Date Issued – 18th December 2024

Preview

Asian stocks edged higher Wednesday ahead of the Federal Reserve’s final rate decision for 2024, with Japan’s Nikkei down 0.2% but gains in Hong Kong, Shanghai, and South Korea. Nissan shares surged 22% on merger talks with Honda, while U.S. futures rose and Bitcoin retreated after hitting $108,000. The Fed is expected to cut rates, though robust U.S. retail data raises doubts about easing in 2025. In South Korea, the Bank of Korea maintained its 2% inflation target despite persistent price pressures. Meanwhile, Kioxia’s Tokyo IPO jumped 12% on optimism about data center demand, and SF Holding rose 3.5% in its Hong Kong debut despite concerns over China’s recovery. Nissan-Honda merger talks sparked record Nissan share gains, signaling potential industry consolidation. Investors remain cautious amid inflation risks, global market uncertainty, and lingering economic challenges. Focus shifts to the Fed’s decision, inflation trends, and recovery signals in tech, logistics, and auto sectors for future growth.

Asian Stocks Edge Higher Ahead of Fed Decision

Asian markets were broadly higher on Wednesday as investors awaited the Federal Reserve’s final interest rate decision for 2024. Japan’s Nikkei 225 dipped 0.2% amid mixed trade data, while Hong Kong’s Hang Seng and Shanghai’s Composite Index posted gains of 0.6% and 0.7%, respectively. South Korea’s Kospi rose 1%, buoyed by optimism. Meanwhile, Nissan Motor shares surged 22% following merger talks with Honda, though no agreement has been finalized.

U.S. futures also gained, while oil prices were mixed. The Fed is widely expected to cut rates for the third time this year, though strong U.S. retail data is raising questions about rate cuts in 2025. Bitcoin remains volatile after hitting a record $108,000 before retreating slightly.

Investment Insight: The Fed’s expected rate cut could provide short-term market lift, but persistent inflation and strong U.S. economic data may limit further easing in 2025. Stay cautious as global risk appetite may waver.

Bank of Korea Maintains 2% Inflation Target Amid Persistent Price Pressures

The Bank of Korea (BOK) announced it will keep its 2% inflation target, stating that a “low-inflation” era is unlikely in the next one to two years. Governor Rhee Chang-yong highlighted stable inflation expectations, though persistent price pressures from a strong dollar, climate change, and public utility costs remain. Despite weaker-than-expected consumer inflation at 1.5% last month, the BOK expects inflation to rise to the upper-1% range in early 2025 and stabilize near the target in the latter half of the year.

Investment Insight: Rising inflation pressures and a weakening currency suggest limited room for further rate cuts in South Korea. Investors should monitor inflation trends and currency movements closely, particularly for export-heavy sectors.

Kioxia Surges 12% in Tokyo IPO Debut Amid Investor Optimism

Memory-chip maker Kioxia Holdings Corp. jumped 12% in its Tokyo Stock Exchange debut, closing at ¥1,627—well above its IPO price of ¥1,455. The listing values the company at ¥877 billion ($5.7 billion), far below the $18 billion paid by Bain Capital and partners to acquire it in 2018. Despite a challenging backdrop of weak NAND memory prices, the IPO drew strong investor demand, helped by its relatively low valuation. Kioxia’s price-to-book ratio of 1.87 lags behind U.S. rival Micron’s 2.67, reflecting cautious optimism about a recovery in chip demand fueled by global data center investments.

Investment Insight: Kioxia’s debut highlights investor appetite for undervalued tech plays, but weak NAND pricing and global demand challenges could weigh on future growth. Investors should focus on broader tech recovery trends and Kioxia’s potential to capitalize on data-center expansion.

Nissan-Honda Merger Talks Spark Record Nissan Share Surge

Nissan Motor Co. and Honda Motor Co. are exploring a potential merger to create a formidable rival to Toyota and better compete globally. Nissan shares soared 24% on the news, marking their largest intraday gain ever, while Honda shares fell 3.4%. A merger would consolidate Japan’s auto industry into two key groups: Honda-Nissan-Mitsubishi and Toyota-led alliances. The talks, in early stages, could result in a new holding company. Both companies aim to strengthen their electric vehicle strategies and scale production to compete with Tesla and Chinese automakers. Analysts view the merger as a strategic move to address financial struggles and market challenges.

