Pinebridge

PineBridge Investments

Reporting Period: March 31st, 2025

Filing Date: May 14th, 2025

PineBridge Investments has distinguished itself as a leading global asset manager, renowned for its strategic expertise and innovative approach to navigating complex financial markets. With a legacy deeply rooted in delivering value across economic cycles, PineBridge has consistently demonstrated a disciplined investment philosophy that combines active management, rigorous research, and a forward-looking perspective. By emphasizing diversification, long-term value creation, and a commitment to identifying emerging opportunities, PineBridge has earned a reputation for resilience and adaptability in an ever-evolving investment landscape.

Under its leadership, PineBridge has excelled in crafting tailored investment solutions that align with client goals, outperforming benchmarks and setting a standard for excellence in asset management. Its ability to integrate global insights with local expertise enables the firm to anticipate market trends and deliver consistent results across multiple asset classes, cementing its position as a trusted partner for institutional and individual investors alike.

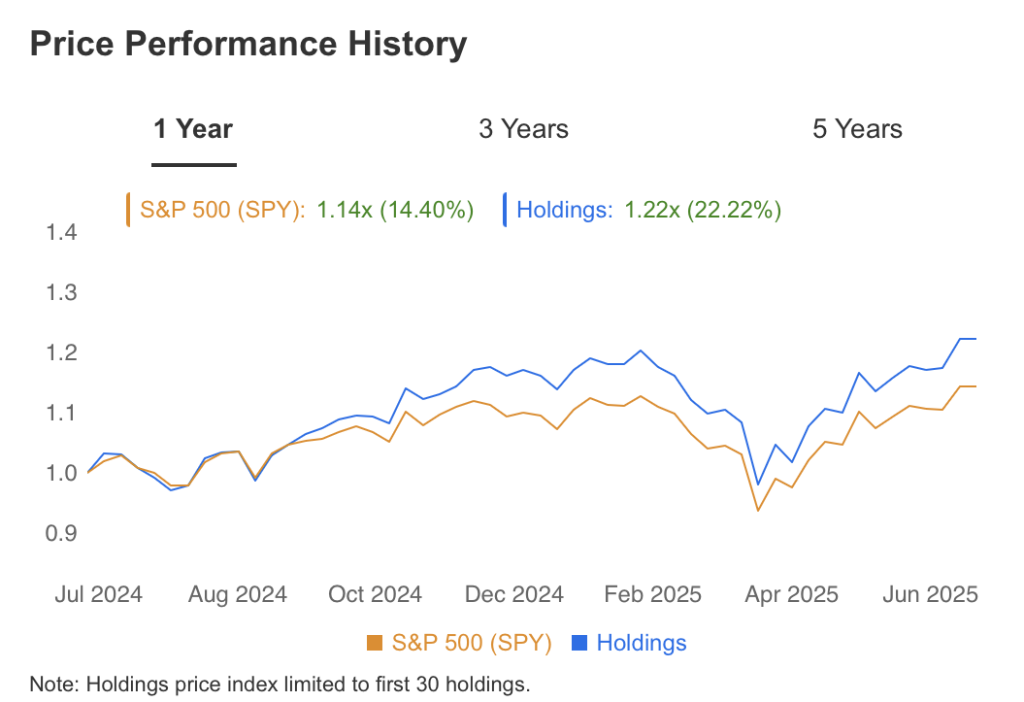

Three Year Return & Holdings Summary

View Holdings

PineBridge Investments

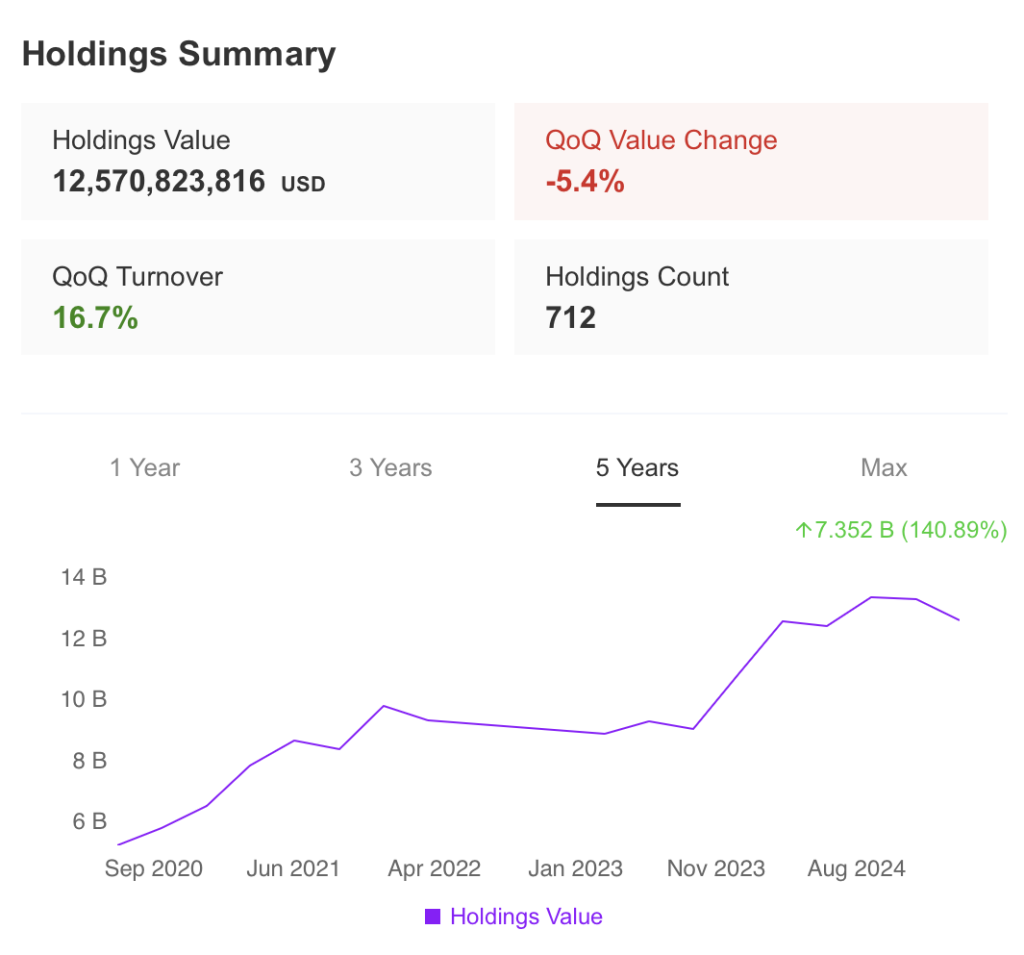

Holdings Summary

View Market

PineBridge Investments

Market View

View Projections

PineBridge Investments

Projections

View Health

PineBridge Investments

Health

MDLZ

Mondelez International, Inc.

(NASDAQ: MDLZ)

Balfour Capital Group has issued a buy recommendation

for Mondelez International, Inc. (MDLZ) on June 23rd, 2025

