Date Issued – 3rd September 2024

Jefferies Downgrades Novartis Amid Near-Term Caution, Despite Long-Term Optimism

Jefferies analysts have downgraded their rating for Novartis (SIX: NOVN) (NYSE: NVS) from “buy” to “hold,” reflecting a more cautious stance on the pharmaceutical giant’s short-term prospects, despite maintaining a positive long-term outlook. The downgrade, dated Tuesday, stems from concerns over upcoming product releases, evolving market dynamics, and revised financial projections. Novartis has experienced a strong year, with its stock appreciating over 20%. Jefferies believes this surge has already captured much of the potential upside from recent favorable developments, leaving limited room for further immediate gains. As a result, the brokerage has adjusted its price target to CHF 105 from CHF 110 per share, indicating only a modest 3% potential upside from current levels. This suggests that recent positive factors may be fully reflected in the stock’s price, with little immediate catalyst for additional gains.

A key factor behind Jefferies’ downgrade is the anticipated delay in market enthusiasm surrounding Novartis’ upcoming product launches, including Scemblix, Pluvicto, and Fabhalta. The analysts noted that “it will take time into 2025 for approvals and ramp-ups to drive wider optimism in trajectory to 2030+,” tempering near-term expectations despite the long-term growth potential of these products. Jefferies also highlighted that while they are more optimistic than the consensus on Novartis’ long-term sales and profit trajectories, their near-term growth projections for 2024 to 2026 remain modest. The analysts expect only a 1% to 3% upside in consensus estimates for this period, indicating that it may take time for approvals and product launches to build broader market confidence beyond 2026.

In a survey conducted among U.S. physicians, Jefferies sought to assess the potential of Scemblix in treating chronic myeloid leukemia. The survey results indicated strong market penetration by 2029, supporting a bullish long-term outlook. However, the analysts cautioned that more concrete evidence of Scemblix’s effectiveness compared to existing treatments is needed, which could delay its wider adoption and make near-term prospects less certain. Pluvicto, another critical drug in Novartis’ pipeline, also faces challenges in achieving its full commercial potential. While Jefferies remains optimistic about Pluvicto’s peak sales, the analysts highlighted several obstacles, including the need to improve patient access to radioligand therapies and secure earlier-line treatment approvals. These uncertainties contribute to the tempered short-term expectations, even as the drug’s long-term outlook remains promising.

Despite the downgrade, Jefferies maintains a bullish long-term view on Novartis. The analysts predict that the company’s sales and profits will exceed current market expectations by 2030, driven by the success of key products such as Scemblix, Pluvicto, Fabhalta, Kisqali, and Cosentyx. These drugs are expected to contribute significantly to Novartis’ growth, solidifying its position in the pharmaceutical industry in the years ahead.

Intel Eyes Strategic Shift Amid Potential Asset Sales and Cost-Cutting Measures

Intel (NASDAQ: INTC) is under the spotlight this week following reports from Reuters that CEO Pat Gelsinger and other senior executives are poised to unveil strategic plans later this month aimed at revitalizing the company. These plans reportedly include asset divestitures and capital expenditure reductions as Intel seeks to reverse its downward trajectory. Last Friday, Intel’s stock surged by more than 9% after Bloomberg revealed that the tech giant is contemplating the spin-off or sale of its foundry business—a division currently operating at a loss by producing chips for external clients. However, sources close to the situation indicate that Intel is not yet committed to selling its contract manufacturing unit but is exploring the possibility of offloading its Altera programmable chip business.

Despite Friday’s rally, Intel’s stock has plummeted over 56% year-to-date, with the decline accelerating last month after a disappointing second-quarter earnings report. In response, the company announced a suspension of its dividend and a 15% reduction in its workforce, targeting $10 billion in cost savings.

Technical Analysis: Key Levels to Watch

Intel’s stock has shown signs of potential recovery, with technical indicators suggesting the formation of a double bottom—a pattern that often signals a reversal to the upside. After gapping down over 26% in early August following its earnings release, the stock has formed two significant troughs, hinting at a possible trend reversal. Although Intel closed above the pattern’s neckline on Friday with above-average trading volume, investors should await a more decisive breakout this week for confirmation.

Key Overhead Resistance Levels

- $25: This level corresponds to a region where early buyers might seek to secure profits, particularly those who entered near the lows of October 2022 and February 2023.

- $30: A move to this level could encounter resistance from a horizontal line that connects multiple peaks and troughs formed between November 2022 and July 2023.

- $32.25: If the stock successfully closes above $30, it may advance to $32.25, where selling pressure could emerge from a trendline that links the August and October 2023 lows with recent trading levels from May to July 2024.

- $37: Continued buying momentum could push the stock towards $37, a confluence point of resistance marked by the downward-sloping 200-day moving average and several price peaks recorded between June 2023 and July 2024.

