Date Issued – 5th September 2024

Tesla’s Stock Poised for Breakout: Key Price Levels to Watch

Tesla (TSLA) shares surged over 4% on Wednesday, defying a broader downturn in large-cap tech stocks. Despite a 25% gain over the past three months, Tesla’s stock has remained relatively flat since late July. Investors are awaiting critical updates on vehicle deliveries, the highly anticipated robotaxi event, and Q3 earnings, all expected next month.

Symmetrical Triangle Formation: Potential for Volatility Ahead

Tesla’s chart reveals a symmetrical triangle pattern, signaling a pause in price movement. This formation suggests that a significant move could be on the horizon, either upwards or downwards. Investors should pay close attention to the following key levels that could shape Tesla’s next trend.

Upside Breakout Levels to Watch

If Tesla’s stock breaks above the symmetrical triangle with strong trading volume, it could rally to the $265 mark, where previous highs from December and July may create resistance. Should momentum continue, the stock could target $300, where it would likely face substantial resistance from levels last seen between December 2021 and July 2022.

Key Support Levels on a Breakdown

Conversely, a breakdown below the triangle pattern could push Tesla’s stock down to the $185 level. This zone could offer support, aligning with the neckline of an inverse head-and-shoulders pattern formed between February and June. Should weakness persist, the next critical support area lies near $152, where bargain hunters may step in around the swing low from April 2023, coinciding closely with another low from April 2024.

Tesla’s stock is at a crucial juncture, and the next move could set the tone for its performance in the coming months. Investors should monitor these key price levels closely as the company gears up for a potentially game-changing quarter.

Qualcomm, Samsung, and Google Collaborate on Mixed-Reality Glasses: A New Approach to AR/VR Technology

Qualcomm’s CEO Cristiano Amon has revealed that the company is partnering with Samsung and Google to develop a new set of mixed-reality glasses, offering a distinct alternative to Apple’s larger headset approach. This collaboration, first announced last year, aims to create glasses that seamlessly integrate augmented reality (AR) and virtual reality (VR) experiences, connected directly to a smartphone. Amon highlighted that the primary goal is to deliver “new experiences” through these smart glasses, with the ultimate vision of encouraging smartphone users to purchase them as complementary devices. Unlike Apple’s Vision Pro, the Samsung-Google-Qualcomm collaboration focuses on smaller, wearable glasses that may offer a more practical and stylish solution for daily use.

Qualcomm’s Role and AR1 Gen 1 Chip

Qualcomm, which has made mixed-reality technology a strategic focus as it diversifies from its smartphone-centered business, is contributing its Snapdragon AR1 Gen 1 chip specifically designed for smart glasses. This chip is crucial in Qualcomm’s broader strategy of enabling AI applications to run directly on devices, enhancing the processing power of both the glasses and the smartphone they connect to. Amon emphasized the importance of localized AI processing: “AI will run on the device, on the cloud, and across both the glasses and the phone,” delivering enhanced, real-time experiences without relying solely on cloud infrastructure.

Market Potential and Challenges

While mixed-reality headsets remain a smaller segment compared to the vast smartphone market with the International Data Corporation predicting only 9.7 million VR/AR headsets shipped this year compared to 1.23 billion smartphones, smaller and more wearable devices like smart glasses could unlock broader consumer adoption. Amon believes the industry needs to achieve a level of comfort and style, where these glasses resemble regular eyewear, to drive mass adoption. In comparison to Meta’s Ray-Ban smart glasses, which are integrated with a camera and AI-powered voice assistant, Qualcomm’s vision is centered around creating a product that feels as natural as wearing everyday glasses, yet fully capable of delivering mixed-reality experiences.

Strategic Implications for Tech Giants

This project represents a significant step in the competition among tech giants for leadership in the mixed-reality space. Apple’s Vision Pro headset has already made waves, but Google, Samsung, and Qualcomm are betting on a different form factor and strategy. With further details expected to emerge soon, this collaboration could be pivotal in shaping the future of AR and VR, potentially transforming how consumers interact with technology in their daily lives. As the development progresses, industry watchers are keen to see how this trio’s product will stand up against other emerging AR/VR technologies, including Apple’s high-profile offerings.