Mondelez International, Inc. (NASDAQ: MDLZ) is one of the world’s leading snack food companies, selling biscuits, chocolate, gum, candy, cheese & grocery items, and powdered beverages across more than 150 countries. Its iconic brands include Oreo, Cadbury, Milka, Ritz, Toblerone, Trident, and Tang. Headquartered in Chicago, IL, it employs around 90,000 people worldwide. In 2024, Mondelēz generated $36.4 billion in net revenue and $4.6 billion in net earnings.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $68.31 on June 23, 2025.

- Our designated price target stands at $95.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

Balfour Capital Group wants to clarify that our recommendation to Buy Mondelez International, Inc. (NASDAQ: MDLZ) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

ALKT

Alkami Technology, Inc.

(NASDAQ: ALKT)

Balfour Capital Group has issued a buy recommendation

for Alkami Technology, Inc. (ALKT) on June 23rd, 2025

Alkami provides cloud-based digital banking solutions tailored for financial institutions across the U.S. Their platform supports online banking, fraud prevention, marketing, user engagement, and AI-driven client insights. Based in Plano, Texas, they’ve grown significantly since their 2021 IPO.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $27.95 on June 23, 2025.

- Our designated price target stands at $44.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Alkami Technology, Inc. (NASDAQ: ALKT) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

BMRN

BioMarin Pharmaceutical Inc.

(NASDAQ: BMRN)

Balfour Capital Group has issued a buy recommendation

for BioMarin Pharmaceutical Inc. (BMRN) on June 23rd, 2025

BioMarin Pharmaceutical Inc. is a global biotech firm headquartered in San Rafael, CA, specializing in enzyme replacement therapies and other treatments for rare genetic diseases. Founded in 1997, it has developed multiple orphan drugs and operates worldwide with robust R&D pipelines.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $55.00 on June 23, 2025.