Conclusion: As Intel prepares for a possible strategic overhaul, these technical levels will be critical in determining whether the stock can sustain its recent upward momentum or face renewed selling pressure.

Tesla Sees Record China Sales in August, but Competition Remains Fierce

Tesla (NASDAQ: TSLA) recorded its best sales month of the year in China this August, driven by strong demand in smaller cities across the world’s largest auto market. The U.S. electric vehicle (EV) giant reported over 63,000 units sold, marking a substantial 37% increase from July. However, this figure is likely slightly below the 64,694 units sold in August 2023. While this uptick in sales is a positive sign, Tesla’s performance continues to trail significantly behind its major Chinese competitors. BYD (SZ: 002594), the world’s leading EV manufacturer, saw its China passenger vehicle sales skyrocket by 35% year-on-year in August, hitting a record monthly high of 370,854 units. Other local EV makers, including Leapmotor (HK: 9863) and Li Auto (NASDAQ: LI), also posted impressive sales growth during the same period.

Tesla, like many automakers, has been hit hard by an ongoing price war in China, exacerbated by sluggish economic growth and fragile consumer confidence. The company’s China sales declined by 5% in the first half of 2024. Despite these challenges, several factors have contributed to Tesla’s recent sales momentum. Since April, Tesla has been offering zero-interest loans of up to five years for Chinese buyers. Additionally, several local governments have recently included Tesla vehicles in their official car purchase programs. Tesla also gained a significant regulatory win earlier this year when China’s top auto industry association confirmed that the company’s data collection practices were in compliance with local regulations. This approval allowed Tesla vehicles to access certain government facilities from which they were previously barred.

An analysis by China Merchants Bank International revealed a 78% year-on-year increase in Tesla deliveries in China’s so-called tier-three cities in July, with sales in second-tier cities such as Hangzhou and Nanjing rising by 47%. Further supporting its growth, Tesla’s China-made vehicle sales, which include exports, rose 3% year-on-year in August, totaling 86,697 units, according to data from the China Passenger Car Association. Deliveries of the China-made Model 3 and Model Y vehicles were up 17% from July. Looking ahead, Tesla plans to produce a six-seat variant of its Model Y in China by late 2025, a move aimed at revitalizing interest in its best-selling, yet aging, EV model.

European Stocks Edge Higher as Investors Monitor Economic Data

European stock markets inched higher on Tuesday, continuing the subdued momentum seen at the start of the week as investors kept a close eye on global interest rate outlooks. As of 03:05 ET (07:05 GMT), Germany’s DAX index rose by 0.3%, the CAC 40 in France gained 0.3%, and the U.K.’s FTSE 100 increased by 0.2%.

Focus on U.S. Data

The European markets traded within narrow ranges on Monday due to the U.S. Labor Day holiday, which kept Wall Street closed. A similar cautious trading pattern is expected throughout the week as investors anticipate the release of Friday’s crucial U.S. nonfarm payrolls report. Investors, along with the Federal Reserve, are seeking confirmation that the economic conditions are conducive to an interest rate cut later this month. The previous month’s labor report missed expectations, triggering a significant sell-off in equity markets over growing recession fears. Given this backdrop, market participants are likely to adopt a conservative approach ahead of this week’s data.

Later in the session, the U.S. ISM manufacturing survey will be a key economic indicator to watch. It is expected to show that the U.S. manufacturing sector remains in contraction, adding further weight to the argument for potential rate cuts.

Eurozone Manufacturing Remains Weak

In Europe, inflation recently dropped to its lowest level in three years, with August’s Eurozone CPI registering a 2.2% year-on-year increase. Additionally, Monday’s data revealed that Eurozone manufacturing activity continued to contract in August, signaling that a recovery may still be distant and could warrant further monetary easing. The European Central Bank (ECB) had already cut interest rates in June, ahead of the U.S. Federal Reserve, and is widely expected to reduce rates again later this month, alongside updated inflation and growth projections.

Volvo Announces Long-Range Electric Truck

In corporate news, Volvo (ST: VOLVb) saw its stock rise by 0.2% after the Swedish automaker announced plans to launch a long-range version of its FH Electric truck. The new model, expected to be available in the second half of 2025, will have a range of up to 600 km (373 miles) on a single charge, targeting customers who require longer-distance capabilities. The truck will maximize battery space while enhancing software to improve performance.

Crude Prices Near Two-Month Highs

Crude oil prices traded mixed on Tuesday as traders balanced concerns over sluggish economic growth in China, the world’s largest crude importer, against supply disruptions in Libya. By 03:05 ET, Brent crude futures were down 0.1% at $77.41 per barrel, while U.S. crude futures (WTI) edged up 0.1% to $74.11 per barrel. The WTI contract did not settle on Monday due to the U.S. Labor Day holiday. China’s purchasing managers’ index hit a six-month low in August, indicating potential weakening demand from the world’s largest crude importer. However, supply constraints provided some support to prices, as oil exports at key Libyan ports were halted on Monday due to political unrest, curtailing production across the OPEC member nation.

