U

Unity Software, Inc.

(NYSE: U)

Balfour Capital Group has issued a buy recommendation

for Unity Software, Inc. (U) on November 25th, 2025

Unity Software Inc. is a leading global platform for creating, deploying, operating, and monetizing real-time 3D (“RT3D”) content. Unity’s engine and data-driven monetization ecosystem are used across gaming, simulation, automotive, architecture, industrial digital twins, and emerging AR/VR applications.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $41.59 on November 25th, 2025.

- Our designated price target stands at $65.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q3 EARNING REPORT

A Q3 report evaluates company financials for investors.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Unity Software, Inc. (NYSE: U) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

IRM

Iron Mountain Inc.

(NYSE: IRM)

Balfour Capital Group has issued a buy recommendation

for Iron Mountain Inc. (IRM) on November 17th, 2025

Iron Mountain Inc. is a global leader in physical records management, data storage, secure information handling, asset lifecycle management, and hyperscale data centres. Founded in 1951, Iron Mountain provides storage, digital transformation, information management, and secure destruction services to more than 225,000 enterprise customers in over 60 countries. It is recognized as one of the world’s most trusted custodians of sensitive information and mission-critical physical and digital assets.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $91.37 on November 17th, 2025.

- Our designated price target stands at $114.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q3 EARNING REPORT

A Q3 report evaluates company financials for investors.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Iron Mountain Inc. (NYSE: IRM) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

Worldquant Stock Portfolio

Worldquant Stock Portfolio

Reporting period: Jun 30th, 2025

Filling Date: Aug 14th, 2025

WorldQuant Millennium Advisors LLC sits at the intersection of high-end quantitative research and established hedge-fund infrastructure. By combining WorldQuant’s research machine (hundreds of PhDs, global data operations) with Millennium’s trading and operational backbone, WMA aims to deliver differentiated returns using systematic, data-driven methods.

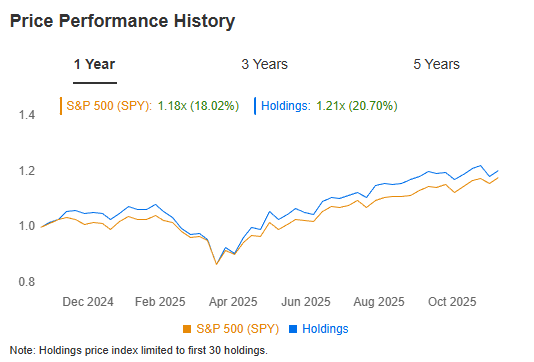

Three Year Return & Holdings Summary

View Holdings

Worldquant Stock Portfolio

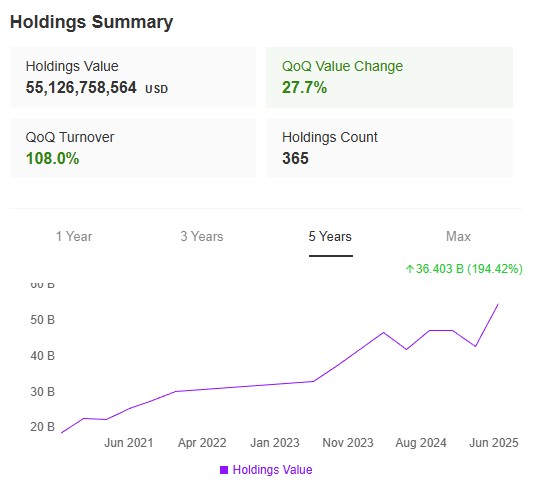

Holdings Summary

View Market

Worldquant Stock Portfolio

Market View

View Projections

Worldquant Stock Portfolio

Projections

View Health

Worldquant Stock Portfolio

Health

Walleye Trading

Walleye Trading

Reporting period: Jun 30th, 2025

Filling Date: Aug 13th, 2025

Walleye Capital is a well-established, multi-strategy investment firm with roots in market-making and a progression into broader hedge-fund style activities. Its infrastructure, technology, quantitative capabilities and disciplined risk approach are central to its identity. The associated entity Walleye Trading operates as part of its broker-dealer / trading-execution and market-making infrastructure supporting these strategies.

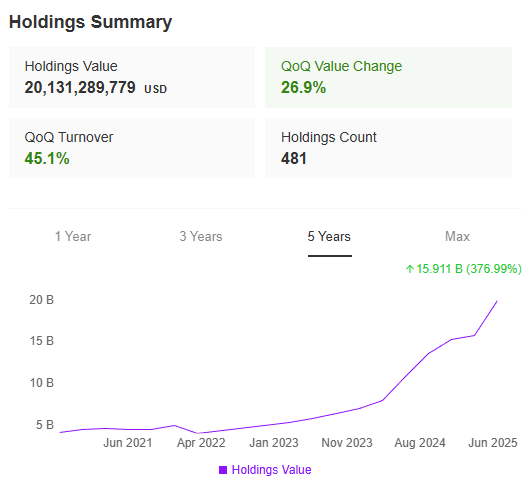

Three Year Return & Holdings Summary

View Holdings

Walleye Trading

Holdings Summary

View Market

Walleye Trading

Market View

View Projections

Walleye Trading

Projections

View Health

Walleye Trading

Health

Juniper Investment

Juniper Investment

Reporting period: Jun 30, 2025

Filling Date: Aug 14, 2025

Juniper Investment Company, LLC is an investment management firm based in New York, founded in September 2008 by Alexis P. Michas and John A. Bartholdson. The firm focuses on a concentrated portfolio of small-cap U.S. publicly traded companies (typically under US$1 billion market-cap) and positions itself as a long-term owner rather than a short-term stock trader.

