DEO

Diageo plc

(NYSE: DEO)

Balfour Capital Group has issued a buy recommendation for Diageo plc (DEO) on December 8th, 2024.

Diageo is a global leader in the production of alcoholic beverages, including renowned brands such as Guinness, Johnnie Walker, Baileys, and Tanqueray. The company operates across a wide range of spirits and beer, with a significant presence in both developed and emerging markets.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $123.40 on December 8th, 2024.

- Our designated price target stands at $175.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

2025 Q3 EARNING REPORT

A Q3 report evaluates company financials for investors

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

Balfour Capital Group wants to clarify that our recommendation to Diageo plc (NYSE: DEO) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

CRDO

Credo Technology Group Holding Ltd

(NASDAQ: CRDO)

Balfour Capital Group has issued a buy recommendation for Credo Technology Group Holding Ltd (CRDO)

on December 8th, 2024.

Credo Technology Group specializes in high-performance connectivity solutions for data centers, 5G networks, and AI infrastructures. Their product portfolio includes chips, cables, and other solutions designed to enhance data speeds, energy efficiency, and reliability. Credo’s innovative solutions cater to the growing demand for advanced data transfer technologies in AI and cloud ecosystems

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $75.27 on December 8th, 2024.

- Our designated price target stands at $95.00

- With our $95.00 target met, we are confidently raising our outlook to $215.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2026 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors

Balfour Capital Group wants to clarify that our recommendation to Credo Technology Group Holding Ltd (NASDAQ: CRDO) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

GE

GE Aerospace

(NYSE: GE)

Balfour Capital Group has issued a buy recommendation for GE Aerospace (GE) on November 23rd, 2024

General Electric is a global industrial conglomerate with key business segments in:

1. Aerospace: Aircraft engines, avionics, and digital solutions.

2. Healthcare: Medical imaging, diagnostics, and patient monitoring systems.

3. Power and Renewable Energy: Gas turbines, wind turbines, and electrical grid infrastructure.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $181.15 on November 23rd, 2024.

- Our designated price target stands at $260.00

- With our $260.00 target met, we are confidently raising our outlook to $338.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors

Balfour Capital Group wants to clarify that our recommendation to GE Aerospace (NYSE: GE) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

PWR

Quanta Services Inc.

(NYSE: PWR)

Balfour Capital Group has issued a buy recommendation for Quanta Services Inc. (PWR) on November 23rd, 2024

Quanta Services Inc. is a global leader in providing infrastructure solutions across several sectors:

Core Services: Design, installation, repair, and maintenance of electric power, pipeline, and telecommunications infrastructure.

Key Focus Areas: Renewable energy projects, grid modernization, energy transition support, and communications networks

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $341.92 on November 23rd, 2024.

- Our designated price target stands at $550.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q1 EARNING REPORT

A Q1 report evaluates company financials for investors

Balfour Capital Group wants to clarify that our recommendation to Quanta Services Inc. (NYSE: PWR) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

ORCL

Oracle Corporation

(NYSE: ORCL)

Balfour Capital Group has issued a buy recommendation

for Oracle Corporation (ORCL) on November 2nd, 2024

Oracle Corporation is a leading global provider of enterprise software and cloud computing services. The company’s offerings include database software, cloud infrastructure, and enterprise resource planning (ERP) solutions, serving a diverse clientele across various industries.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $170.20 on November 2nd, 2024.

- Our designated price target stands at $210.00

- With our $210.00 target met, we are confidently raising our outlook to $312.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

ARGUS QUANTITATIVE

Argus Quantitative analyzes energy, commodities, and finance with data analytics.

View More

ARGUS ANALYST

Argus Analyst Notes offers timely investment recommendations, insights.

View More

THOMSON REUTERS

Thomson Reuters delivers global financial, legal, and business information to professionals.

View More

2025 Q3 EARNING REPORT

A Q3 report evaluates company financials for investors

Balfour Capital Group wants to clarify that our recommendation to Oracle Corporation (NYSE: ORCL) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

CAG Gold Black

CONAGRA BRANDS, INC.

