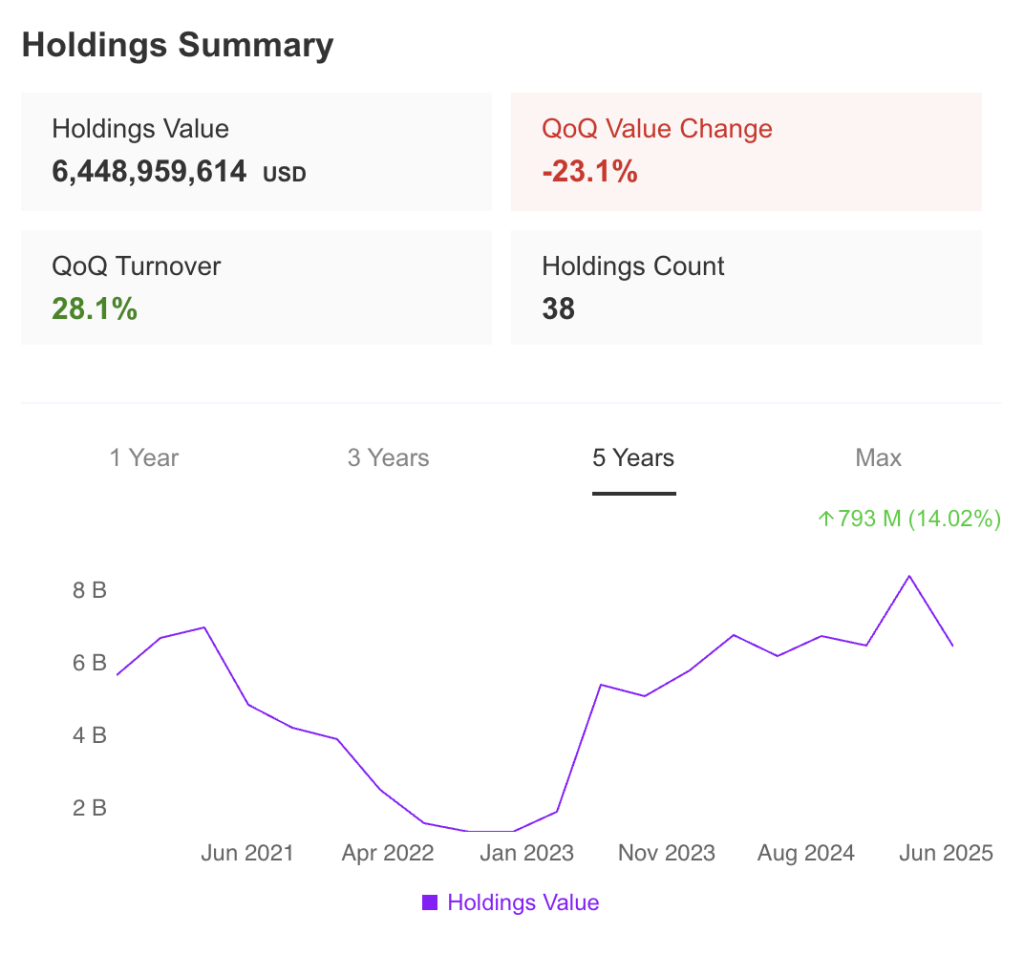

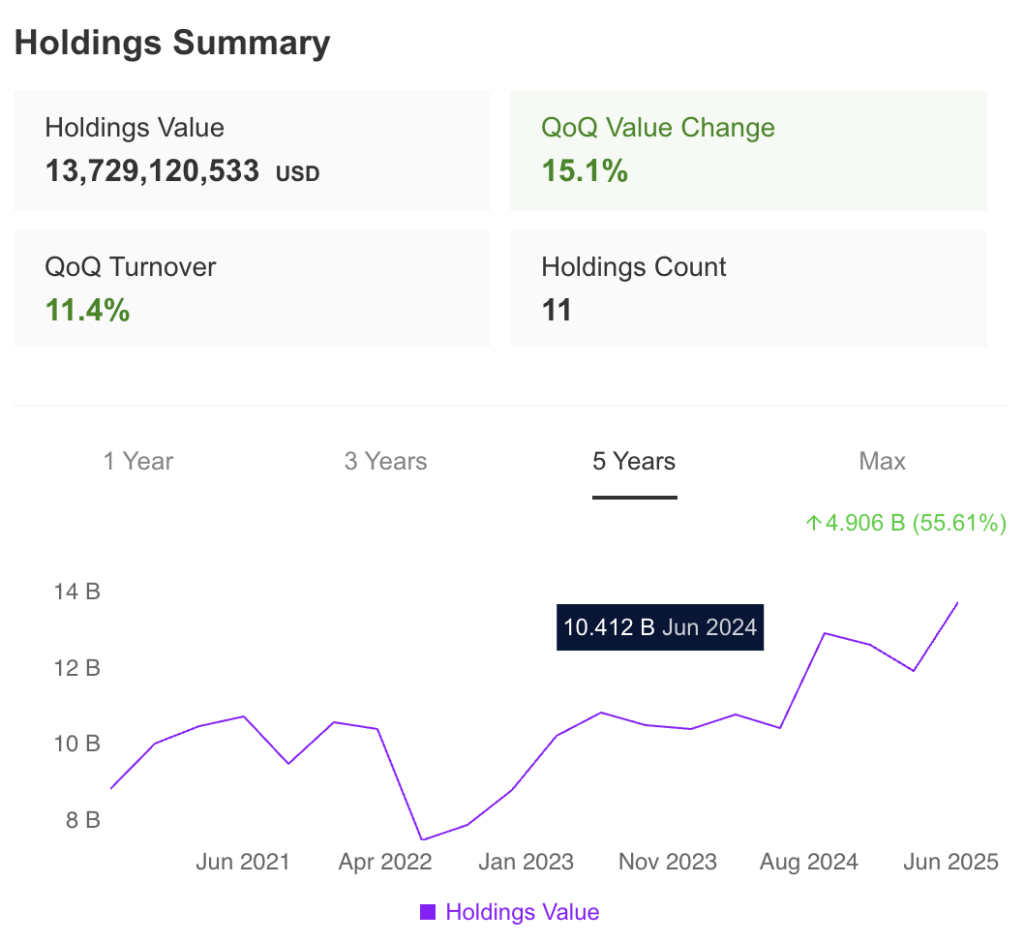

Holdings Summary

View Market

David Tepper

Market View

View Projections

David Tepper

Projections

View Health

David Tepper

Health

Daniel Loeb

Daniel Loeb

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

Daniel Loeb is the founder and CEO of Third Point LLC, a prominent hedge fund known for its activist investing approach and event-driven strategies.

