Date Issued – 12th December 2024

Preview

Asian stocks rallied Thursday as softer US inflation data strengthened expectations of a Federal Reserve rate cut, with the MSCI Asia Pacific Index hitting a one-month high. Japanese and Hong Kong markets led gains, while Australia’s jobless rate fell unexpectedly, tempering RBA rate-cut bets and boosting the Australian dollar. Meanwhile, Alphabet surged to a record high on AI and quantum breakthroughs, while Nvidia expanded in China despite U.S. trade restrictions. The Biden administration escalated trade tensions with higher tariffs on Chinese solar and tungsten imports, signaling supply chain shifts. Investors eye opportunities in Asian tech stocks, resilient Australian assets, and U.S. innovation leaders like Alphabet, but geopolitical risks remain a concern.

Asian Markets Rally as US Inflation Data Supports Fed Rate Cut

Asian stocks climbed on Thursday, buoyed by expectations of a Federal Reserve rate cut following benign US inflation data. The MSCI Asia Pacific Index hit a one-month high, led by gains in Japanese and Hong Kong markets. US consumer price index data aligned with forecasts, cementing a 25-basis-point rate cut later this month, as swaps traders now price in near-certainty of the move. Meanwhile, Australian bond yields and the dollar rose on stronger-than-expected employment data, while China’s yuan gained after authorities set a firmer currency fixing. The Nasdaq 100’s record rally on Wednesday further propped up sentiment in technology stocks.

Elsewhere, South Korea’s political turbulence weighed on the won, oil steadied after a three-day rally, and traders awaited ECB and Swiss National Bank rate decisions. Bitcoin slipped slightly, while Ethereum saw gains.

Investment Insight: Lower US inflation strengthens the case for a Fed rate cut, bolstering risk-on sentiment in equities. Investors may find opportunities in Asian tech stocks, but geopolitical and currency risks, particularly in South Korea and China, warrant close monitoring.

Australia’s Jobless Rate Hits 8-Month Low, Easing Rate-Cut Bets

Australia’s unemployment rate unexpectedly fell to 3.9% in November, its lowest level since March, defying forecasts of a rise to 4.2%. Employment rose by 35,600, outpacing expectations, and full-time job gains led the increase. The robust labor market prompted markets to scale back chances of a Reserve Bank of Australia (RBA) rate cut in February, with swap-implied probabilities dropping to 55% from 68%. The Australian dollar gained 0.6% to $0.6409, while bond futures fell. Analysts noted that while soft economic growth and muted wage gains previously raised the odds of a rate cut, the resilient labor market tempers this expectation.

Investment Insight: Australia’s strong labor market reduces the likelihood of near-term rate cuts, boosting the Australian dollar. Investors should monitor upcoming Q4 CPI and employment data for further clarity on RBA policy, as steady rates may support equities and local currency bonds.

Alphabet Hits All-Time High on AI and Quantum Breakthroughs

Alphabet’s stock surged over 5% to a record high on Wednesday, fueled by the unveiling of its advanced AI model, Gemini 2.0, and optimism around President-elect Trump’s nomination of Andrew Ferguson to lead the FTC. Investors anticipate a friendlier regulatory climate under Ferguson. The rally also followed Alphabet’s introduction of its new quantum computing chip, Willow, which Bank of America analysts say underscores the company’s innovation leadership, though commercial applications remain distant. Alphabet’s shares have climbed nearly 40% year-to-date, with analysts maintaining a “buy” rating and a $210 price target.

Investment Insight: Alphabet’s advancements in AI and quantum computing strengthen its competitive edge, while a potentially softer regulatory stance could ease investor concerns. Long-term investors may find value in Alphabet’s innovation-driven growth, despite regulatory and technological uncertainties.

Market price: Alphabet Inc (GOOG): USD 196.75

US Raises Tariffs on Chinese Solar and Tungsten Imports

The Biden administration announced sharp tariff increases on Chinese imports of solar wafers, polysilicon, and tungsten products. Starting January 1, tariffs on solar materials will rise to 50%, while tungsten duties will increase to 25%. The move, aimed at protecting U.S. clean energy industries and supply chain resilience, follows a broader review of Chinese trade practices. This escalation comes amid heightened trade tensions, with Beijing recently restricting exports of critical minerals like gallium and graphite to the U.S. Analysts warn tungsten could become a flashpoint, given its strategic importance and China’s dominance in its production.