Part of their strategy is actively engaging with the management of their portfolio companies in order to execute strategy, improve operations, and maximise long-term value while managing risks. By some estimates, as of late 2023⁄early 2025 the firm held major stakes in companies such as Lincoln Educational Services Corporation and Bioventus Inc., with its estimated net worth in the US$100 million + range.

Three Year Return & Holdings Summary

View Holdings

Juniper Investment

Holdings Summary

View Market

Juniper Investment

Market View

View Projections

Juniper Investment

Projections

View Health

Juniper Investment

Health

ARGX

Argenx SE

(NASDAQ: ARGX)

Balfour Capital Group has issued a buy recommendation

for Argenx SE (ARGX) on November 3rd, 2025

Argenx SE is a commercial-stage immunology biotechnology company pioneering the use of FcRn antibody recycling and related immunomodulatory mechanisms to treat severe autoimmune diseases. Headquartered in Ghent, Belgium, argenx employs approximately 1,300 staff globally, with major operational hubs in the Netherlands, the United States, and Japan. Its lead therapy VYVGART® (efgartigimod) is approved in multiple geographies for generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP), including the subcutaneous Hytrulo formulation and a prefilled syringe designed for at-home administration. The company’s expanding pipeline includes FcRn-targeted candidates, complement inhibitors, and co-stimulatory pathway antibodies addressing additional autoimmune conditions in neurology, hematology, and nephrology.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $826.28 on November 3rd, 2025.

- Our designated price target stands at $1200.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

2025 Q3 EARNING REPORT

A Q3 report evaluates company financials for investors.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Argenx SE (EBR: ARGX) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

ZION

Zions Bancorporation NA

(NASDAQ: ZION)

Balfour Capital Group has issued a buy recommendation

for Zions Bancorporation NA (ZION) on October 30th, 2025

Zions Bancorporation, National Association, is a U.S. regional financial services company operating across 11 western and southwestern states, including Utah, Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Washington, and Wyoming. The company offers a broad suite of services through seven locally managed bank divisions, covering commercial and small business lending, capital markets and investment banking, commercial real estate lending, retail banking, and wealth management.

Its product mix includes C&I and owner-occupied lending, public finance, trust services, syndications, and project finance. The firm emphasizes conservative credit management and a strong capital base, supported by a long-standing presence in the U.S. Mountain West. Zions’ operational model combines local decision-making with centralized risk and technology infrastructure.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $51.94 on October 30th, 2025.

- Our designated price target stands at $74.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q3 EARNING REPORT

A Q3 report evaluates company financials for investors.

Balfour Capital Group wants to clarify that our recommendation to Buy Zions Bancorporation NA (NASDAQ: ZION) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

MMC

Marsh & McLennan Companies, Inc.

(NYSE: MMC)

Balfour Capital Group Researched Marsh & McLennan Companies, Inc. (MMC) on October 30th, 2025.

Marsh & McLennan Companies, Inc. is a global professional services firm focused on risk, strategy, and people, operating through four main subsidiaries: Marsh (insurance broking & risk management), Guy Carpenter (reinsurance), Mercer (health, wealth & career consulting), and Oliver Wyman (management and strategy consulting). The company’s business model combines fee- based consulting revenues with cyclical insurance and reinsurance brokerage income, serving clients in over 130 countries. MMC’s diversified operations provide resilience, though growth momentum has recently slowed as pricing tailwinds in insurance moderates and cost pressures weigh on consulting margins.

Post Recommendation Price Trend Chart

- We have established a Sell recommendation at $178.67 on October 30th, 2025.

- Our designated price target stands at $140.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q3 EARNING REPORT

A Q3 report evaluates company financials for investors

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Sell Marsh & McLennan Companies, Inc. (NYSE: MMC) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

FLR

Fluor Corporation

(NYSE: FLR)

Balfour Capital Group has issued a buy recommendation

for Fluor Corporation (FLR) on October 30th, 2025

Fluor Corporation (“Fluor”) is a global engineering, procurement, and construction (EPC) firm providing project management, design, fabrication, and maintenance services across diverse industries. The company operates through three segments: Energy Solutions, Urban Solutions, and Mission Solutions, delivering complex capital projects for clients in energy, infrastructure, mining, and government services. Fluor’s portfolio combines reimbursable and lump-sum contracts with a strategic focus on high-quality backlog growth, improved execution, and risk management. It is one of the world’s largest EPC firms, executing large-scale industrial and infrastructure projects in over 60 countries.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $49.31 on October 30th, 2025.

- Our designated price target stands at $75.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q2 EARNING REPORT

A Q2 report evaluates company financials for investors.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Fluor Corporation (NYSE: FLR) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

WMS

Advanced Drainage Systems Inc

(NYSE: WMS)

Balfour Capital Group has issued a buy recommendation

for Advanced Drainage Systems Inc (WMS) on October 28th, 2025

Advanced Drainage Systems, Inc. (“ADS”) designs, manufactures, and supplies thermoplastic corrugated pipe and water management products serving the stormwater and onsite septic wastewater industries. The company operates through four main segments: Pipe, Infiltrator Water Technologies, Allied Products & Other, and International. ADS supports sustainable infrastructure across residential, commercial, agricultural, and municipal markets, emphasizing recycled materials and green construction practices. Its vertically integrated model spans resin sourcing, recycling, manufacturing, and logistics—making ADS one of the largest plastic recyclers in North America.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $142.81 on October 28th, 2025.

- Our designated price target stands at $205.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q4 EARNING REPORT

A Q4 report evaluates company financials for investors.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Advanced Drainage Systems Inc (NYSE: WMS) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.