Since founding the firm in 1995, Loeb has gained a reputation for his bold and often confrontational style in pushing for changes in the companies he invests in, including major corporations like Yahoo, Sony, and Nestlé. His ability to identify underperforming assets and drive strategic transformations has resulted in significant returns for his investors. Loeb’s deep analytical approach and his willingness to challenge management have made him a powerful force in the investment world, establishing him as one of the most influential and respected activist investors in the industry.

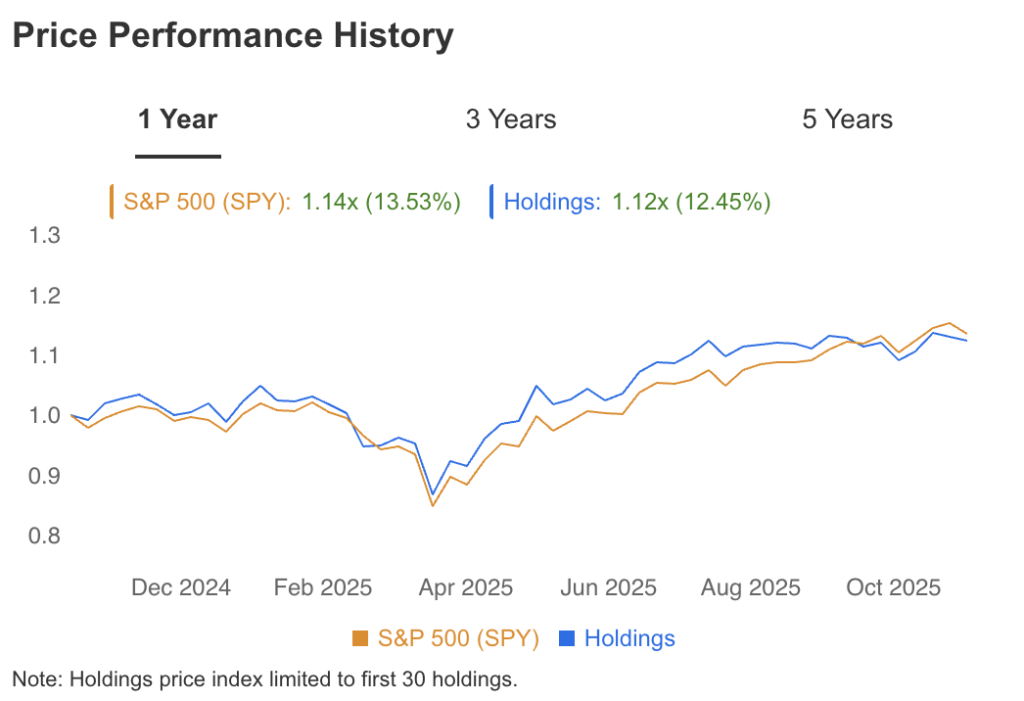

