Date Issued – 16th December 2024

Preview

This week, all eyes are on the Federal Reserve’s final meeting of 2024, where a 25-basis-point rate cut is anticipated. Fed Chair Jerome Powell’s comments on the 2025 outlook will be pivotal, especially as rate cuts may proceed more cautiously than expected. Key economic data on inflation, retail sales, and manufacturing will further shape market sentiment. In Asia, Chinese equities dragged regional markets after weak retail sales growth, while Japan bucked the trend with strong machinery orders. Globally, Bitcoin hit a record $106,000 amid speculation of a U.S. strategic reserve, and Palantir gained attention following its Nasdaq 100 inclusion. Meanwhile, the “Magnificent Seven” tech stocks sustain U.S. markets, though declining breadth is a concern. Investors should remain cautious, monitoring Powell’s remarks, China’s policy shifts, and Bitcoin’s regulatory outlook.

The Final Fed Meeting of 2024: Key Highlights for the Week Ahead

Investors are bracing for the Federal Reserve’s last meeting of the year on Dec. 18, where a widely expected 25-basis-point rate cut will be announced. Markets are closely watching Fed Chair Jerome Powell’s comments on the 2025 outlook, as the path for rate reductions appears less aggressive than previously anticipated. Economic updates on retail sales, the Fed’s preferred inflation gauge (PCE), and activity in manufacturing and services will also shape the week. Meanwhile, the “Magnificent Seven” tech stocks continue to buoy markets despite signs of declining breadth, with the Dow suffering its worst streak since 2020.

Investment Insight: Stay cautious as markets digest Fed signals. A slower pace of rate cuts could mean prolonged pressure on sectors sensitive to higher rates, favoring resilient growth stocks. Monitor inflation trends and Powell’s remarks for clarity on 2025.

Chinese Shares Drag Asian Markets Amid Weak Retail Data

Asian equities slumped as Chinese stocks weighed on the region following disappointing retail sales data. China’s retail sales grew just 3% year-on-year, missing forecasts of 5%, highlighting continued struggles in the world’s second-largest economy. The CSI 300 Index fell for a second day, dragging Hong Kong and Australian markets lower, while Japan posted gains. Investors remain cautious as Beijing’s recent consumption-boosting pledges lack concrete fiscal measures.

Meanwhile, Korea’s Kospi erased gains after President Yoon Suk Yeol’s impeachment, with the central bank pledging support to stabilize markets. Globally, traders are preparing for a week of central bank meetings, including the Fed, Bank of Japan, and Bank of England. In commodities, oil retreated on supply glut concerns, and gold remained stable.

Investment Insight: China’s economic weakness and lack of decisive stimulus could continue to pressure Asian markets. Investors should remain cautious on regional equities while monitoring potential policy shifts.

Bitcoin Hits Record High on Strategic Reserve Speculation

Bitcoin surged past $106,000 to a new record on Monday after President-elect Donald Trump hinted at plans to create a U.S. bitcoin strategic reserve akin to the oil reserve, fueling optimism among crypto investors. Trump’s pro-crypto stance, coupled with MicroStrategy’s inclusion in the Nasdaq-100 index, has bolstered sentiment, with Bitcoin now up 192% year-to-date. Smaller cryptocurrencies such as Ether also rallied, climbing 1.5% to $3,965.

While some analysts remain cautious about the feasibility of a bitcoin reserve, the market is responding to Trump’s crypto-friendly rhetoric and the broader embrace of digital assets by governments worldwide. Bitcoin’s total market value has nearly doubled this year, reaching over $3.8 trillion.

Investment Insight: Bitcoin’s record-breaking rally highlights its growing role as a speculative and institutional asset. Investors should monitor regulatory developments, as Trump’s pro-crypto policies could drive further gains but introduce volatility tied to policy implementation risks.

Japan’s Machinery Orders Beat Expectations in October

Japan’s core machinery orders rose 2.1% month-on-month in October, exceeding the 1.2% growth forecast by economists, and jumped 5.6% year-on-year, far outpacing the 0.7% prediction. Orders from manufacturers surged 12.5%, signaling strength in the manufacturing sector, while non-manufacturing orders dipped 1.2%. Despite the better-than-expected data, the Cabinet Office maintained its view that the recovery in machinery orders is pausing.