Navigating Conflict and Crisis: How Ukraine Secured a Wartime Debt Restructuring

In the wake of Russia’s invasion, Ukraine faced an economic crisis that required a swift and significant restructuring of its sovereign debt. Just months after the conflict began, Yuriy Butsa, Ukraine’s debt chief, was handed a crucial document from Rothschild & Co., the country’s financial advisor, detailing major debt restructurings over the past three decades. This would soon become vital as Ukraine embarked on one of the fastest and largest debt restructurings in history. By August 2022, with Ukraine’s economy devastated by war, the country reached an agreement with creditors to pause bond payments. Last week, in a landmark achievement, Ukraine finalized the restructuring of over $20 billion in debt, a move that will save the country $11.4 billion over the next three years. This restructuring is not only crucial for Ukraine’s war effort but also aligns with its commitments under the International Monetary Fund (IMF) program.

Reviving Stalled Negotiations

Initial negotiations between Ukraine and its creditors were rocky. By June, talks had broken down, with creditors balking at Ukraine’s demands, which exceeded the 20% writedown most had anticipated. The core committee of bondholders warned that Ukraine’s demands could harm long-term relations. With time running out before the August 2022 payment moratorium expired, Rothschild organized face-to-face meetings in Paris. These discussions took place in Rothschild’s prestigious offices on Avenue de Messine, a setting that underscored the gravity of the negotiations. Both government and creditor representatives approached the talks pragmatically, despite significant differences in their positions.

Overcoming Exceptional Uncertainty

Several factors prompted a return to negotiations. The looming deadline was one, but equally important was the IMF’s updated economic projections for Ukraine, which, despite reflecting a worsening situation, provided a new basis for talks. Ukraine’s proposal, presented in July, was met with counter-demands from creditors. The creditors, including major asset managers like BlackRock and Amundi, insisted on the immediate resumption of ‘coupon’ payments and a clear path to higher principal recovery. They also emphasized the need for simplicity in the restructuring process. IMF experts played a critical role, providing real-time support from Kyiv and Washington. Their involvement was crucial for the labor-intensive modeling required to evaluate the impact of various proposals on Ukraine’s long-term debt sustainability. By July 18, after nearly 48 hours of intense discussions, the teams were still fine-tuning the numbers, working under extreme pressure to reach a deal.

Closing the Deal

A significant challenge in the negotiations was the need to avoid the costly GDP warrants that had complicated Ukraine’s 2015 restructuring. Instead, Ukraine proposed a simpler GDP-linked bond, which, along with the immediate coupon payments that creditors wanted, helped bridge the gap between the two sides. The restructuring deal was finally within reach, but the process wasn’t without its last-minute dramas. As Butsa was driving back from a Polish airport, a safer route since the invasion had grounded flights from Kyiv a car crash delayed his return. Despite this, Butsa managed to finalize the agreement, securing more than 97% support from bondholders. This historic restructuring, executed amidst unprecedented challenges, not only provides Ukraine with the financial relief needed to continue its war effort but also sets a precedent for how sovereign debt can be restructured under extreme conditions.

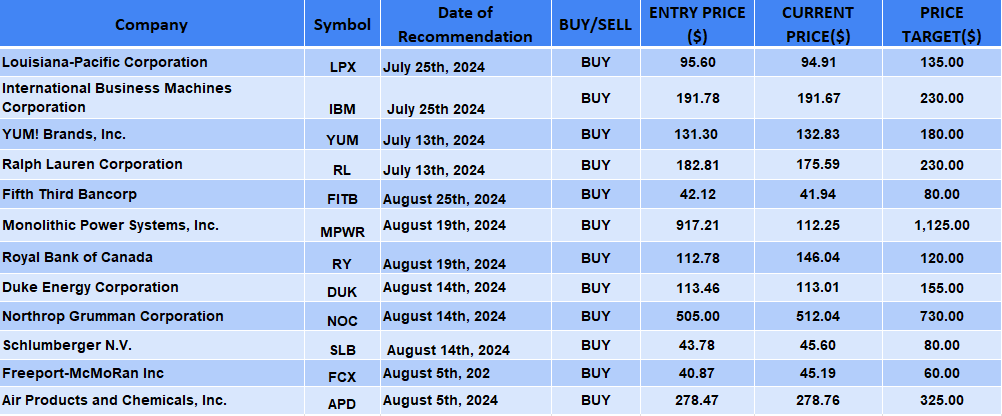

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.