Dollar Struggles Amid Growing Bets on Aggressive Fed Rate Cut

The U.S. dollar found itself under pressure on Thursday, weighed down by rising expectations of an outsized rate cut from the Federal Reserve as concerns about the U.S. economy’s growth outlook intensify. Renewed fears over the slowing U.S. labor market and softer-than-expected economic data have driven investor sentiment toward a more aggressive easing cycle by the Fed. Amid this, the Japanese yen emerged as a standout performer, gaining on the back of its safe-haven status and speculation that upcoming rate hikes from the Bank of Japan (BoJ) could strengthen the yen by narrowing interest rate differentials. The yen rose 0.26% to 143.36 per dollar, reaching a one-month high earlier in the session. For the week, the yen is up 1.8%, reflecting increased demand for safer assets.

U.S. Economic Outlook and Fed Expectations

Global financial markets remain on edge, with stocks taking a hit following weak U.S. economic data. Earlier this week, U.S. job openings for July fell to a 3.5-year low, indicating a cooling labor market. This came on the heels of Tuesday’s ISM manufacturing report, which showed continued contraction in the sector. Investors are now factoring in the possibility of a larger-than-expected rate cut by the Fed, as economic growth prospects appear less robust than previously forecast. Hemant Mishr, Chief Investment Officer at S CUBE Capital, remarked, “The markets are becoming more anxious. There’s been a shift from focusing on positive news to rationalizing a sell-off based on negative data.” Economists at Wells Fargo noted that the latest labor market data reaffirm the notion that the job market is no longer a primary source of inflationary pressure for the U.S. economy. With the Fed focused on labor market stability, any signs of further weakening are likely to influence the central bank’s decision-making.

Dollar’s Performance and Market Sentiment

The U.S. dollar made a modest recovery on Thursday, inching up 0.02% against a basket of major currencies to 101.28, but remained subdued overall. The euro dipped slightly by 0.05% to $1.1077, while the British pound held steady at $1.3146. Meanwhile, the Australian dollar slipped 0.02% to $0.6724, although it remained supported by a still-hawkish stance from the Reserve Bank of Australia. Investors are now betting on a 45% chance of the Federal Reserve lowering interest rates by 50 basis points at its upcoming meeting, with more than 100 basis points worth of cuts priced in by the year’s end. The market’s focus remains squarely on Friday’s nonfarm payrolls report, where economists expect the U.S. economy to have added 160,000 jobs in August, compared with 114,000 in July. The unemployment rate is anticipated to tick down to 4.2%. Mishr from S CUBE Capital commented, “If the unemployment rate rises beyond 4.5%, markets will likely start pricing in a more aggressive 50-basis-point cut.”

Global Currency Movements

Elsewhere, the New Zealand dollar edged up 0.05% to $0.6202, while the Chinese yuan strengthened, with the onshore rate gaining around 0.2% to 7.1003 per dollar, approaching its strongest level in over a year.

As the U.S. economy shows signs of slowing, the prospect of a significant rate cut by the Federal Reserve continues to weigh on the dollar, while currencies like the yen and yuan benefit from their safe-haven status. All eyes are now on Friday’s labor market report, which could set the tone for the Fed’s next move.

Hang Seng Index Falls as Tech Stocks Struggle, Mainland China Markets Rebound on Stimulus Hopes

U.S. Markets End Mixed on Wednesday

U.S. equity markets closed mixed on Wednesday, September 4, following a market sell-off the previous day. The Nasdaq Composite and S&P 500 dipped 0.30% and 0.16%, respectively, while the Dow Jones Industrial Average gained a modest 0.09%. Notably, Nvidia (NVDA) extended its Tuesday 9.53% decline with an additional 1.66% loss.