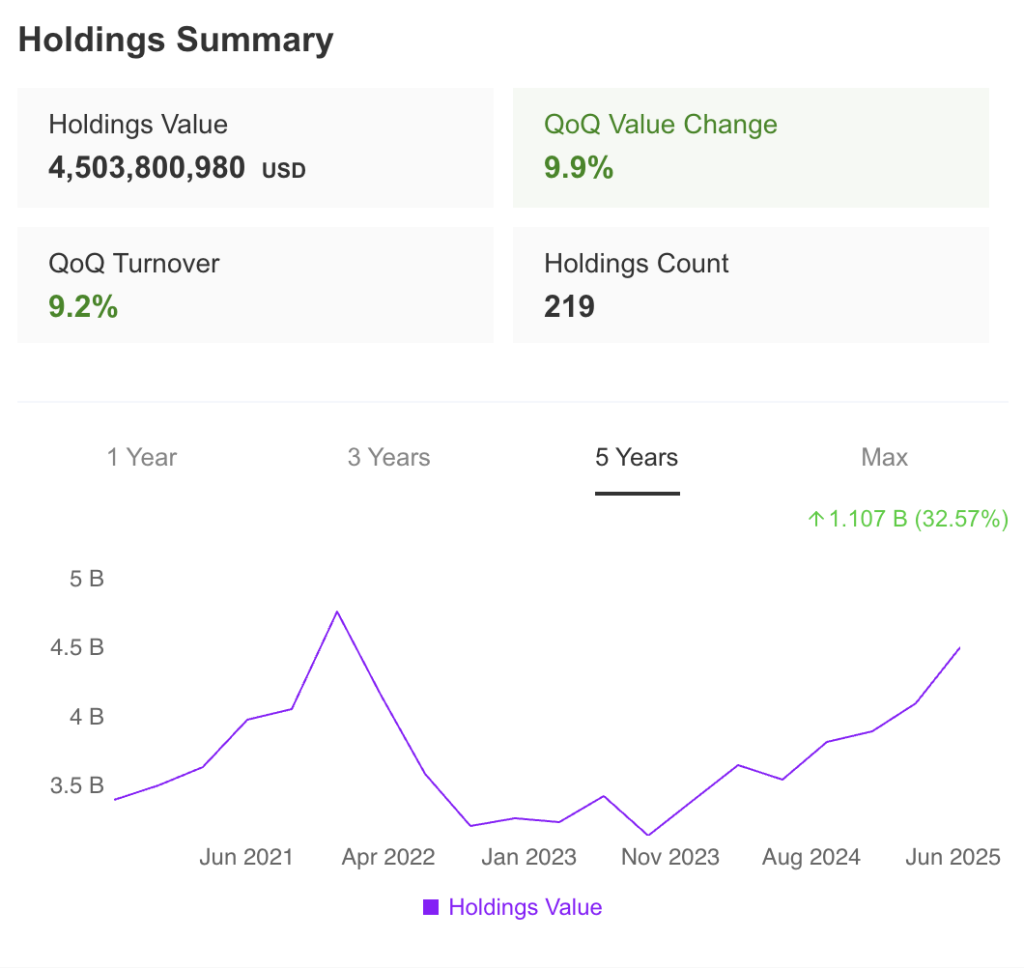

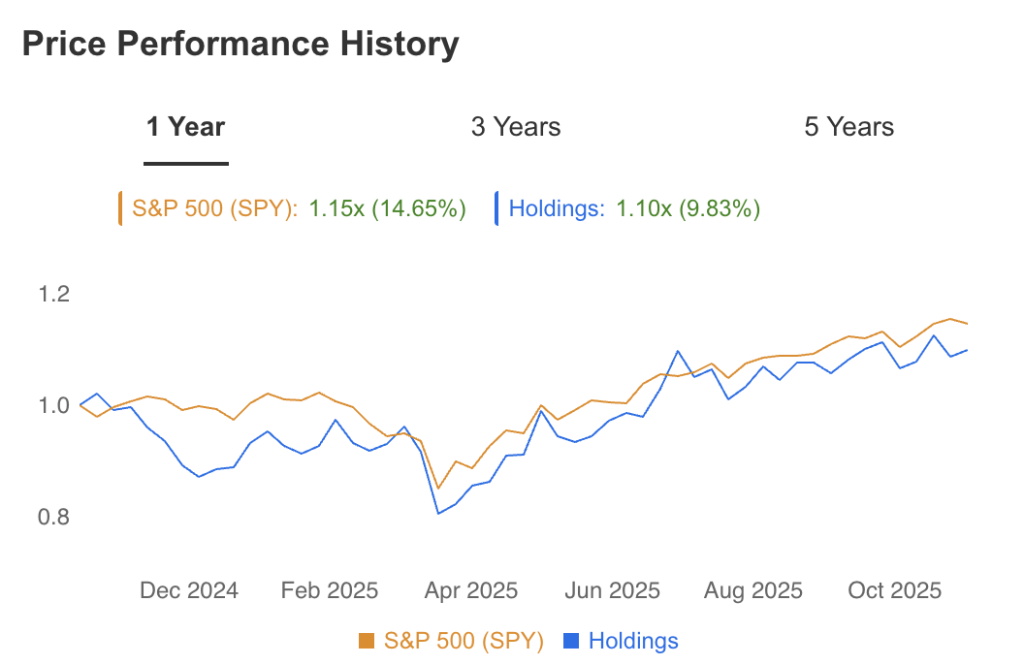

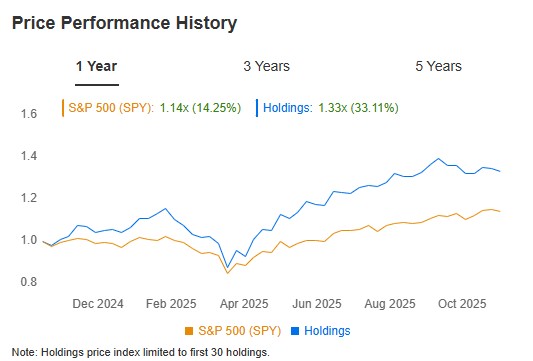

Three Year Return & Holdings Summary

View Holdings

Daniel Loeb

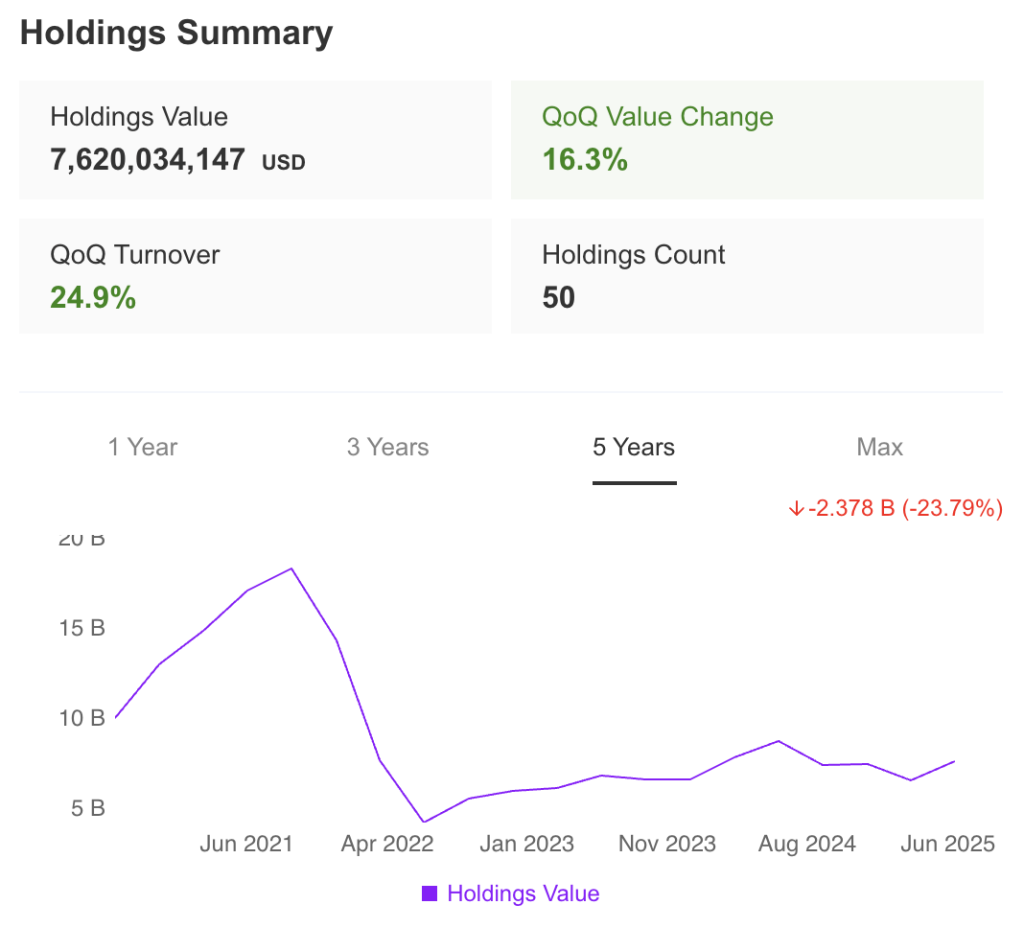

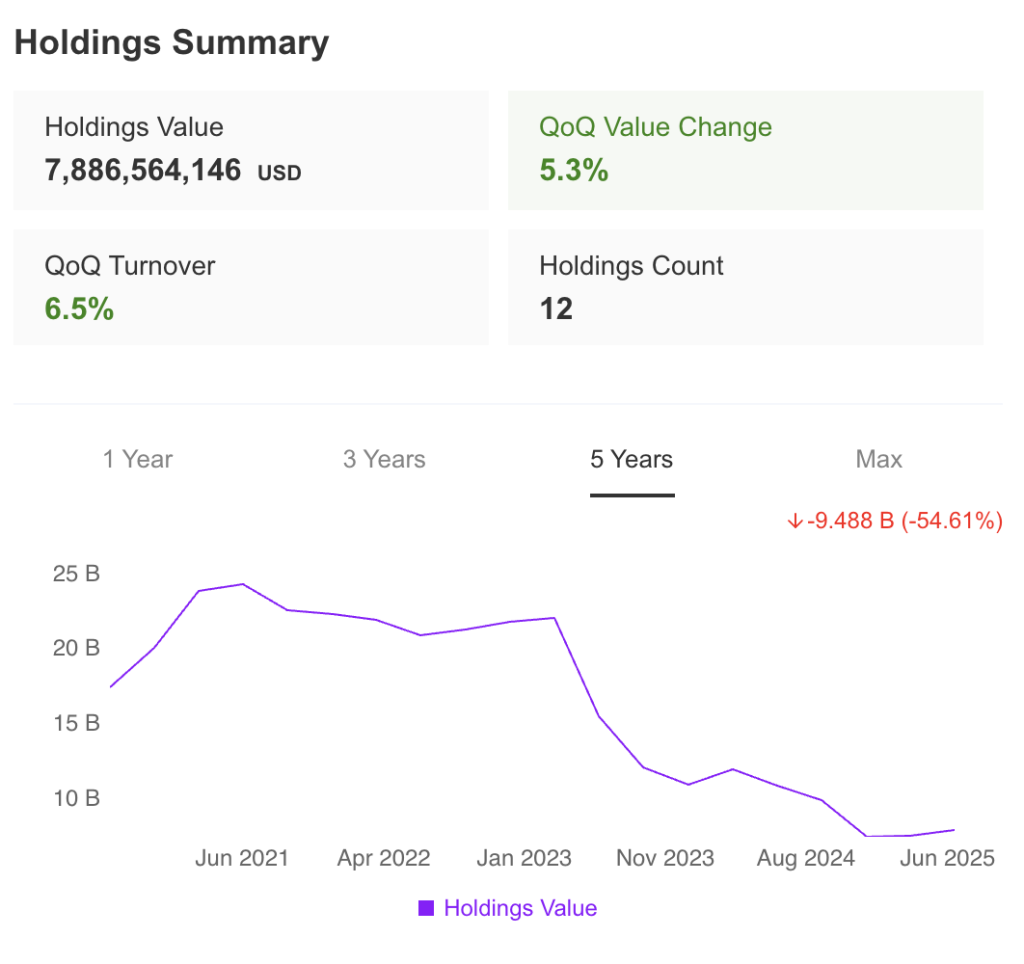

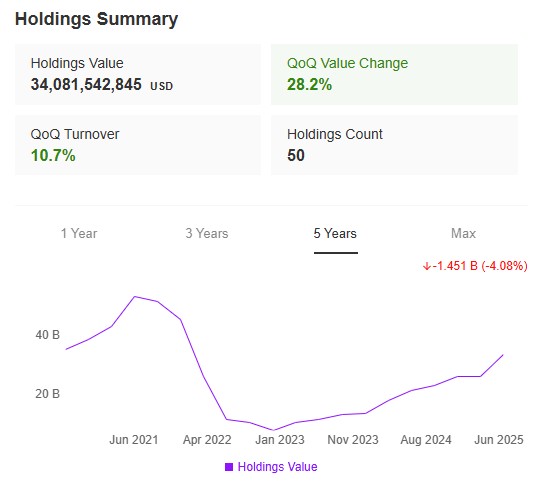

Holdings Summary

View Market

Daniel Loeb

Market View

View Projections

Daniel Loeb

Projections

View Health

Daniel Loeb

Health

Nelson Peltz

Nelson Peltz

Reporting period: Jun 30, 2025

Filling Date: Aug 14, 2025

Nelson Peltz is the co-founder and chairman of Trian Fund Management, a multi-billion dollar investment firm known for its activist investing approach. Under his leadership, Trian focuses on enhancing shareholder value by engaging with management teams and advocating for strategic changes in the companies in which it invests.

Peltz, a prominent and influential investor, has a track record of successful interventions in major corporations such as Procter & Gamble, PepsiCo, and Mondelez International. His ability to drive operational improvements and strategic transformations has established him as a key figure in the investment community. Peltz’s expertise and impact in corporate governance and value creation have made him a notable name in the world of finance.