Investment Insight: Tariff hikes signal continued trade frictions and could drive up costs for U.S. clean energy and manufacturing sectors. Investors may look to domestic suppliers and alternative markets in Africa or Southeast Asia as potential beneficiaries of supply chain shifts.

Nvidia Expands in China to Boost AI and Autonomous Driving R&D

Nvidia has significantly expanded its workforce in China, growing its headcount from 3,000 to 4,000 this year, including the addition of 200 researchers in Beijing focused on autonomous driving technologies. Despite U.S. trade restrictions limiting sales of its most advanced AI chips, China remains a key research hub and market for Nvidia, contributing $5.4 billion in sales during the September quarter. The company is also strengthening after-sales service and networking software teams in the region. Meanwhile, a fresh antitrust probe into Nvidia’s 2020 Mellanox acquisition signals rising tensions amid the U.S.-China trade dispute.

Investment Insight: Nvidia’s strategic investment in China underscores the region’s centrality to AI and EV innovation. However, escalating U.S.-China trade tensions and regulatory risks could weigh on long-term prospects. Investors should balance Nvidia’s growth potential against geopolitical uncertainties.

Market Price: NVIDIA Corp (NVDA): USD 139.31

Conclusion

Global markets are navigating a mix of optimism and caution. Softer US inflation data has bolstered hopes for a Fed rate cut, lifting Asian equities, while Australia’s strong labor market challenges expectations of RBA easing. Alphabet’s AI and quantum strides highlight innovation-driven growth, while Nvidia’s expansion in China underscores the region’s importance despite trade tensions. However, escalating U.S.-China tariffs and geopolitical risks, particularly in South Korea, could temper sentiment. Investors should balance opportunities in resilient labor markets, tech innovation, and shifting supply chains with the uncertainties posed by regulatory and geopolitical challenges across key markets.

Upcoming Dates to Watch

December 12, 2024: US PPI

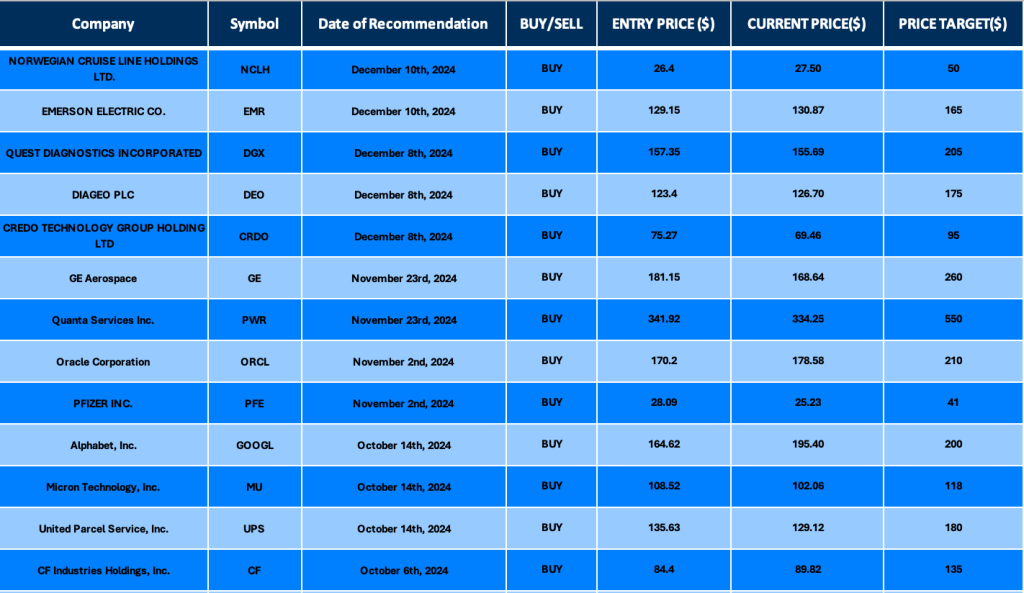

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.