Date Issued – 26th September 2024

Futures Higher, Powell to Speak, Micron’s Outlook – What’s Moving Markets

Futures Rise as Investors Eye Powell’s Comments and Inflation Data

U.S. stock futures are trending upward, with markets focusing on upcoming remarks from Federal Reserve Chair Jerome Powell and the release of key inflation data later this week. By 03:29 ET (07:29 GMT), Dow futures had climbed by 160 points (0.4%), S&P 500 futures rose by 43 points (0.7%), and Nasdaq 100 futures surged by 274 points (1.4%). This follows a mixed trading session on Wednesday, where the S&P 500 dipped 0.2%, the Dow lost 0.7%, and the Nasdaq Composite eked out a modest 0.04% gain. Despite recent volatility, all major indices are on track for monthly gains, driven by the Fed’s recent 50-basis point rate cut.

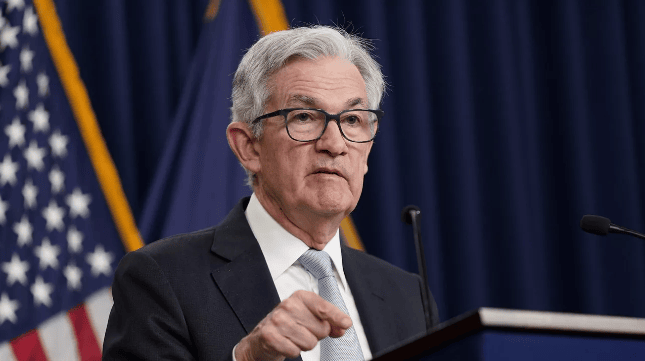

Powell to Address Markets Amid Ongoing Policy Adjustments

Federal Reserve Chair Jerome Powell is set to deliver pre-recorded remarks at the U.S. Treasury Market Conference in New York on Thursday. Following the Fed’s aggressive rate cut last week, Powell described the move as a “recalibration” aimed at supporting the labor market while bringing inflation down to the 2% target. His comments will be closely watched by investors, especially as other Fed officials have expressed differing views on the size of the rate cut. Some, like Fed Governor Michelle Bowman, have voiced concerns over persistent inflation risks.

Micron Surges on Strong AI-Driven Demand

Micron Technology shares soared in after-hours trading, following the company’s better-than-expected guidance for the current quarter. The memory chipmaker, buoyed by rising demand for chips in AI applications, forecasted adjusted earnings of $1.74 per share on revenue of $8.7 billion, surpassing Wall Street estimates. This performance reflects the company’s strong position in the high-bandwidth memory chip market, essential for powering AI-driven graphics processing units. Micron’s CEO Sanjay Mehrotra highlighted continued strength in demand from data center customers, reinforcing a positive outlook for the firm.

OpenAI Explores For-Profit Restructure Amid $6 Billion Fundraising Plan

OpenAI is reportedly considering restructuring into a for-profit entity, a move aimed at attracting more investors. This comes as the company seeks to raise over $6 billion in capital, with key backers like Microsoft and Apple expected to participate. CEO Sam Altman is poised to receive equity under the new structure, marking a significant shift from the company’s original non-profit roots. Valued at an estimated $150 billion, OpenAI has become one of Silicon Valley’s most valuable companies. Several top executives, including the chief technology officer, have resigned amid these developments.

Oil Prices Drop on Saudi Output Plans and Libyan Supply Prospects

Oil prices took a sharp decline on Thursday after reports indicated that Saudi Arabia is abandoning its $100 per barrel price target, with plans to ramp up production. By 03:30 ET, Brent crude fell 2.4% to $71.14 per barrel, while U.S. crude futures (WTI) slid 2.8% to $67.72. Additionally, the potential return of 1 million barrels per day from Libya, following a political agreement, further weighed on prices. The market largely overlooked data showing larger-than-expected declines in U.S. oil inventories, focusing instead on the potential increase in global supply.

New York Mayor Eric Adams Indicted on Federal Charges, Vows to Fight

Charges and Federal Investigation

New York City Mayor Eric Adams is facing a federal indictment after a long-running corruption investigation, making him the first sitting mayor in the city’s history to face criminal charges. Despite the allegations, Adams declared his innocence in a video statement on Wednesday, vowing to fight the charges and continue leading the city. “If I’m charged, I know I’m innocent. I will request an immediate trial so New Yorkers can hear the truth,” Adams stated, adding, “You elected me to lead this city, and lead it I will.”