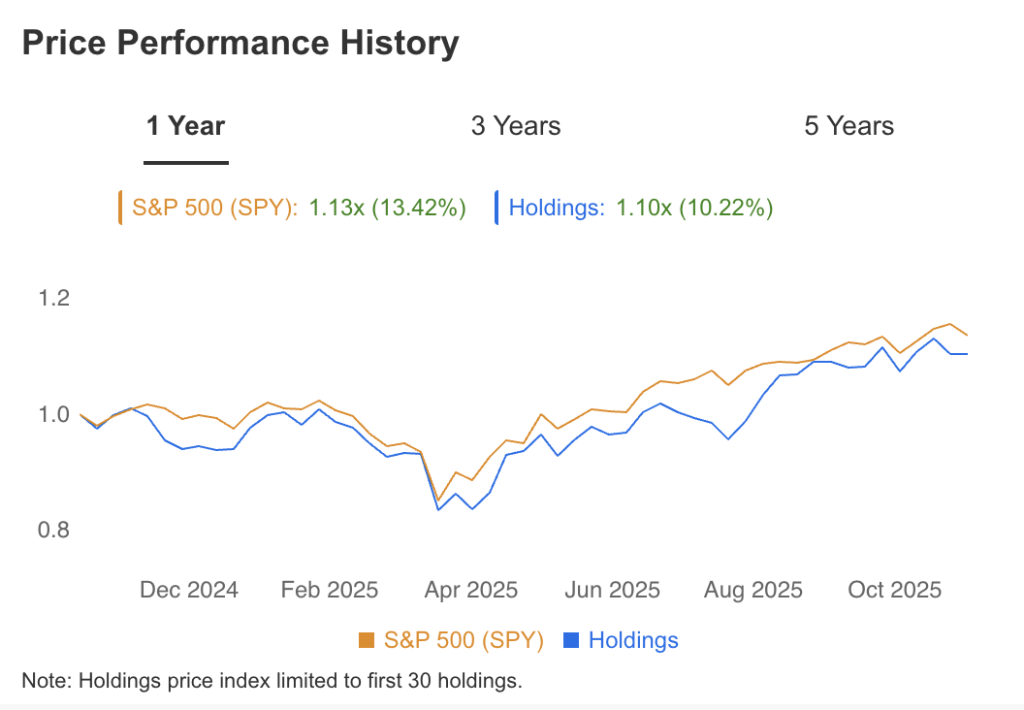

Three Year Return & Holdings Summary

View Holdings

Nelson Peltz

Holdings Summary

View Market

Nelson Peltz

Market View

View Projections

Nelson Peltz

Projections

View Health

Nelson Peltz

Health

Farallon Capital

Farallon Capital

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

Farallon Capital Management is a prominent investment firm founded by Thomas Steyer in 1986, known for its diversified approach to investing across public and private markets.

The firm employs a multi-strategy investment approach, focusing on long/short equity, credit, and special situations to generate significant returns. Under its leadership, Farallon has managed substantial assets, leveraging deep research and market insight to identify and capitalize on high-growth opportunities and undervalued assets. The firm has a reputation for its disciplined investment process and ability to navigate complex financial environments. Farallon Capital’s expertise and strategic vision have established it as a significant player in the investment community.

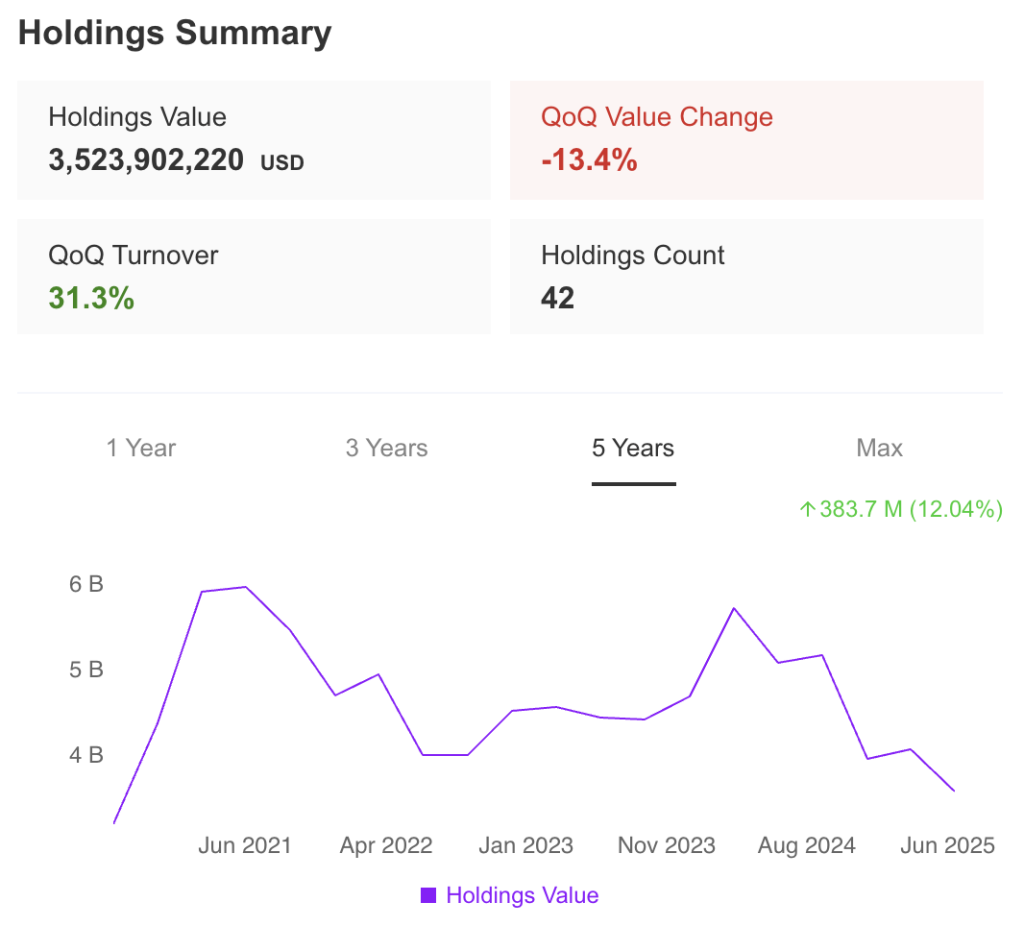

Three Year Return & Holdings Summary

View Holdings

Farallon Capital

Holdings Summary

View Market

Farallon Capital

Market View

View Projections

Farallon Capital

Projections

View Health

Farallon Capital

Health

Chilton Investment

Chilton Investment

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

Chilton Investment Company is a distinguished investment management firm known for its focus on value-oriented equity investing. Founded by Richard Chilton in 1992, the firm manages a range of investment strategies, including long/short equity and concentrated portfolios, with a focus on generating attractive risk-adjusted returns.

Chilton Investment is recognized for its rigorous research process and disciplined investment approach, which emphasizes identifying undervalued stocks and opportunities with significant growth potential. The firm has built a reputation for its expertise in stock selection and portfolio management, contributing to its standing as a respected entity in the investment community.