(CAG)

Balfour Capital Group Researched CONAGRA BRANDS, INC. (CAG)

on December 18th, 2023.

Conagra Brands, headquartered in Chicago, combines a rich heritage of making great food with a sharpened focus and entrepreneurial spirit.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $29.25 on December 18th, 2023.

- Our designated price target stands at $50.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

BALFOUR CAPITAL GROUP

Balfour Capital Group buy recommendation research

Balfour Capital Group wants to clarify that our recommendation to Buy CONAGRA BRANDS, INC. (CAG) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

CAG Green Black

CONAGRA BRANDS, INC.

(CAG)

Balfour Capital Group Researched CONAGRA BRANDS, INC. (CAG)

on December 18th, 2023.

Conagra Brands, headquartered in Chicago, combines a rich heritage of making great food with a sharpened focus and entrepreneurial spirit.

Post Recommendation Price Trend Chart

- We have established a Buy recommendation at $29.25 on December 18th, 2023.

- Our designated price target stands at $50.00

Analysts Research

With steadfast dedication to thorough research, Balfour Capital Group engages with esteemed analysts and companies, evident below, to amplify and elevate our proficiency. This collaborative approach enriches our findings, granting readers and researchers a profound comprehension of the rationale behind our recommendations and research objectives.

View More

BALFOUR CAPITAL GROUP

Balfour Capital Group buy recommendation research

Balfour Capital Group wants to clarify that our recommendation to Buy CONAGRA BRANDS, INC. (CAG) is based on thorough research conducted by our dedicated teams.

We invest significant time and resources in analyzing market trends, financial data, and industry insights to provide well-informed guidance.

However, it is important to note that our recommendation does not guarantee any specific financial outcomes. The decision to act on our recommendation should be made at your discretion. Please be aware that investments carry inherent risks, and the value of investments can fluctuate, potentially resulting in financial loss.

*THIS INFORMATION IS PROVIDED FOR COMMERCIAL AND INDICATIVE PURPOSES ONLY AND MAY DIFFER FROM REALITY. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TRADING WITH LEVERAGE INVOLVES A SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.*

American Assets

American Assets

Reporting Period: March 31st, 2025

Filing Date: May 9th, 2025

American Assets is a highly regarded figure in the investment world, known for his strategic foresight and commitment to sustainable growth. His background is rooted in a deep understanding of real estate and financial markets, which has been the foundation of his successful career. Over the years, he has built a reputation for being a prudent and visionary investor, with a keen eye for undervalued assets and long-term growth opportunities. His investment philosophy centers around value investing, focusing on acquiring high-quality assets that offer sustainable returns over time. This approach has led to the consistent growth and expansion of his investment portfolio, making him a respected leader in the industry.

In addition to his professional success, American Assets is also known for his philanthropic efforts, which reflect his commitment to giving back to the community. He has been actively involved in various charitable initiatives, particularly those aimed at education, healthcare, and environmental sustainability. His philanthropic work is driven by a belief in the importance of creating lasting positive impacts, both in the business world and in society at large. Through his leadership and vision, American Assets has not only achieved significant success in his career but has also contributed meaningfully to the betterment of society.

