Date Issued – 17th December 2024

Alibaba Plans to Sell Intime Department Stores for $1 Billion Amid Restructuring

Alibaba Group announced plans to sell its department store chain, Intime, to a consortium led by Youngor Fashion and Intime’s management for 7.4 billion yuan ($1.02 billion). The sale marks a strategic shift as Alibaba refocuses on its core e-commerce and cloud operations. The company, which acquired Intime in 2017 for $4 billion, will record a loss of 9.3 billion yuan on the transaction. The move comes as Intime struggles with waning consumer spending in China post-Covid. This divestment is part of broader restructuring efforts by Alibaba, which previously expanded aggressively into physical retail under former CEO Daniel Zhang.

Investment Insight:

Alibaba’s pivot away from brick-and-mortar reflects a sharper focus on high-margin tech sectors like cloud computing. The sale underscores challenges in China’s retail sector, signaling caution for investors exposed to consumer-driven stocks.

Cohere Partners with Palantir to Deploy AI Models for Enterprise Customers

Cohere, a prominent AI startup valued at $5.5 billion, is quietly collaborating with Palantir to deploy its language models to enterprise customers. Details shared at Palantir’s DevCon1 conference in November revealed that Cohere’s AI is already being accessed through Palantir’s Foundry platform, which serves commercial clients. While specific customers remain undisclosed, Cohere highlighted its ability to handle strict data constraints and perform inference in languages like Arabic, showcasing its technical versatility.

This partnership adds to Palantir’s growing AI ecosystem, which includes collaborations with startups like Anthropic, as it expands its footprint in both commercial and defense sectors. Cohere, known for its enterprise focus, has been less vocal about its defense-related engagements, declining to comment on potential military use cases.

Investment Insight:

Cohere’s collaboration with Palantir strengthens its position in the enterprise AI market, signaling opportunities for scalable growth. Investors should monitor how AI startups balance commercial ambitions with potential defense applications, which could impact public perception and regulatory scrutiny.

Walmart Partners with Meituan to Boost E-Commerce in China

Walmart China has announced a strategic partnership with Meituan, the country’s largest food delivery platform, to accelerate its e-commerce growth. The collaboration integrates Walmart stores into Meituan’s delivery ecosystem, capitalizing on the rapid growth of online shopping. Currently, nearly half of Walmart China’s sales come from e-commerce.

This follows Walmart’s decision to sell its $3.7 billion stake in JD.com earlier this year, signaling a shift toward building its own operations. Walmart has also expanded its Sam’s Club footprint in China, operating 50 stores to tap into the rising demand for membership-based retail.

Investment Insight:

Walmart’s partnership with Meituan leverages China’s robust delivery infrastructure, positioning it to better compete in a highly competitive market. For investors, the move signals Walmart’s commitment to localized strategies to drive growth in the Chinese retail sector.

China Targets Record Budget Deficit of 4% of GDP in 2025 Amid Growth Challenges

China plans to raise its budget deficit to a record 4% of GDP in 2025, up from this year’s 3% target, while maintaining an economic growth goal of around 5%, according to sources familiar with the discussions at recent high-level economic meetings. The increased deficit, amounting to 1.3 trillion yuan ($179.4 billion), is part of a “proactive” fiscal policy to counter a slowing economy, local government debt issues, and potential U.S. tariff hikes under President-elect Donald Trump.

China is also expected to issue more off-budget special bonds and adopt an “appropriately loose” monetary stance, signaling further rate cuts and liquidity injections. Meanwhile, pressure from weakened exports, a property crisis, and declining consumer demand continues to weigh on the world’s second-largest economy.

Investment Insight:

China’s record deficit signals a strong commitment to stimulus amid domestic and external pressures. Investors should watch for fiscal and monetary easing measures, but rising debt and trade risks could limit long-term growth prospects. Diversify exposure to mitigate volatility.

Australia Consumer Sentiment Falls as Economic Uncertainty Grows

Australian consumer confidence dropped 2% in December to 92.8 points, according to a Westpac survey, reflecting renewed concerns over inflation, high interest rates, and global instability. Despite improvement over the year, confidence remains below the 100-point threshold dividing optimism and pessimism. Economic growth stagnated in recent quarters, and homebuyer sentiment fell sharply, with the “time to buy a dwelling” index declining 6% to 81.6.

The biggest declines were in short- and long-term economic outlook sub-indexes, which fell 9.6% and 7.9%, respectively, erasing gains from prior months. However, sentiment toward purchasing major household items rose to a 2.5-year high, suggesting mixed consumer behavior as unemployment unexpectedly dipped to 3.9%.

Investment Insight:

The dip in sentiment underscores consumer caution, driven by inflation and interest rate pressures. Investors should monitor sectors tied to discretionary spending and housing, as uncertainty could weigh on recovery. Defensive stocks and essential goods may offer stability.

Conclusion:

Alibaba’s divestment of Intime signals a sharper focus on core operations amid China’s struggling retail sector, while Cohere’s partnership with Palantir underscores the growing enterprise AI market. Walmart’s collaboration with Meituan highlights the importance of localized strategies in a competitive Chinese e-commerce landscape. Meanwhile, China’s record budget deficit plan reflects intensified stimulus efforts to combat slowing growth and rising debt. In Australia, declining consumer sentiment points to lingering economic uncertainty despite pockets of optimism. Across these developments, shifting corporate strategies and fiscal policies emphasize the need for investors to balance opportunities in growth sectors with caution toward broader market risks.

Upcoming Dates to Watch:

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

- December 18, 2024: UK/Eurozone CPI

- December 19, 2024: Japan rate decision

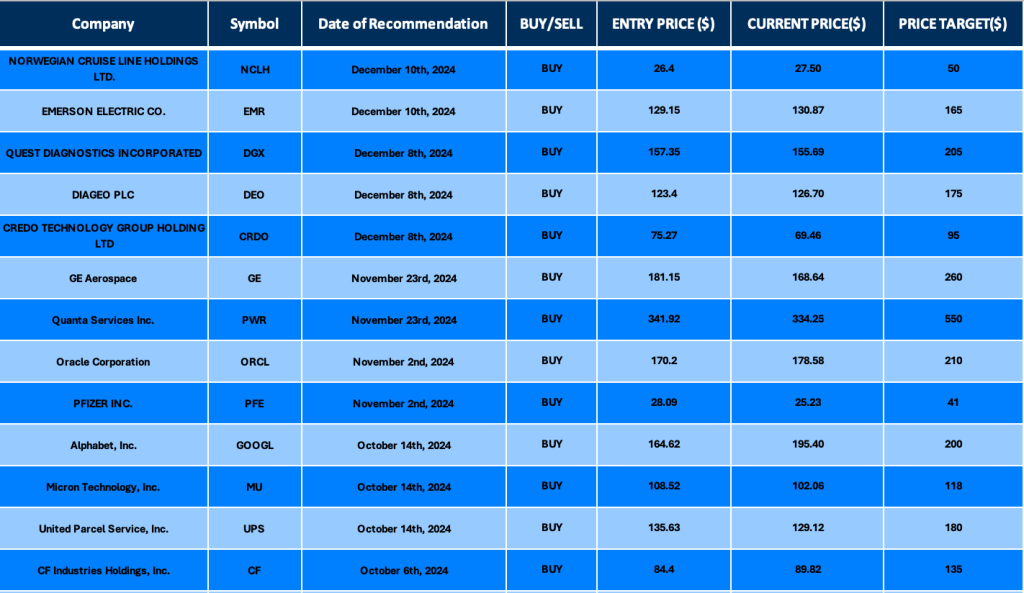

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.