Three Year Return & Holdings Summary

View Holdings

Chilton Investment

Holdings Summary

View Market

Chilton Investment

Market View

View Projections

Chilton Investment

Projections

View Health

Chilton Investment

Health

Larry Robbins

Larry Robbins

Reporting period: Jun 30, 2025

Filling Date: Aug 14, 2025

Larry Robbins is the founder, CEO, and portfolio manager of Glenview Capital Management, a highly regarded investment firm specializing in long/short equity strategies.

Since founding Glenview in 2000, Robbins has established a reputation for his expertise in identifying undervalued stocks and capitalizing on market inefficiencies. The firm manages a substantial portfolio, focusing on sectors such as healthcare, financial services, and consumer goods. Robbins is known for his deep analytical approach and strategic insights, which have contributed to Glenview’s strong performance and significant influence in the investment community. His ability to navigate complex market conditions and his successful track record have made him a prominent figure in the world of finance.

Three Year Return & Holdings Summary

View Holdings

Larry Robbins

Holdings Summary

View Market

Larry Robbins

Market View

View Projections

Larry Robbins

Projections

View Health

Larry Robbins

Health

Ray Dalio

Ray Dalio

Reporting period: Jun 30th, 2025

Filling Date: Aug 13th, 2025

Ray Dalio is the founder and co-chief investment officer of Bridgewater Associates, one of the world’s largest and most successful hedge funds. Under his leadership, the firm has grown to manage hundreds of billions of dollars, specializing in macroeconomic investing and global diversification.

Dalio, known for his pioneering principles-based approach to investing and management, has gained a reputation for his ability to anticipate and navigate complex economic trends. His firm has been instrumental in shaping modern investment strategies, and Dalio himself is recognized for his insights into global markets and his influential book, “Principles: Life and Work.” His achievements have solidified his status as a leading figure in the investment community.

Three Year Return & Holdings Summary

View Holdings

Ray Dalio

Holdings Summary

View Market

Ray Dalio

Market View

View Projections

Ray Dalio

Projections

View Health

Ray Dalio

Health

Carl Icahn

Carl Icahn

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

Carl Icahn is the founder and chairman of Icahn Enterprises, a diversified holding company with interests in various industries including automotive, energy, and real estate.

Renowned for his aggressive activist investing style, Icahn has built a reputation for shaking up companies to enhance shareholder value. His strategic interventions in firms such as Apple, Xerox, and eBay have made a significant impact on their performance and governance. Icahn’s ability to identify undervalued assets and his skillful negotiation tactics have established him as a formidable figure in the investment world. His career is marked by a series of high-profile successes that have cemented his status as a leading and influential investor.