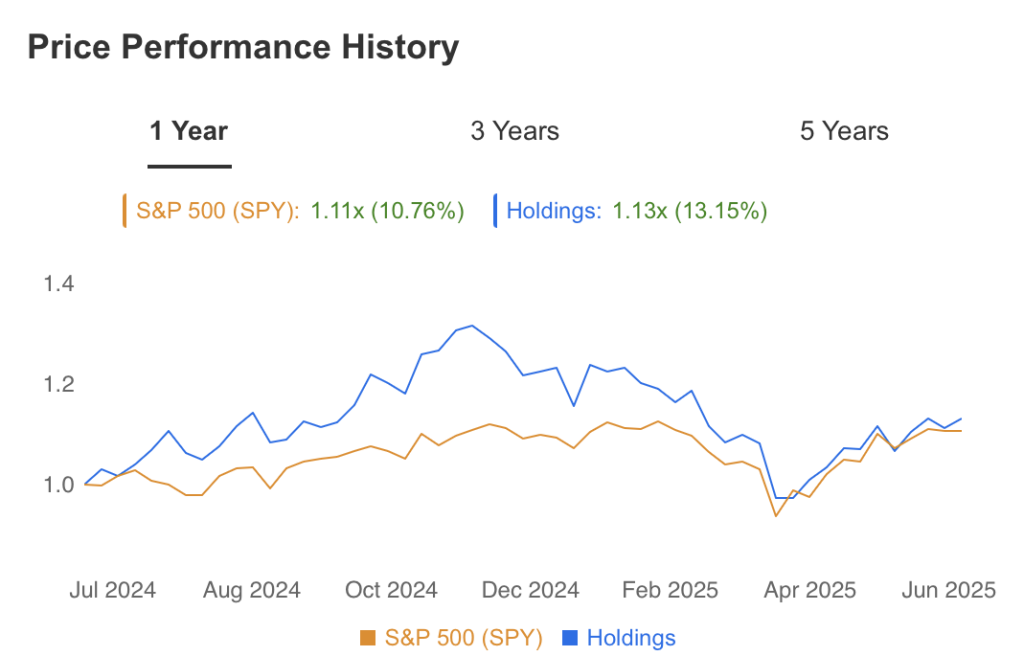

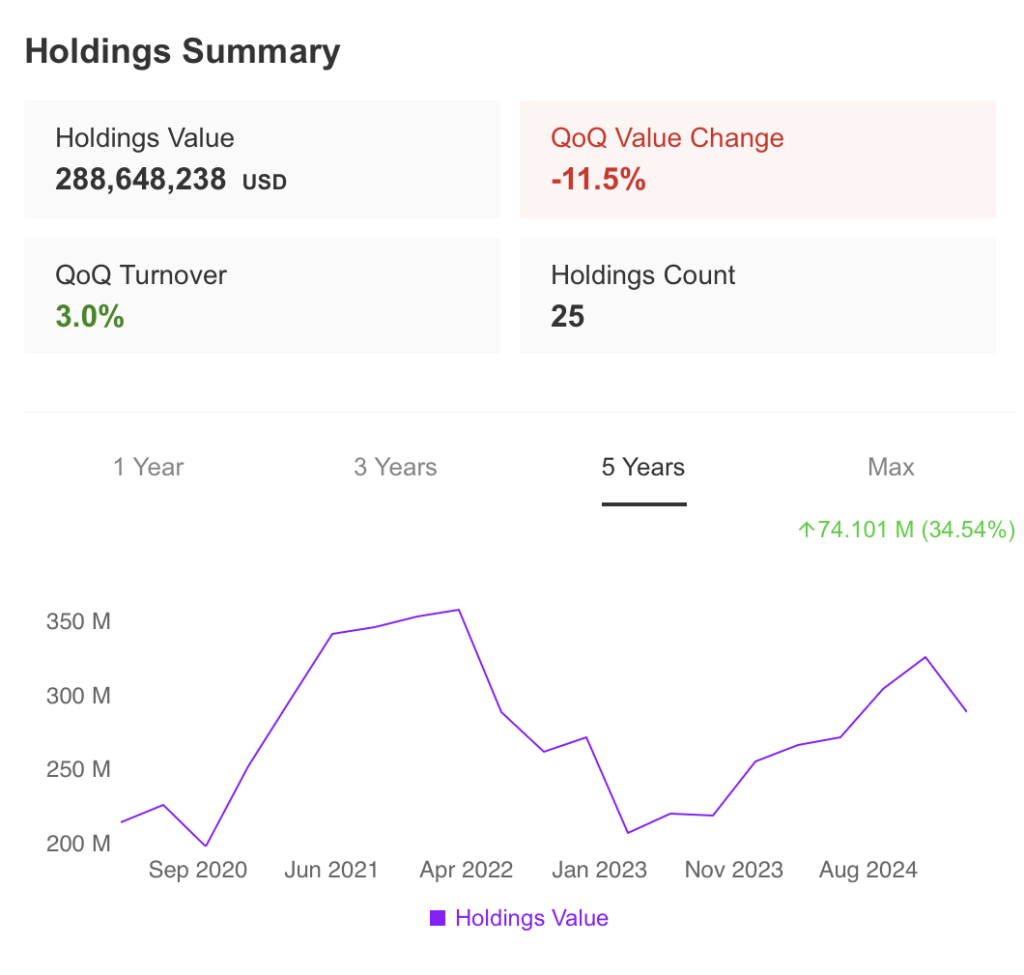

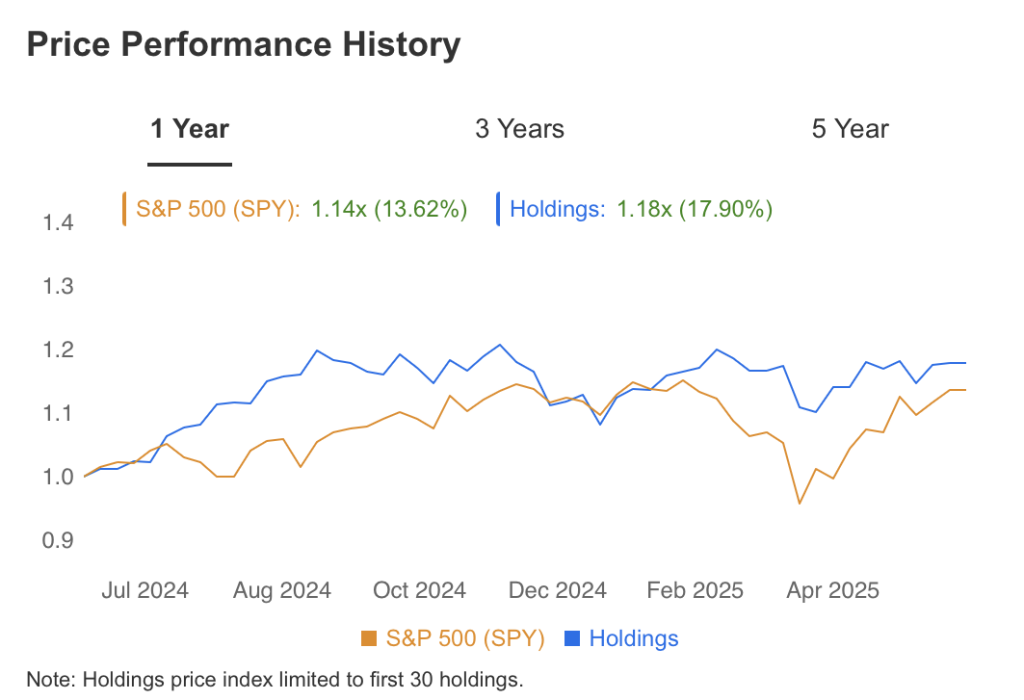

Three Year Return & Holdings Summary

View Holdings

American Assets

Holdings Summary

View Market

American Assets

Market View

View Projections

American Assets

Projections

View Health

American Assets

Health

Opseu Pension Plan

Opseu Pension Plan

Reporting: Period: Mar 31, 2024

Filing Date: May 7, 2024

Opseu Pension Plan has built a reputation as a visionary in the world of investment management, with a career defined by a steadfast commitment to the financial security of its members. As the steward of one of Canada’s largest and most successful pension funds, Opseu Pension Plan has embraced a disciplined investment philosophy that prioritizes long-term growth, risk management, and sustainability. His background in economics and finance has informed his strategic approach, which balances diversified asset allocation with an emphasis on stable, income-generating investments. This strategy has enabled the pension plan to achieve consistent returns, ensuring the financial well-being of its members over the decades.