- Our designated price target stands at $84.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy BioMarin Pharmaceutical Inc. (NASDAQ: BMRN) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

CRM

Salesforce, Inc.

(NYSE: CRM)

Balfour Capital Group has issued a buy recommendation

for Salesforce, Inc. (CRM) on June 23rd, 2025

Salesforce is a leading American cloud‑based software company specializing in Customer Relationship Management (CRM) solutions. Its flagship platform provides Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud, Analytics (Einstein/CRM Analytics), Slack, and AI-powered tools to help businesses manage sales, service, marketing, e‑commerce, and app development—all within a unified customer-data ecosystem.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $260.63 on June 23, 2025.

- Our designated price target stands at $335.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2026 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

Balfour Capital Group wants to clarify that our recommendation to Buy Salesforce, Inc. (NYSE: CRM) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

DDOG

Datadog, Inc.

(NASDAQ: DDOG)

Balfour Capital Group has issued a buy recommendation

for Datadog, Inc. (DDOG) on June 17th, 2025

Datadog is a cloud-native SaaS provider specializing in observability and security for cloud-scale applications. Its unified platform monitors servers, databases, tools, and services—offering real-time metrics, logs, traces, and security monitoring in one consolidated dashboard

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $121.93 on June 17, 2025.

- Our designated price target stands at $185.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Datadog, Inc. (NASDAQ: DDOG) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

GS

The Goldman Sachs Group, Inc.

(NYSE: GS)

Balfour Capital Group has issued a buy recommendation

for The Goldman Sachs Group, Inc. (GS) on June 17th, 2025

Goldman Sachs is a leading global investment bank and financial services firm founded in 1869 and headquartered in New York City. It operates through major segments: Global Banking & Markets, Asset & Wealth Management, and Platform Solutions (including direct banking). Services include M&A advisory, underwriting, trading (both flow and proprietary), prime brokerage, asset- and wealth-management, and transaction banking.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $627.85 on June 17, 2025.

- Our designated price target stands at $750.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

Balfour Capital Group wants to clarify that our recommendation to Buy The Goldman Sachs Group, Inc. (NYSE: GS) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

PBR

Petroleo Brasileiro SA Petrobras

(NYSE: PBR)

Balfour Capital Group has issued a buy recommendation

for Petroleo Brasileiro SA Petrobras (PBR) on June 3rd, 2025

Petrobras is Brazil’s state-controlled, vertically integrated energy company and one of the world’s largest oil and gas producers. Its operations span exploration and production (E&P), refining, transportation, marketing, and energy generation. The company is a global leader in deepwater and ultra-deepwater oil production, with a strong focus on Brazil’s offshore pre-salt fields. It also engages in petrochemicals, ethanol exports, and low-carbon energy initiatives.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $11.61 on June 3rd, 2025.

- Our designated price target stands at $20.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

Balfour Capital Group wants to clarify that our recommendation to Buy Petroleo Brasileiro SA Petrobras (NYSE: PBR) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

TTWO

Take-Two Interactive Software

(NASDAQ: TTWO)

Balfour Capital Group has issued a buy recommendation

for Take-Two Interactive Software (TTWO) on June 3rd, 2025

Take-Two Interactive Software, Inc. is a leading American video game holding company headquartered in New York City. Founded in 1993, it develops, publishes, and markets interactive entertainment for consumers globally. The company operates through several labels, including Rockstar Games, 2K, Private Division, and Zynga, offering products across console, PC, and mobile platforms. Notable franchises under its umbrella include Grand Theft Auto, NBA 2K, Red Dead Redemption, and Civilization.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $227.60 on June 3rd, 2025.

- Our designated price target stands at $335.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

2025 Q4 EARNING REPORT

A Q4 report evaluates company financials for investors.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Buy Take-Two Interactive Software (NASDAQ: TTWO) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

EBAY

eBay

(NASDAQ: EBAY)

Balfour Capital Group has issued a buy recommendation

for EBAY (EBAY) on May 21st, 2025

eBay Inc. is a global e-commerce platform that connects millions of buyers and sellers across more than 190 markets. Founded in 1995 by Pierre Omidyar, eBay enables users to buy and sell a wide range of goods and services through online auctions and fixed-price listings. The company generates revenue primarily through transaction fees, advertising, and payment processing services.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $72.59 on May 21st, 2025.

- Our designated price target stands at $95.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

XBalfour Capital Group wants to clarify that our recommendation to Buy eBay (NASDAQ: EBAY) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*