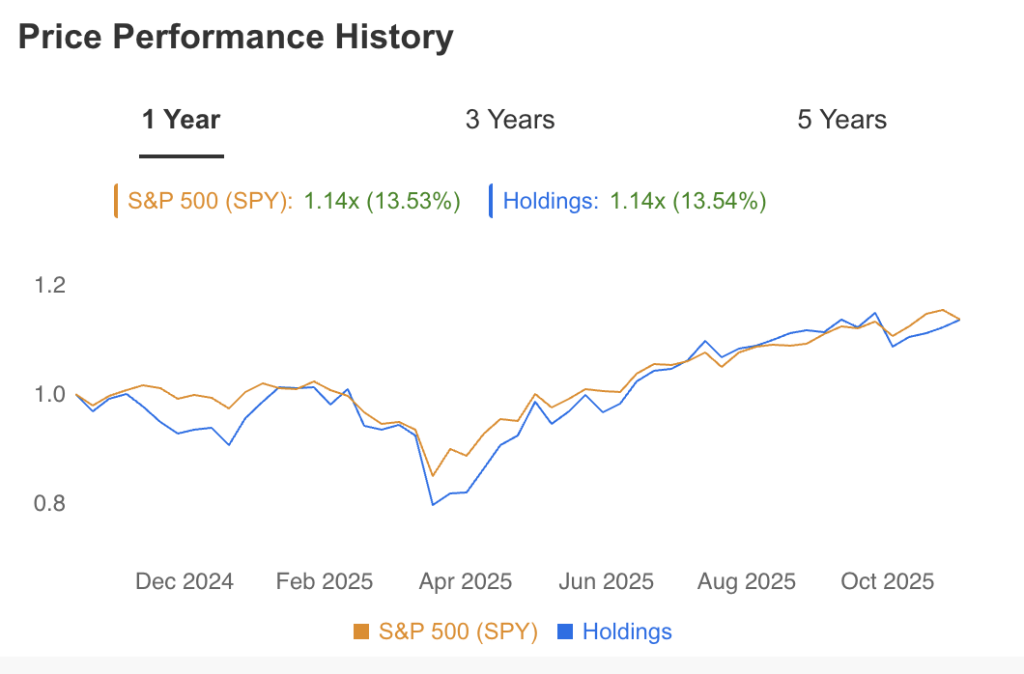

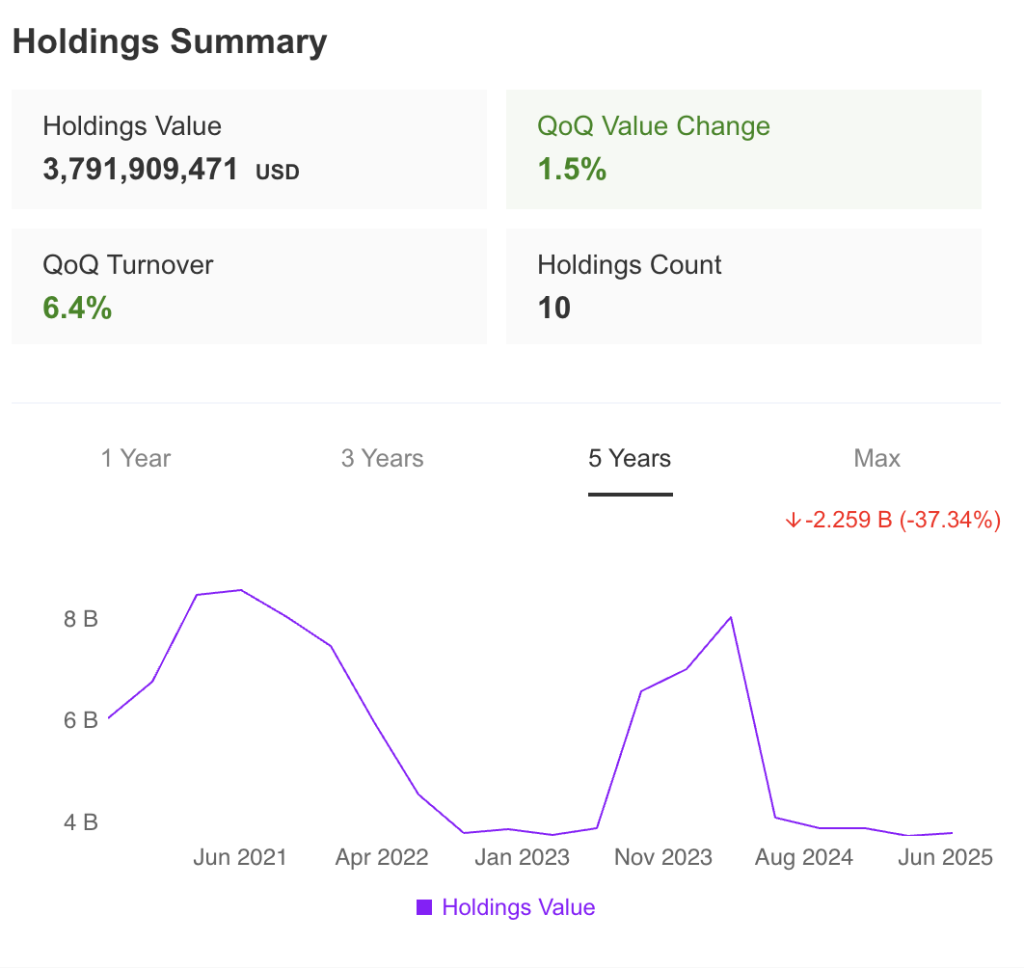

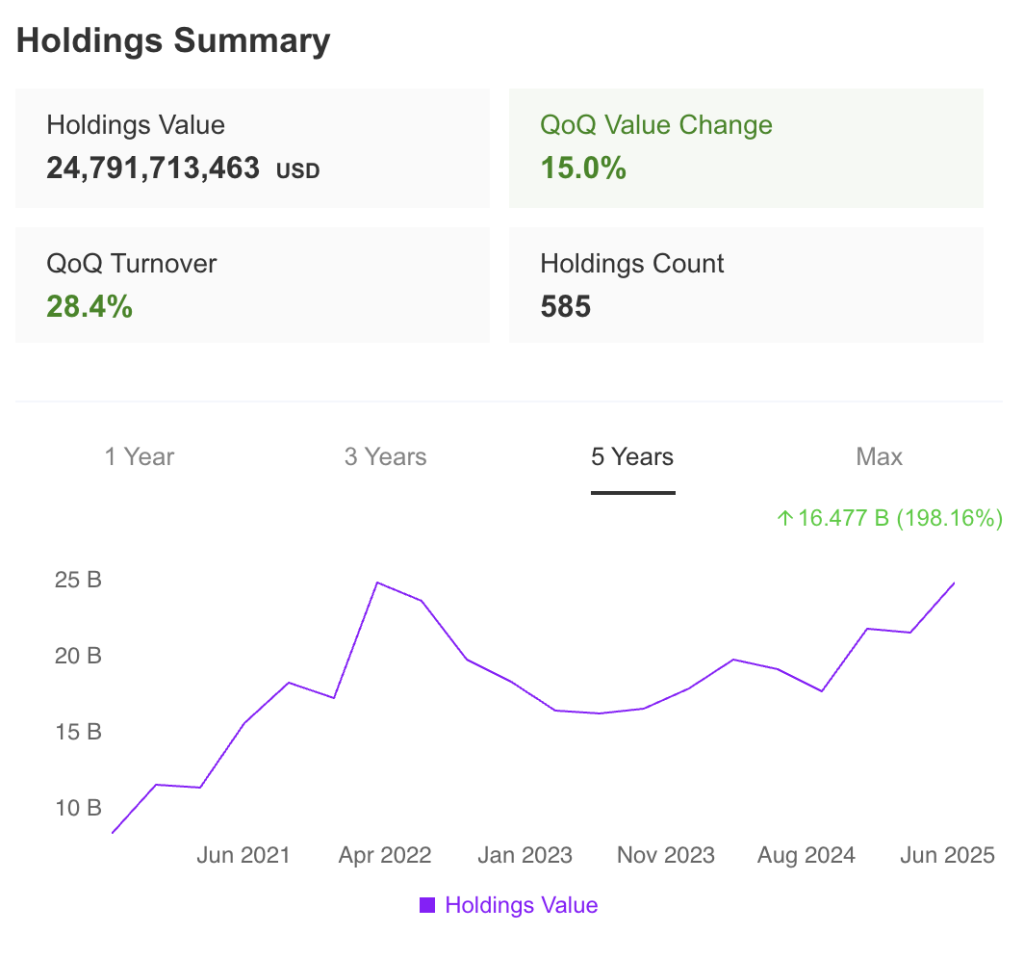

Three Year Return & Holdings Summary

View Holdings

Carl Icahn

Holdings Summary

View Market

Carl Icahn

Market View

View Projections

Carl Icahn

Projections

View Health

Carl Icahn

Health

Bill Ackman

Bill Ackman

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

Bill Ackman is the founder and CEO of Pershing Square Capital Management, a highly regarded hedge fund known for its bold investment strategies and ability to achieve substantial returns.

Under his leadership, the fund has gained prominence by focusing on activist investing in publicly traded companies. Ackman, a prominent investor with well-publicized, high-conviction positions, is recognized for his significant investments in companies such as Chipotle, Herbalife, and Valeant Pharmaceuticals. His analytical approach and strategic investment choices have established him as a key figure in the finance and investment world.