Investment Insight: If finalized, the merger could provide short-term relief for Nissan and long-term scale benefits for both automakers. However, overlapping operations and integration risks may pose challenges. Investors should watch for further announcements and implications for Japan’s auto sector dynamics.

Market price: Nissan Motor Co Ltd. (TYO: 7201): JPY 418.00

SF Holding Rises in Hong Kong Debut After $749 Million Listing

SF Holding Co., China’s largest express-delivery firm, saw a modest 3.5% rise in its Hong Kong trading debut following a $749 million IPO—the city’s second-largest listing this year. While its valuation offered a 25% discount to its mainland share price, investor enthusiasm was tempered by lingering concerns over China’s economic recovery and renewed trade tensions after Donald Trump’s U.S. election win. SF has grown rapidly, partnering with giants like Alibaba and JD.com, but its debut fell short of expectations, with analysts predicting stronger gains.

Investment Insight: SF’s discounted valuation appeals to long-term investors, but macroeconomic uncertainty and trade risks could weigh on performance. Watch for catalysts like China’s recovery momentum and global logistics demand to assess growth potential.

Market price: S.F. Holding Co Ltd. (HKG:6936): HKD 32.40

Conclusion

Markets are navigating a mix of optimism and caution as key economic decisions and corporate developments unfold. The Fed’s anticipated rate cut could provide short-term relief, but persistent inflation and strong U.S. data cloud the 2025 outlook. In Asia, the Bank of Korea’s inflation stance, Nissan-Honda merger talks, and Kioxia’s strong IPO debut highlight opportunities amid challenges. SF Holding’s modest Hong Kong debut reflects lingering concerns over China’s recovery. Investors should stay vigilant, focusing on inflation pressures, global demand trends, and industry-specific catalysts, as markets remain sensitive to economic shifts and evolving corporate strategies heading into 2024.

Upcoming Dates to Watch

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

- December 18, 2024: UK/Eurozone CPI

- December 19, 2024: Japan rate decision

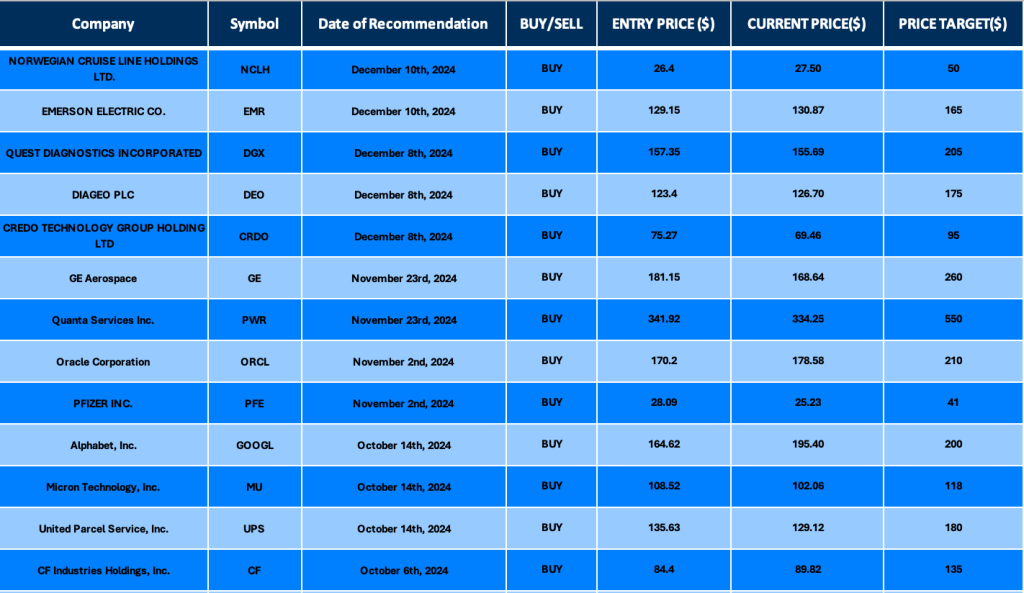

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.