The exact charges have not yet been made public, but the indictment is expected to be unsealed on Thursday. It remains unclear whether Adams will be arrested or voluntarily surrender to authorities. Multiple reports suggest that a federal grand jury indicted the mayor, though no official comments have been made by the U.S. Attorney’s office in Manhattan. The investigation has entangled several city officials, with top resignations following a search of Adams’ electronic devices by the FBI in November 2023. Media reports have linked the case to potential illegal donations to Adams’ 2021 mayoral campaign, including funds from foreign sources such as the Turkish government, Israel, China, and other countries.

Political Repercussions and Calls for Resignation

The indictment has sparked a wave of political reactions, with some Democratic leaders urging Adams to step down. Public Advocate Jumaane Williams would assume the role of mayor if Adams were forced out of office. Comptroller Brad Lander, one of Adams’ likely challengers in the 2025 mayoral race, called for the mayor’s resignation, stating that New York needs focused leadership. U.S. Representative Alexandria Ocasio-Cortez also called for Adams to step down, saying it would be “for the good of the city.” Despite these pressures, Adams has remained defiant, promising to continue his duties while defending his innocence.

Campaign Finance Allegations and International Links

The U.S. Attorney’s investigation reportedly centers on illegal campaign contributions, with a focus on whether Adams’ 2021 campaign accepted foreign money through a straw-donor scheme involving a Brooklyn construction company. The probe is also looking into Adams’ interactions with various countries, including Israel, Qatar, and South Korea. While Adams has consistently denied any wrongdoing, his legal team has conducted its own investigation, claiming to have found no evidence of illegal activity. They have shared their findings with federal prosecutors, expressing confidence in the mayor’s defense.

City in Political Turmoil

The indictment adds to ongoing political upheaval in New York. Several high-profile resignations have shaken the administration in recent weeks, including Police Commissioner Edward Caban and the city’s chief legal adviser. Public Schools Chancellor David Banks also announced his retirement, further complicating the city’s leadership at a critical time. As Adams faces federal charges, the political landscape in New York City is likely to become even more turbulent, raising questions about the future of his administration and the city’s governance moving forward.

Klarna Partners with Adyen to Bring Buy Now, Pay Later to Physical Retail Stores

Introduction

Swedish fintech Klarna has announced a significant partnership with Dutch payments firm Adyen to introduce its popular Buy Now, Pay Later (BNPL) service to brick-and-mortar retail locations. This collaboration expands Klarna’s reach beyond online shopping, allowing consumers to use BNPL at physical checkout terminals.

Key Details of the Partnership

- Klarna’s BNPL service will be integrated into more than 450,000 Adyen payment terminals globally.

- The service will launch first in Europe, North America, and Australia, with plans for further expansion.

- Klarna’s BNPL service lets consumers spread payments over interest-free installments, a model primarily associated with e-commerce until now.

Strategic Importance

This move highlights Klarna’s growing focus on physical retail as BNPL companies aim to broaden their market beyond online transactions. Klarna’s Chief Commercial Officer, David Sykes, emphasized the company’s goal to make flexible payments available “at any checkout, anywhere.” Similarly, Adyen’s Head of EMEA, Alexa von Bismarck, pointed to the importance of offering consumers payment flexibility at physical retail points.

Background

Klarna has previously collaborated with Adyen on e-commerce payments, but this new deal strengthens their partnership in physical retail. The announcement follows Klarna’s sale of its online checkout solution, a move that allows the firm to focus less on competing with payment gateways like Adyen, Stripe, and Checkout.com.

Klarna’s Growth and Challenges

Klarna is expanding its services ahead of a potential IPO in 2024, introducing products like Klarna Balance and cashback rewards to attract consumers. However, the BNPL sector faces criticism for encouraging overspending, leading regulators in markets like the U.K. to push for more stringent regulations on the payment method.

Conclusion

The Klarna-Adyen partnership represents a significant step for the BNPL industry, bringing flexible, interest-free payment options into physical stores while intensifying competition among fintechs to dominate the retail payments market.

H&M Shares Drop as Rising Costs and Weak Sales Squeeze Profitability

H&M Group (ST) shares declined by 7.6% on Thursday, trading at SEK 167.6 after the company reported a 2.8% year-on-year drop in gross profit to SEK 30.1 billion for the latest quarter. Net sales also fell by 3.1% to SEK 59 billion. Despite this, H&M managed to slightly improve its gross margin to 51.1%, up from 50.9% in the same period last year.