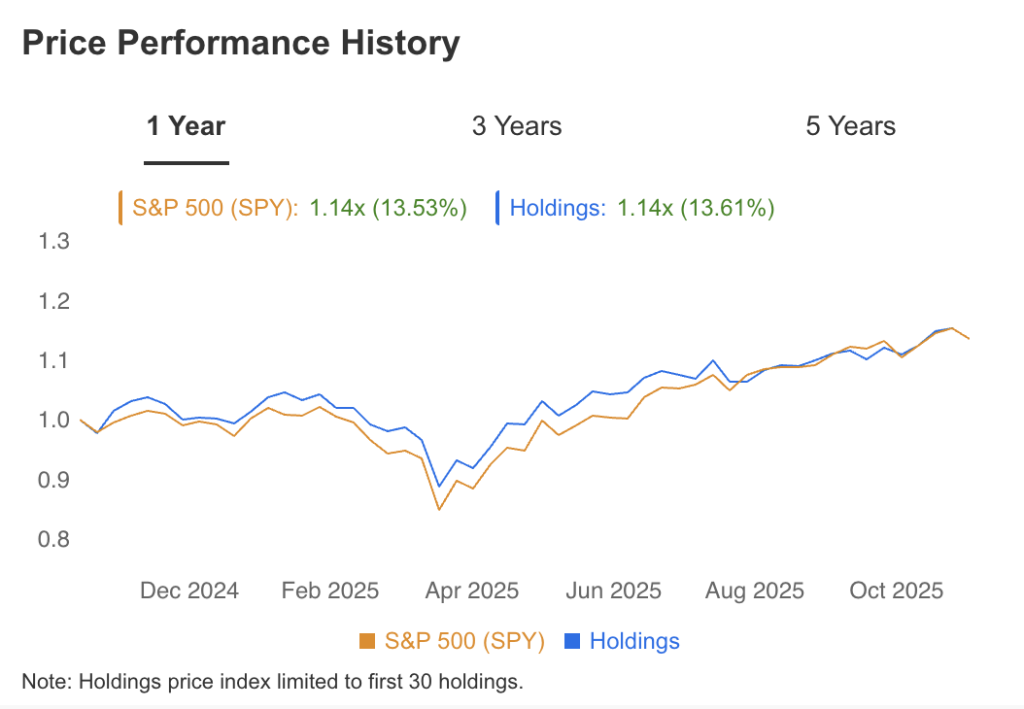

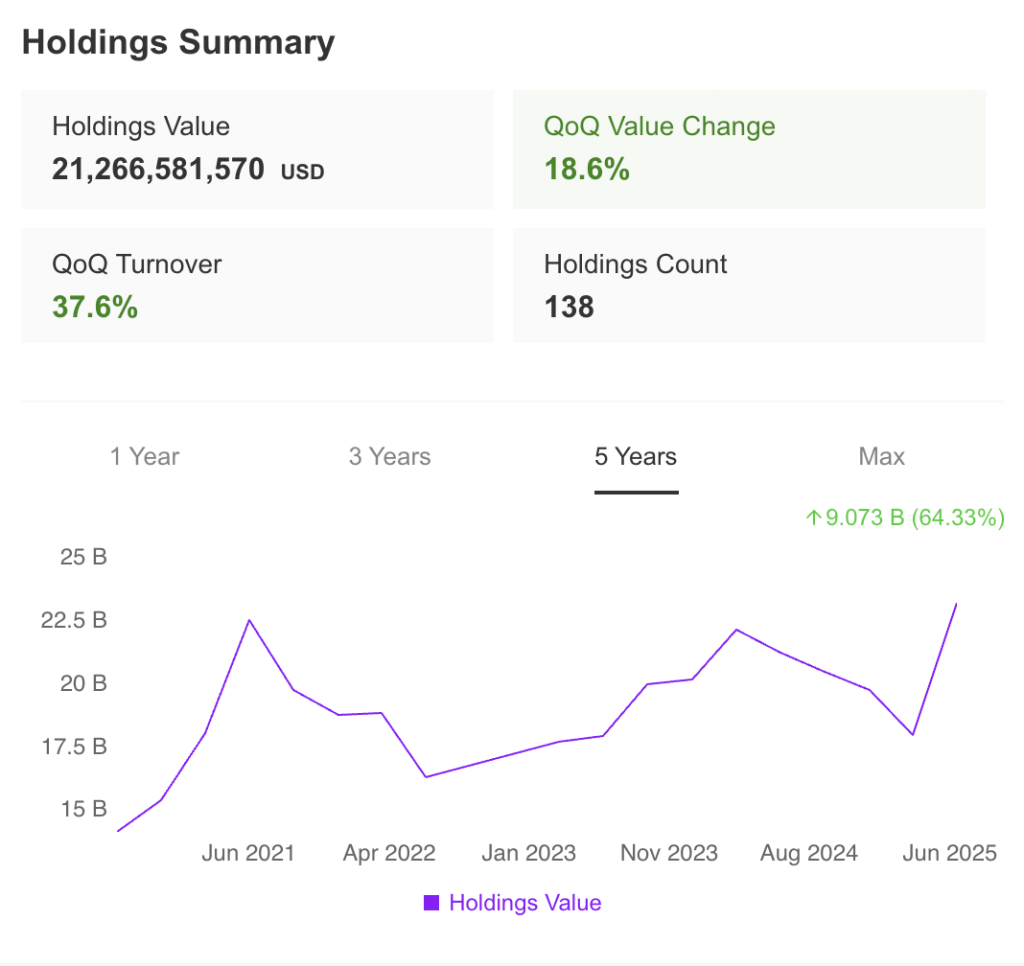

Three Year Return & Holdings Summary

View Holdings

Bill Ackman

Holdings Summary

View Market

Bill Ackman

Market View

View Projections

Bill Ackman

Projections

View Health

Bill Ackman

Health

Chase Coleman

Chase Coleman

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

Chase Coleman is the founder and managing partner of Tiger Global Management, one of the most successful and influential hedge funds in the world.

Under his leadership, the firm has grown to manage billions of dollars, specializing in both public and private equity investments. Coleman, a protégé of legendary investor Julian Robertson, has earned a reputation for his keen ability to identify high-growth technology companies early, leading to significant returns for his investors. His accomplishments include backing industry giants like Facebook, LinkedIn, and Spotify in their early stages, which contributed to Tiger Global’s stellar performance and made Coleman one of the most prominent figures in the investment community.

Three Year Return & Holdings Summary

View Holdings

Chase Coleman

Holdings Summary

View Market

Chase Coleman

Market View

View Projections

Chase Coleman

Projections

View Health

Chase Coleman

Health