Fed Rate Cut Speculation Grows Amid Labor Market Weakness

Weak U.S. labor market data intensified bets on a more aggressive 50-basis-point rate cut from the Federal Reserve in September. The latest JOLTs report showed job openings declined from 7.910 million in June to 7.673 million in July, prompting an increase in the likelihood of a larger cut from 38% to 45%. FOMC member Raphael Bostic highlighted the growing vulnerabilities in the labor market, signaling that further Fed action may be required. Weaker labor conditions raise concerns about slower wage growth and lower consumer spending, which could hamper U.S. economic performance as consumption accounts for more than 60% of GDP.

Analyst Insights on U.S. Labor Market

Arch Capital Global Chief Economist Parker Ross commented on the latest figures: “Today’s JOLTs report largely reaffirms the weakening we’ve already observed in July’s jobs data and other indicators. It doesn’t offer any major surprises but reinforces the trend of labor market deterioration.”

Australia’s Trade Surplus Widens as Imports Drop

Australia’s trade surplus widened unexpectedly from A$5.425 billion in June to A$6.009 billion in July, as imports dropped by 0.8%, while exports increased by 0.7%. Despite rising exports, falling imports signal a potential weakening in domestic demand.

RBA Signals No Rate Cuts in 2024

Reserve Bank of Australia Governor Michele Bullock indicated that interest rate cuts are unlikely in 2024, maintaining a vigilant stance on inflationary risks. Although inflation concerns persist, the tone was slightly less hawkish than previous statements.

Hang Seng Declines, Mainland China Markets Buoyed by Stimulus Hopes

The Hang Seng Index fell 0.27% on Thursday, following a sell-off in U.S. tech stocks, particularly the Nasdaq’s overnight losses. The Hang Seng Tech Index (HSTECH) dropped 0.17%, with notable names like Baidu (-1.18%), Alibaba (-0.37%), and Tencent (-0.13%) contributing to the decline. However, mainland China markets saw a modest recovery, with the CSI 300 and Shenzhen Composite Index rising 0.16% and 0.73%, respectively, as speculation grew around a potential fiscal stimulus package from Beijing. The mixed private sector PMI data from China underscored the need for stimulus to meet the government’s 5% growth target.

Nikkei Edges Higher Despite Strong Yen

The Nikkei 225 Index inched up 0.03% on Thursday morning, despite the yen strengthening against the dollar, following a 1.20% slide in USD/JPY to 143.728 on Wednesday. A stronger yen can reduce the profits of export-oriented companies, but selective stocks saw gains. Nissan Corp rose by 1.64%, and Softbank Group added 1.12%, while Tokyo Electron Ltd extended losses, dropping 2.54%.

ASX 200 Tracks Dow Higher

The ASX 200 Index gained 0.16%, buoyed by strength in banking and tech stocks, despite weakness in gold, mining, and oil sectors. The S&P/ASX All Tech Index climbed 1.25%, led by ANZ Group Holdings Ltd., which advanced 1.74%. However, Northern Star Resources Ltd fell 0.21%, following a dip in gold prices, and Woodside Energy Group declined by 6.90% amid a crude oil pullback and a Citi downgrade.

Investor Outlook: Monitoring Central Bank Commentary

As central bank rhetoric intensifies and with the U.S. Jobs Report on the horizon, investors should remain vigilant. Real-time data and expert commentary will be crucial for managing trading strategies, especially across Asian equity markets. Stay updated with the latest analysis to navigate the volatile landscape.

BOJ Policymaker Urges Caution on Rate Hikes Amid Market Volatility

Bank of Japan (BOJ) board member Hajime Takata emphasized the need for a cautious approach to interest rate hikes, highlighting the potential impact of market volatility on businesses. Speaking on Thursday, Takata reiterated that while the central bank remains committed to gradually raising rates, any adjustments would depend on ensuring that volatile markets do not undermine corporate investment and wage growth. Takata’s remarks align with BOJ Governor Kazuo Ueda’s previous comments, signaling that future rate increases will proceed in stages if economic conditions and inflation targets evolve as forecasted. However, Takata stressed that these hikes are conditional and would only occur if financial market conditions allow businesses to continue their spending and wage-increase plans without disruption.

