BLOCKCHAIN TECHNOLOGY Balfour Capital Group Initial Coin Offering – Blockchain – Bitcoin Funds

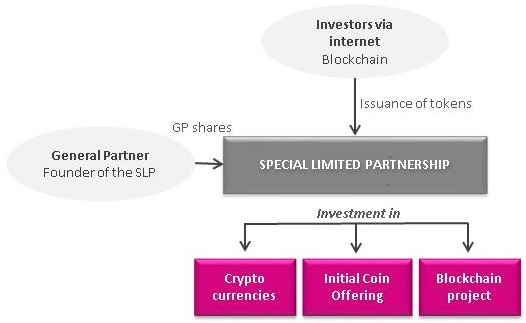

The Special Limited Partnership (SLP) can be used to set up a Bitcoin Fund as an Alternative Investment Fund (AIF).

An Initial Coin Offering (ICO) is a fundraising method operating via the issuance of digital assets exchangeable against cryptocurrencies during the start-up phase of a project.

Initial Coin Offering Process

The issuer prepares a White Paper, a document in which the underlying project is explained by its promoter.

Components of an offer:

- Project details

- Project timelines

- Amount of capital required

- Tokens (financial instrument)

- Dividends to be paid per token to investors

The next stage is the marketing campaign in which the issuer promotes their project to secure the initial capital.

Buying/selling of tokens to investors through an exchange. There are 2 ways to release tokens on blockchain:

- Based on the initial investment made.

- By releasing the tokens on a number of cryptocurrency exchanges in advance of the trading.

Initial Coin Offering Process

With the rise of cryptocurrencies, investment managers may create AIFs to invest in or trade these currencies, grant loans to traders, and invest in companies active in this sector, etc.

A Crypto Fund can be set up as an unregulated SLP within a couple of weeks and remain unregulated if the manager’s AUM stay below €100 million.

Such Funds can also invest in tokens, participate in ICOs, and companies active in the blockchain industry (private or public).

The SLP is a flexible and fast solution for Alternative Investment strategies.

Initial Coin Offering Process

Blockchain is widely regarded as one of the most revolutionary technology innovations of the 21st century. It provides a secure ledger system distributed across various network participants, creating a highly secure accounting system resistant to unauthorized use. Blockchain offers several key advantages:

- Security: Blockchain aims to enhance system security against hacking and fraud.

- Easy to use: It provides an easy mechanism for users to securely transfer currencies or assets between them and facilitates easy auditing of user accounts.

- Flexibility: Using blockchain technology does not require a public ledger or open system if this is undesirable; it can be restricted to certain

- Privacy: The system may remain completely private if desired, with key differences between public and private blockchains.

- Accounting: Blockchain provides a powerful accounting and auditing layer.

- Malleable technology: Blockchain assets are currently unregulated, which helps minimize management costs and expand potential user base and distribution channels.

Any Assets can be tokenized or placed on the blockchain:

- A security (bonds, shares, funds, warrants, options, etc.)

- A currency (or a cryptocurrency)

- A movable asset (car, plane, boat, etc.)

- An intellectual property right or even

- Real Estate

All these assets can be held by a securitization Special Purpose Vehicle (SPV).

The SPV can issue a token, which is a debt security tradable on a blockchain, whether private or public.

Once issued, the token can be traded on a stock exchange or transferred to any participant in this exchange.