Beyond his role in investment management, Opseu Pension Plan has also been a leader in philanthropic efforts, recognizing the importance of giving back to the community. His initiatives often focus on education, healthcare, and environmental sustainability, reflecting a belief that responsible investing goes hand in hand with social responsibility. By integrating ESG (Environmental, Social, and Governance) factors into the investment process, Opseu Pension Plan has not only delivered financial success but has also contributed to positive social impact, setting a benchmark for ethical and effective pension fund management.

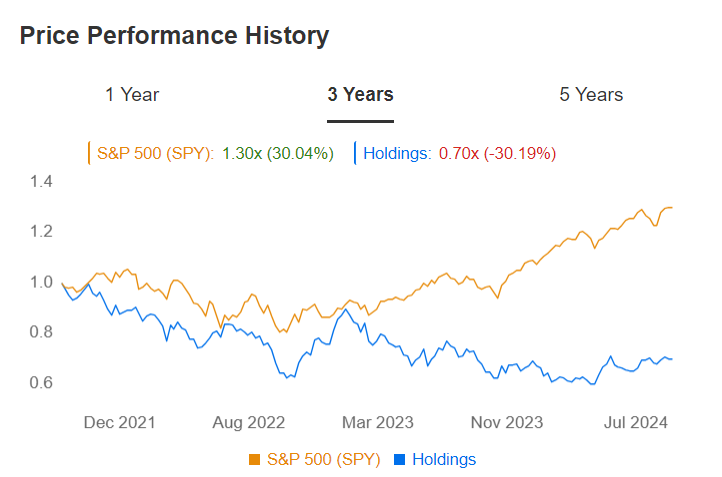

Three Year Return & Holdings Summary

View Holdings

Opseu Pension Plan

Holdings Summary

View Market

Opseu Pension Plan

Market View

View Projections

Opseu Pension Plan

Projections

View Health

Opseu Pension Plan

Health

Uniplan Investment

Uniplan Investment

Reporting Period: Mar 31st, 2025

Filing Date: May 15th, 2025

Uniplan Investment is a renowned figure in the financial industry, known for his strategic foresight and innovative investment approaches. With a background rooted in finance and economics, he has built a reputation for identifying and capitalizing on market opportunities ahead of the curve. His investment philosophy centers on a disciplined, long-term approach, prioritizing diversification and risk management while seeking out undervalued assets and emerging markets. His ability to anticipate market trends and adjust strategies accordingly has led to consistent success and significant returns for his clients and investors.

In his role as a leader within Uniplan Investment, he has spearheaded numerous high-profile investment initiatives, guiding the firm to become a respected name in the industry. His strategies often involve a blend of traditional and alternative investments, focusing on sectors such as technology, healthcare, and sustainable energy. Beyond his professional achievements, he is also committed to philanthropy, directing substantial resources toward educational programs, environmental conservation, and community development. His philanthropic efforts reflect his belief in giving back to society and supporting causes that align with his values and vision for a better future.