“We are prepared to adjust monetary policy if our economic and inflation forecasts are achieved, but we must be mindful of potential risks posed by market turbulence,” Takata said during a news conference. “We cannot proceed with a preset timeline for rate hikes, as we need to closely monitor the impact of market developments on the economy.”

Inflation Risks and Market Volatility in Focus

Takata’s caution is driven by global market volatility, exacerbated by concerns over the U.S. economic outlook. Japan’s Topix stock index plunged 3.7% on Wednesday, its sharpest daily drop since early August, when global market sell-offs intensified. BOJ Deputy Governor Shinichi Uchida had previously assured that the central bank would not raise rates in an unstable market environment, echoing the current sentiment. In a significant policy shift earlier this year, the BOJ abandoned its negative interest rate policy and raised short-term rates to 0.25% in July, as it saw progress toward achieving its 2% inflation target. Governor Ueda has expressed the bank’s readiness to raise rates further, provided inflation remains around 2% and wage growth continues to support consumption. However, Takata pointed out that the global divergence in monetary policies could contribute to market instability. While many central banks, including the Federal Reserve, are beginning to ease after aggressive tightening cycles, the BOJ plans to continue its gradual hikes to avoid overheating the economy or stoking inflationary pressures.

Balancing Inflation with Wage Growth

Takata also addressed concerns about inflation overshooting targets, driven by companies’ willingness to pass on rising costs to consumers. He noted that the central bank must remain vigilant for signs of additional price hikes in the latter half of the fiscal year, while monitoring the broader impact on economic stability. On the issue of the neutral rate of interest — the level at which policy neither stimulates nor constrains the economy — Takata provided little clarity, acknowledging the difficulty in determining this benchmark. He cautioned against setting a rigid target, instead advocating for a flexible approach based on evolving market conditions. As Japan’s inflation-adjusted wages rose for two consecutive months in July, the BOJ’s confidence in sustained wage growth bolstering consumption and enabling further price hikes remains strong. However, with markets in flux, the path forward for rate hikes remains subject to careful scrutiny. Takata’s statements reinforce the BOJ’s cautious yet determined approach to monetary policy, emphasizing the importance of balancing inflation targets with market stability to avoid disrupting the ongoing economic recovery.

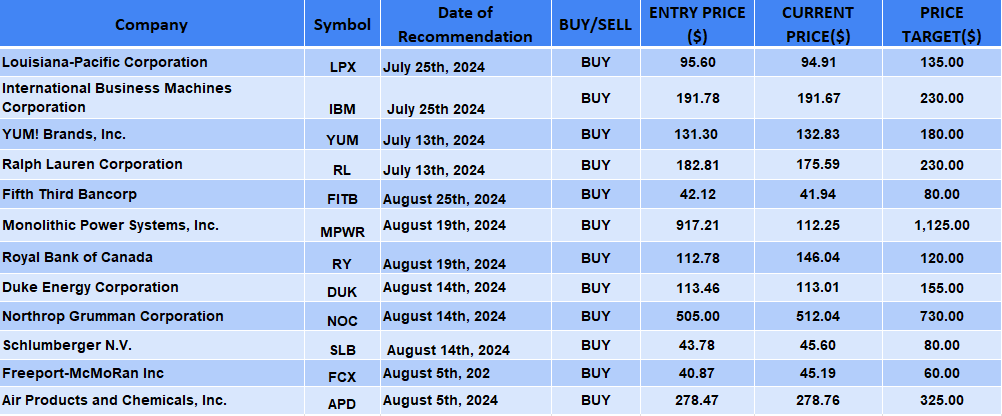

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.