Investment Insight: Japan’s manufacturing sector shows resilience, but the subdued non-manufacturing activity and cautious outlook suggest uneven recovery. Investors should focus on capital spending trends, as they could signal broader economic momentum in the months ahead.

Palantir Gains Spotlight After Nasdaq 100 Inclusion

Palantir Technologies (PLTR) shares are set to attract attention after being added to the Nasdaq 100 Index, announced late Friday. The stock has more than quadrupled this year, fueled by growing demand for its AI-driven software solutions. This shift follows Palantir’s strategic move from the NYSE to Nasdaq, making it eligible for index inclusion alongside other high-growth tech companies.

The inclusion is expected to drive passive inflows and further institutional interest. However, analysts caution that overbought conditions, as indicated by a high relative strength index (RSI), could lead to near-term price fluctuations. Investors are also watching key support levels around $45 and between $33 and $29 as potential entry points during pullbacks.

Investment Insight: Palantir’s Nasdaq 100 inclusion underscores its growing prominence in AI-driven tech. While short-term volatility may arise, the firm’s AI adoption story and index visibility make it a key stock to monitor for long-term growth.

Market Price: Palantir Technologies Inc. (PLTR): USD 76.07

Conclusion

This week offers a critical mix of central bank decisions, economic data, and market-moving developments. The Federal Reserve’s final meeting of 2024 will set the tone for 2025, as investors assess the pace of rate cuts and inflation trends. Globally, China’s economic struggles and Bitcoin’s record rally highlight diverging opportunities and risks, while Japan’s strong machinery data signals resilience. Palantir’s Nasdaq 100 inclusion and the ongoing dominance of tech giants underline the tech sector’s influence. As markets navigate cautious optimism and potential volatility, staying focused on policy signals, economic trends, and sector-specific strength will be key for informed decision-making.

Upcoming Dates to Watch

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

- December 18, 2024: UK/Eurozone CPI

- December 19, 2024: Japan rate decision

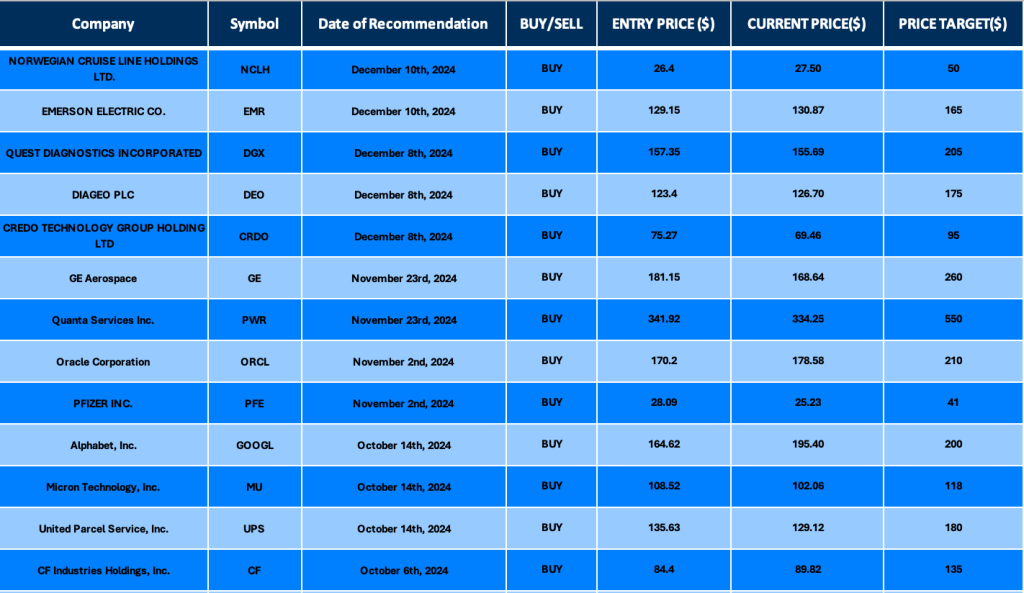

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.