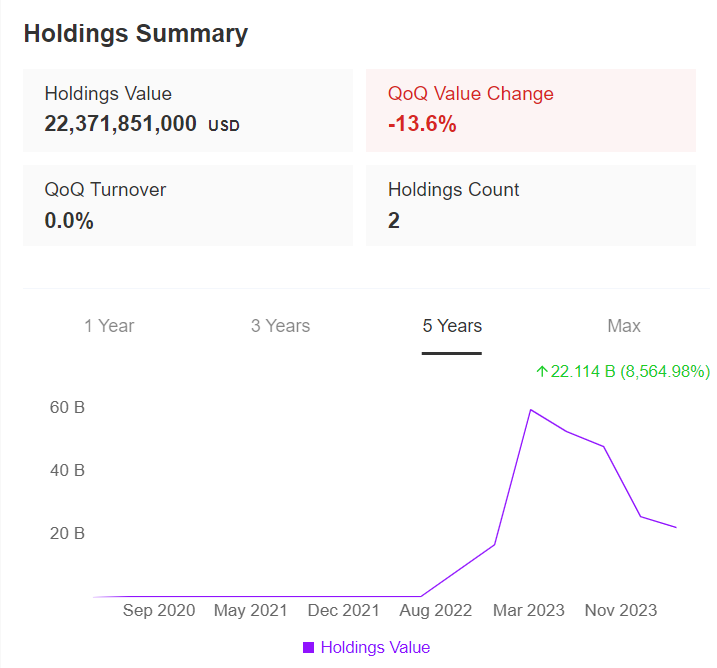

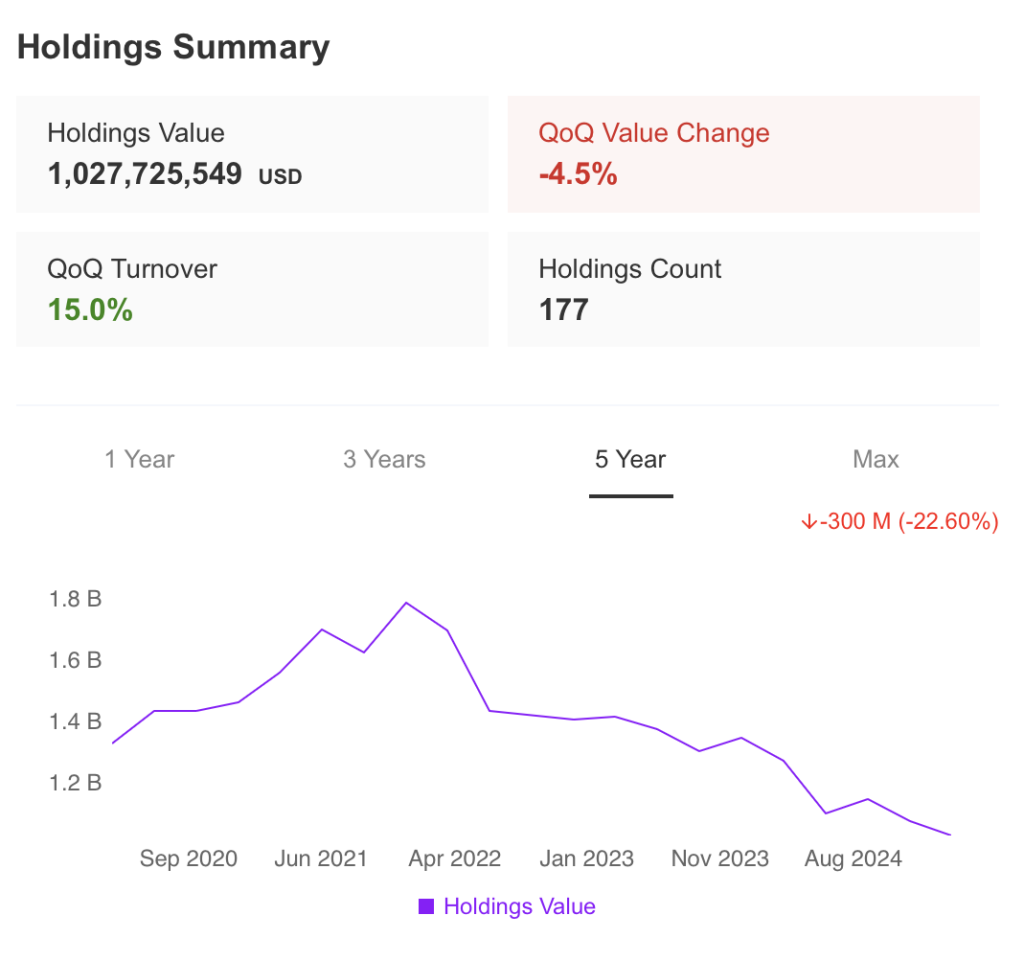

Three Year Return & Holdings Summary

View Holdings

Uniplan Investment

Holdings Summary

View Market

Uniplan Investment

Market View

View Projections

Uniplan Investment

Projections

View Health

Uniplan Investment

Health