CEO Daniel Ervér attributed part of the weaker sales performance to unseasonably cold weather in June, which dampened consumer activity in key European markets. However, the company’s challenges extended beyond weather patterns. Operating profit plummeted by 26% to SEK 3.5 billion, driving the operating margin down to 5.9% from 7.8% last year.

The significant contraction in profitability was exacerbated by rising selling and administrative expenses, which increased by 1% to SEK 26.6 billion, and grew by 4% in local currencies. These mounting costs put additional strain on H&M’s margins. Analysts from RBC Capital Markets noted that SEK 550 million of these expenses were related to long-term marketing investments and costs associated with winding down the company’s Afound division.

The company’s after-tax profit dropped sharply, declining to SEK 2.3 billion from SEK 3.3 billion in Q3 2023. As a result, earnings per share fell 31% to SEK 1.44, down from SEK 2.04 in the same quarter last year. Cash flow from operating activities also weakened, coming in at SEK 8.2 billion, a significant drop from SEK 12.3 billion in the previous year.

Ervér pointed out that persistent external challenges, including elevated consumer living costs and global economic turbulence, negatively impacted both sales revenue and purchasing costs more than anticipated. H&M’s inventory levels rose 3% to SEK 41.7 billion, though management remains optimistic about future demand, describing the current stock composition as “well-positioned.”

Despite these setbacks, the company’s autumn collection has been well received, and management expects September 2024 sales to grow by 11% in local currencies compared to last year. However, looking ahead to the fourth quarter, analysts expect further pressure on H&M’s gross margin due to external factors and increased markdown costs. Marketing investments are also forecasted to rise slightly, further weighing on the company’s bottom line.

Gold (XAU) Daily Forecast: Can Gold Sustain Its Bullish Momentum Above $2,614?

Market Overview

Gold (XAU/USD) opened the week with strong upward momentum, nearing a high of $2,631 as investors flocked to safe-haven assets. The Federal Reserve’s surprise decision to cut interest rates by 50 basis points, combined with rising geopolitical tensions, has driven this rally. The weakening U.S. dollar, following the Fed’s aggressive monetary easing, has further bolstered gold prices, as investors increasingly turn to non-interest-bearing assets. Analysts had largely anticipated a more moderate rate cut, but with the Federal Open Market Committee (FOMC) signaling potential additional cuts before the year’s end, the appeal of gold continues to grow. Philadelphia Fed President Patrick Harker emphasized the Fed’s delicate balancing act between “hard” and “soft” economic data, while Fed Governor Michelle Bowman expressed concerns over inflation, advocating for a smaller cut. Meanwhile, Governor Christopher Waller, a supporter of the 50 bps cut, suggested that further action will depend on incoming economic data.

Economic Growth Outlook and Its Impact on Gold

Although interest rate cuts traditionally benefit gold, the Fed’s optimistic outlook for U.S. economic growth may limit future gains. The central bank forecasts steady annual growth of around 2.0% through 2027, hinting at a possible “soft landing” for the economy rather than a significant downturn. This positive growth outlook could reduce the need for safe-haven assets like gold, as investors may become more confident in the resilience of the U.S. economy.

Key Data to Watch: PMI and Market Sentiment

Traders are closely watching today’s release of the U.S. Purchasing Managers Index (PMI), as a stronger-than-expected reading could boost the dollar, potentially weighing on gold prices. Additionally, ongoing geopolitical developments, particularly rising tensions in the Middle East, may continue to support gold’s safe-haven appeal, providing a counterbalance to any positive economic data.

Short-Term Forecast

Gold remains firmly bullish above $2,614, with immediate resistance at $2,633.77. A break above this level could push prices higher, while a move below $2,614 may spark short-term selling.

Gold Price Forecast: Technical Analysis

Gold (XAU/USD) is currently trading at $2,631.09, up 0.33%, hovering near critical resistance. The pivot point is at $2,614.93, and as long as prices stay above this level, the bullish trend is likely to persist. Key resistance levels are seen at $2,633.77, with further targets at $2,653.45 and $2,668.63. On the downside, support is found at $2,600.31, followed by $2,588.50. The 50-day EMA at $2,574.62 continues to provide solid backing for the upward trend. A bullish engulfing candle formation suggests further buying pressure, potentially targeting the 161.8% Fibonacci extension level at $2,633.77. However, a break below $2,614.93 could lead to a sharper decline in gold prices.

Conclusion

As long as gold remains above the $2,614 level, the bullish momentum is expected to hold. However, investors should keep an eye on key economic data and geopolitical developments, which could influence market sentiment and trigger shifts in gold’s short-term trajectory.

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.